- United States

- /

- Capital Markets

- /

- NYSE:EVR

Evercore’s (EVR) $250M Private Debt Placement Could Be a Game Changer for Capital Strategy

Reviewed by Simply Wall St

- On July 10, 2025, Evercore Inc. announced it entered into a note purchase agreement for a private placement of US$125,000,000 aggregate principal amount of 5.17% Series K senior notes due 2030 and US$125,000,000 of 5.47% Series L senior notes due 2032, with interest payable semi-annually and proceeds to be used for refinancing and general corporate purposes.

- This move highlights Evercore's focus on proactively managing its capital structure through debt refinancing and the implementation of financial covenants, underscoring an emphasis on balance sheet strength and financial discipline.

- We'll examine how Evercore's US$250,000,000 private debt placement and new financial covenants may affect its future growth outlook.

Evercore Investment Narrative Recap

To own Evercore stock, investors need to believe in the firm's ability to capture upside as global transaction activity rebounds and capital markets stabilize. The recent US$250,000,000 private debt placement, earmarked for refinancing and general purposes, strengthens Evercore's balance sheet but is unlikely to materially shift the biggest short-term catalyst, market normalization, and does little to offset the principal risk posed by external macroeconomic headwinds dampening deal flow and earnings growth.

One announcement closely linked to this backdrop is Evercore’s ongoing expansion of its senior talent bench through high-profile hires in Industrials, Healthcare, and Private Capital Advisory. This move aligns with the theme that, should market conditions improve, investments in sector expertise can accelerate performance against headwinds to transaction volumes and revenue potential.

By contrast, investors should be aware that even with solid refinancing, returns could be squeezed if...

Read the full narrative on Evercore (it's free!)

Evercore's narrative projects $4.4 billion revenue and $728.3 million earnings by 2028. This requires 12.8% yearly revenue growth and a $289.5 million earnings increase from $438.8 million today.

Uncover how Evercore's forecasts yield a $318.33 fair value, a 7% upside to its current price.

Exploring Other Perspectives

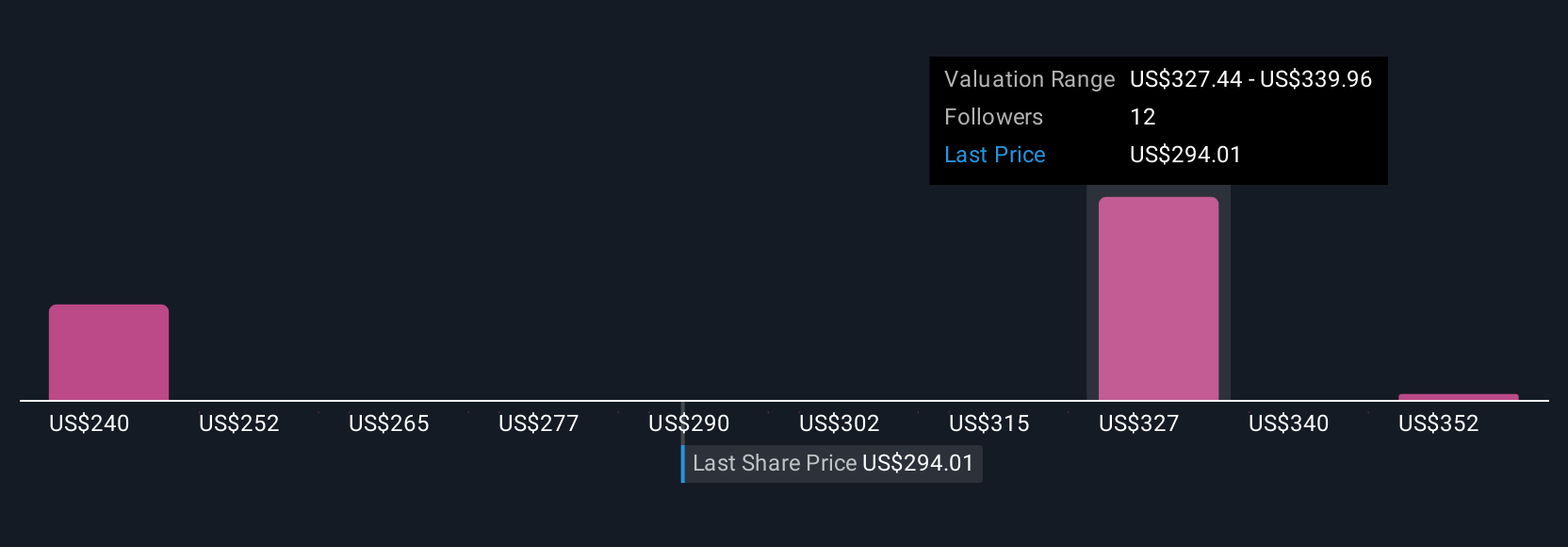

Simply Wall St Community members produced three fair value estimates for Evercore, ranging from US$271.03 to US$331 per share. While assessors differ, many will be watching whether the company’s ability to maintain revenue growth above market forecasts can outpace persistent volatility in global capital markets.

Build Your Own Evercore Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Evercore research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Evercore research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Evercore's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evercore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVR

Evercore

Operates as an independent investment banking firm in the Americas, Europe, Middle East, Africa, and Asia-Pacific.

High growth potential with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives