- United States

- /

- Consumer Finance

- /

- NYSE:ENVA

Enova International (ENVA): Valuation Insights Following $400 Million Share Buyback Authorization

Reviewed by Simply Wall St

The Board of Directors at Enova International (ENVA) just approved a new share repurchase plan, authorizing the company to buy back up to $400 million of its own stock through June 2027. This move often signals management’s positive outlook on future performance.

See our latest analysis for Enova International.

Enova International’s share price has rallied strongly so far this year, with a year-to-date share price return of over 25%. Momentum has built rapidly in recent months, even with short-term pullbacks. The company has delivered an impressive 18% total shareholder return in the past year, highlighting both near-term optimism and robust long-term performance.

If the latest buyback news has you thinking about other standouts, now is a good opportunity to broaden your view and discover fast growing stocks with high insider ownership

With shares already up over 25% this year and a sizable buyback in play, the key question now emerges: is Enova International undervalued, or is the market already factoring in its future growth?

Most Popular Narrative: 14.4% Undervalued

Enova International’s most widely cited narrative currently argues that the stock is trading below consensus fair value, with a last close of $120.40 versus a narrative fair value of $140.63. With market optimism running high, understanding the drivers behind this target is crucial for anyone following the recent rally.

*"Enova's use of advanced machine learning and AI for real-time, data-driven credit risk management allows rapid adjustment to credit models, improving underwriting and limiting losses even in volatile environments. This technology edge supports lower default rates and boosts net margins over time."*

Curious which financial gears are powering this bold valuation? The most popular narrative spotlights a unique blend of aggressive growth projections, tightening profit margins, and a shrinking share count. Think you can guess the key variables behind the target? The assumptions may surprise you. Get the full breakdown in the original narrative.

Result: Fair Value of $140.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent changes in consumer sentiment or tighter lending regulations could quickly shift the outlook, which may challenge even the most optimistic growth scenarios.

Find out about the key risks to this Enova International narrative.

Another View: What Do Earnings Ratios Say?

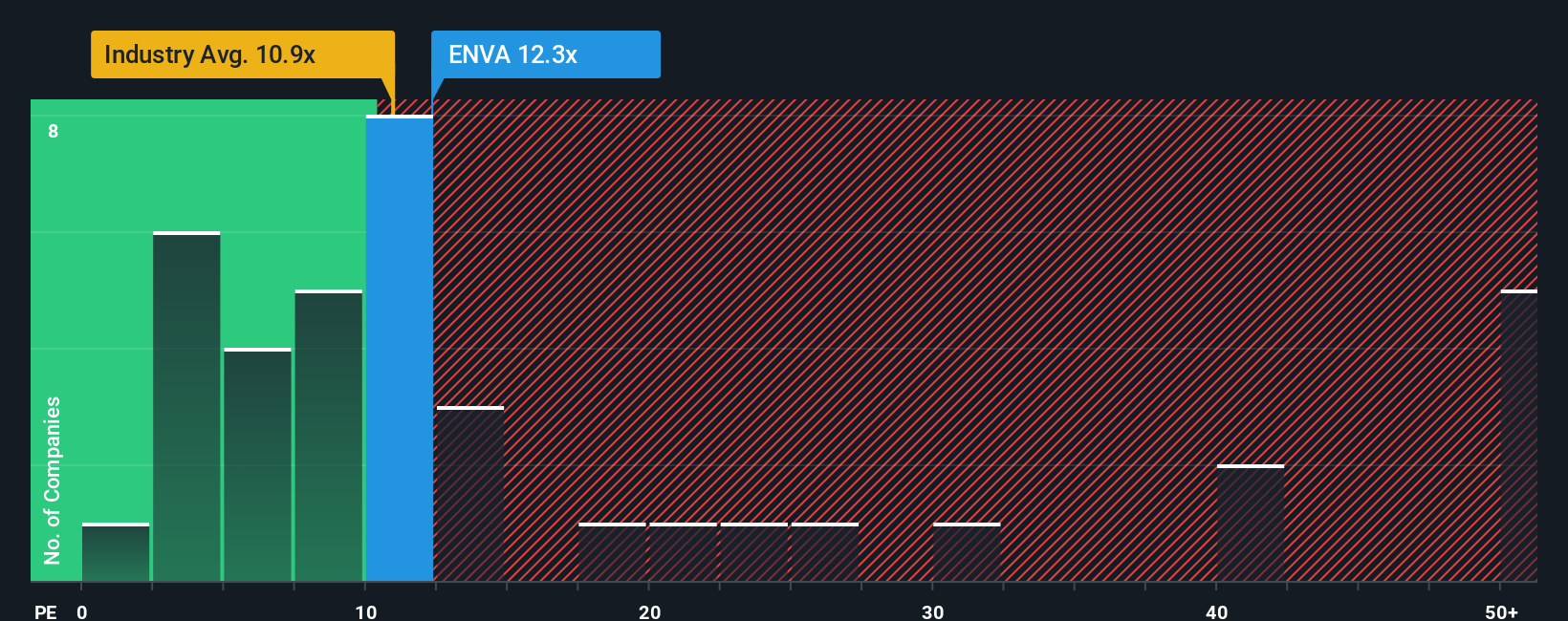

Looking at Enova International’s valuation through the lens of its price-to-earnings ratio offers a slightly different perspective. The company trades at 10.2x earnings, making it more expensive than the US Consumer Finance industry average of 9.9x. However, it remains well below the peer average of 33.3x. Interestingly, the fair ratio for Enova is estimated at 14.9x, which means the current market price leaves some upside if sentiment shifts. So, is the market underestimating future growth, or are investors already stretching the optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Enova International Narrative

If the current analysis doesn't quite align with your perspective, take a few moments to dig into the numbers yourself and develop a narrative that fits your unique take. You can personalize your view in under three minutes. Do it your way

A great starting point for your Enova International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize the moment and uncover new opportunities other investors may be overlooking with the Simply Wall Street Screener’s tailored stock ideas curated for your strategy.

- Capitalize on fast-rising digital currencies by tapping into these 81 cryptocurrency and blockchain stocks featuring companies that are driving blockchain and payment innovations forward.

- Secure reliable income with these 16 dividend stocks with yields > 3% which spotlights stocks delivering steady dividend payouts and strong yield potential above 3%.

- Accelerate your growth potential by checking out these 26 AI penny stocks at the forefront of artificial intelligence breakthroughs and industry-changing automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enova International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ENVA

Enova International

A technology and analytics company, provides online financial services in the United States, Brazil, and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives