- United States

- /

- Diversified Financial

- /

- NYSE:EQH

Evaluating Equitable Holdings (EQH): How a Major Annuity Launch Shapes the Latest Valuation Narrative

Reviewed by Kshitija Bhandaru

Equitable Holdings (EQH) has just unveiled Structured Capital Strategies Premier, an addition to its annuity product lineup designed for clients seeking both higher market upside and added downside protection. The rollout features innovative investment tools along with flexible risk management options.

See our latest analysis for Equitable Holdings.

Equitable Holdings’ new product launch comes as the company continues to show solid momentum, with a $51.16 share price and long-term total shareholder returns of over 21% in the past year. Recent events like this expanded annuity lineup signal Equitable’s commitment to growth, and this appears to be resonating with investors as the company outpaces many industry peers in multi-year performance.

If you’re open to finding out what other fast-growing companies insiders are supporting, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst price targets, investors are left wondering whether Equitable Holdings presents a compelling value or if the market has already factored in its impressive growth trajectory.

Most Popular Narrative: 21.6% Undervalued

Market watchers see Equitable Holdings trading well below the most widely followed fair value estimate, with the stock closing at $51.16 compared to a narrative target in the mid-$60s range. Investors are now focusing on the powerful drivers behind this bullish narrative, wondering what underlying trends might justify such a gap.

Product innovation (notably in RILAs, fee-based, and protection-focused annuities) and first-mover advantages through partnerships with major asset managers (BlackRock, AB, JPMorgan) position Equitable to capture premium pricing, differentiate from competitors, and access new markets. This is expected to improve average margins and support long-term earnings growth.

Curious about what’s powering such an aggressive valuation call? This narrative hints at strategic moves, industry partnerships, and financials that could reshape expectations. Want to uncover the bullish math and see just how ambitious analysts are about future profit margins and growth? Dive in, the projections might surprise you.

Result: Fair Value of $65.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased competition in retirement solutions or outflows from key asset management businesses could challenge the bullish outlook for Equitable Holdings.

Find out about the key risks to this Equitable Holdings narrative.

Another View: Multiples Tell a Different Story

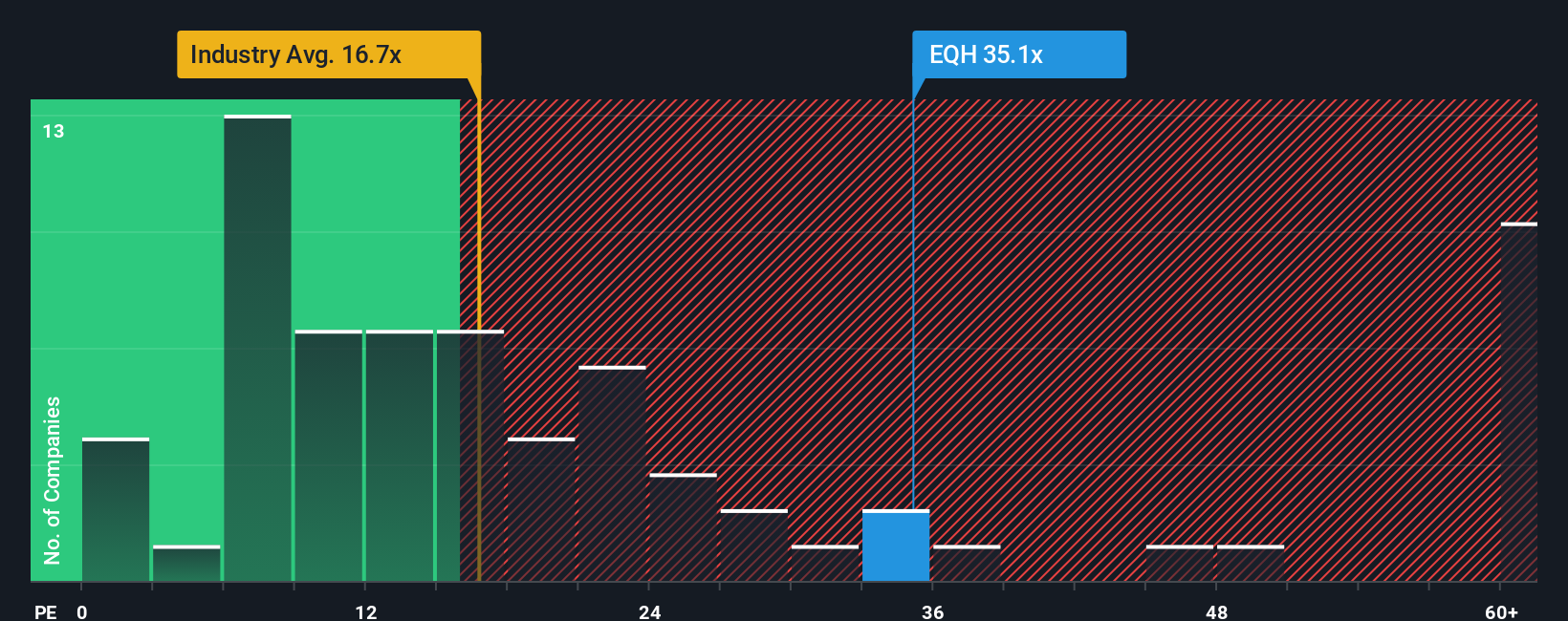

Looking at Equitable Holdings through the lens of its price-to-earnings ratio, the current valuation appears high. With a ratio of 35.7x, it trades noticeably richer than both its peer group (16.6x) and the broader industry (16.5x). Even relative to what our fair ratio analysis suggests the multiple should be (26x), the stock looks expensive. For investors, this gap signals elevated valuation risk. Could strong growth alone justify the premium, or does it expose downside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Equitable Holdings Narrative

If you want to dig into the numbers yourself or shape a different perspective, you can build your own narrative in just minutes. Do it your way

A great starting point for your Equitable Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that market leaders aren’t the only place to find real opportunities. Get ahead of the crowd by using proven tools to power up your portfolio and keep your strategy fresh.

- Capture potential in up-and-coming tech by reviewing these 24 AI penny stocks positioned at the forefront of artificial intelligence advances and rapid industry disruption.

- Maximize yield and cash flow with these 19 dividend stocks with yields > 3% that consistently pay strong, above-market dividends that can boost your returns and add stability.

- Seize the next financial frontier by reviewing these 78 cryptocurrency and blockchain stocks as you explore companies pioneering real innovation in blockchain and digital currency ecosystems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equitable Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EQH

Equitable Holdings

Together with its consolidated subsidiaries, operates as a diversified financial services company worldwide.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives