- United States

- /

- Consumer Finance

- /

- NYSE:ENVA

What Enova International (ENVA)'s $400 Million Share Buyback Means For Shareholders

Reviewed by Sasha Jovanovic

- On November 12, 2025, Enova International announced that its Board of Directors had authorized a share repurchase program, allowing the company to buy back up to US$400 million of its outstanding common stock through June 30, 2027.

- This significant buyback plan can signal management’s confidence in Enova’s future prospects and may offer further support to shareholder value initiatives.

- We’ll explore how the new share repurchase authorization enhances Enova’s investment narrative and may influence its longer-term financial profile.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Enova International Investment Narrative Recap

For investors considering Enova International, the core belief rests on the company's ability to capture ongoing demand for digital lending by leveraging its technology-driven underwriting and strong presence in both consumer and small business segments. The latest US$400 million share buyback authorization underscores management’s confidence, although it does not dramatically alter the central short-term catalyst of continued origination growth or the principal risk from regulatory pressures, which remain highly relevant in shaping Enova’s future results.

Of recent company developments, Enova’s October 2025 earnings report stands out, highlighting both revenue and net income growth over the prior year. While the buyback is designed to return value, the earnings announcement provides a clearer picture of Enova’s operational progress, as growth in digital lending originations remains a key catalyst for shareholder value.

By contrast, investors should be especially mindful of tightening regulations that could...

Read the full narrative on Enova International (it's free!)

Enova International's outlook anticipates $5.7 billion in revenue and $426.8 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 60.7% and an earnings increase of $170.6 million from the current $256.2 million.

Uncover how Enova International's forecasts yield a $140.62 fair value, a 13% upside to its current price.

Exploring Other Perspectives

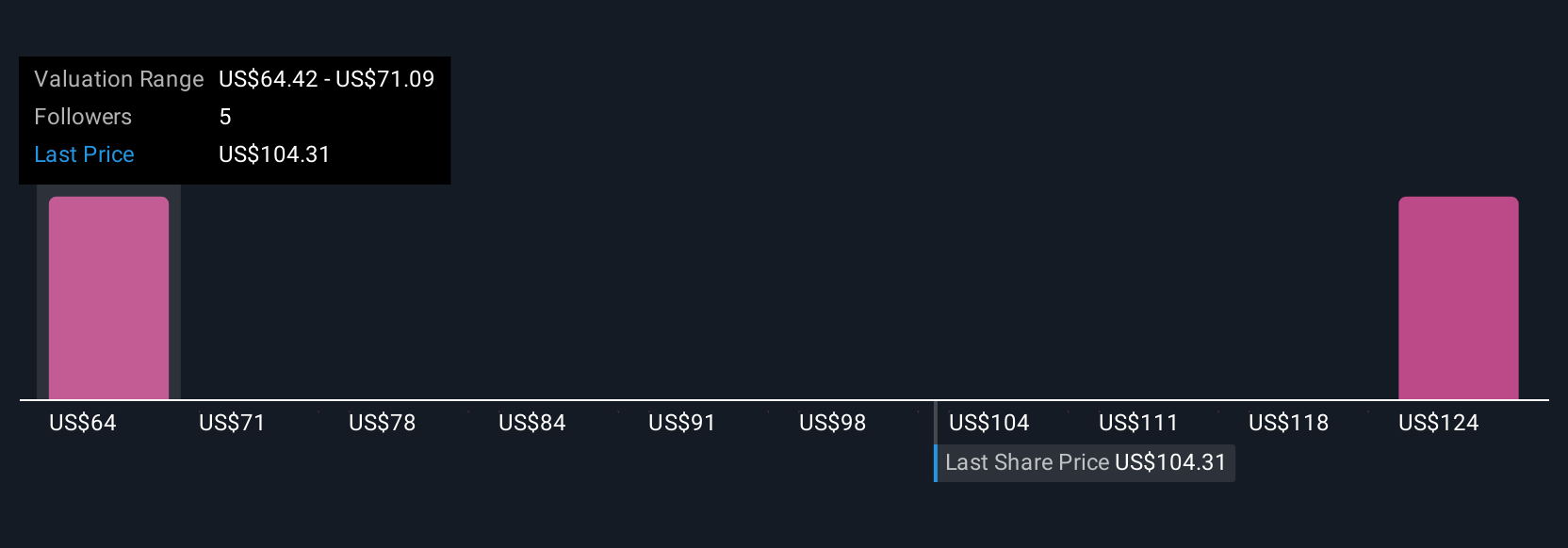

Four fair value estimates from the Simply Wall St Community range widely from US$64.42 to US$467.73 per share. While estimates differ, the leading concern around potential regulatory tightening continues to shape how shareholders may view Enova’s outlook and risk profile.

Explore 4 other fair value estimates on Enova International - why the stock might be worth 48% less than the current price!

Build Your Own Enova International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enova International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Enova International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enova International's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enova International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ENVA

Enova International

A technology and analytics company, provides online financial services in the United States, Brazil, and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives