- United States

- /

- Diversified Financial

- /

- NYSE:ESNT

Benign Growth For Essent Group Ltd. (NYSE:ESNT) Underpins Its Share Price

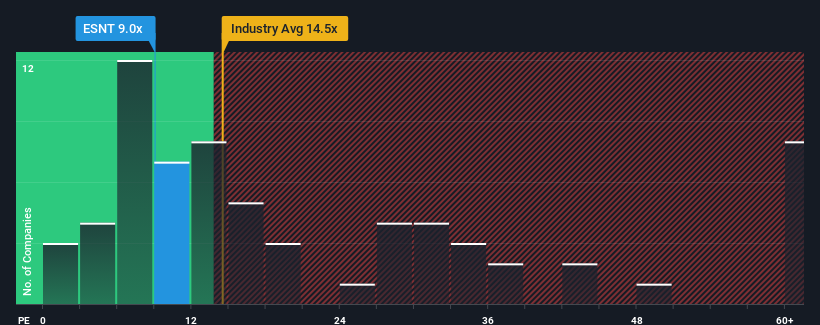

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 18x, you may consider Essent Group Ltd. (NYSE:ESNT) as an attractive investment with its 9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

There hasn't been much to differentiate Essent Group's and the market's retreating earnings lately. It might be that many expect the company's earnings performance to degrade further, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. In saying that, existing shareholders may feel hopeful about the share price if the company's earnings continue tracking the market.

Check out our latest analysis for Essent Group

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Essent Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 1.9% decrease to the company's bottom line. Even so, admirably EPS has lifted 82% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 2.9% per year over the next three years. Meanwhile, the rest of the market is forecast to expand by 10% per year, which is noticeably more attractive.

In light of this, it's understandable that Essent Group's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Essent Group's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for Essent Group that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Essent Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESNT

Essent Group

Through its subsidiaries, provides private mortgage insurance and reinsurance for mortgages secured by residential properties located in the United States.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives