- United States

- /

- Mortgage REITs

- /

- NYSE:DX

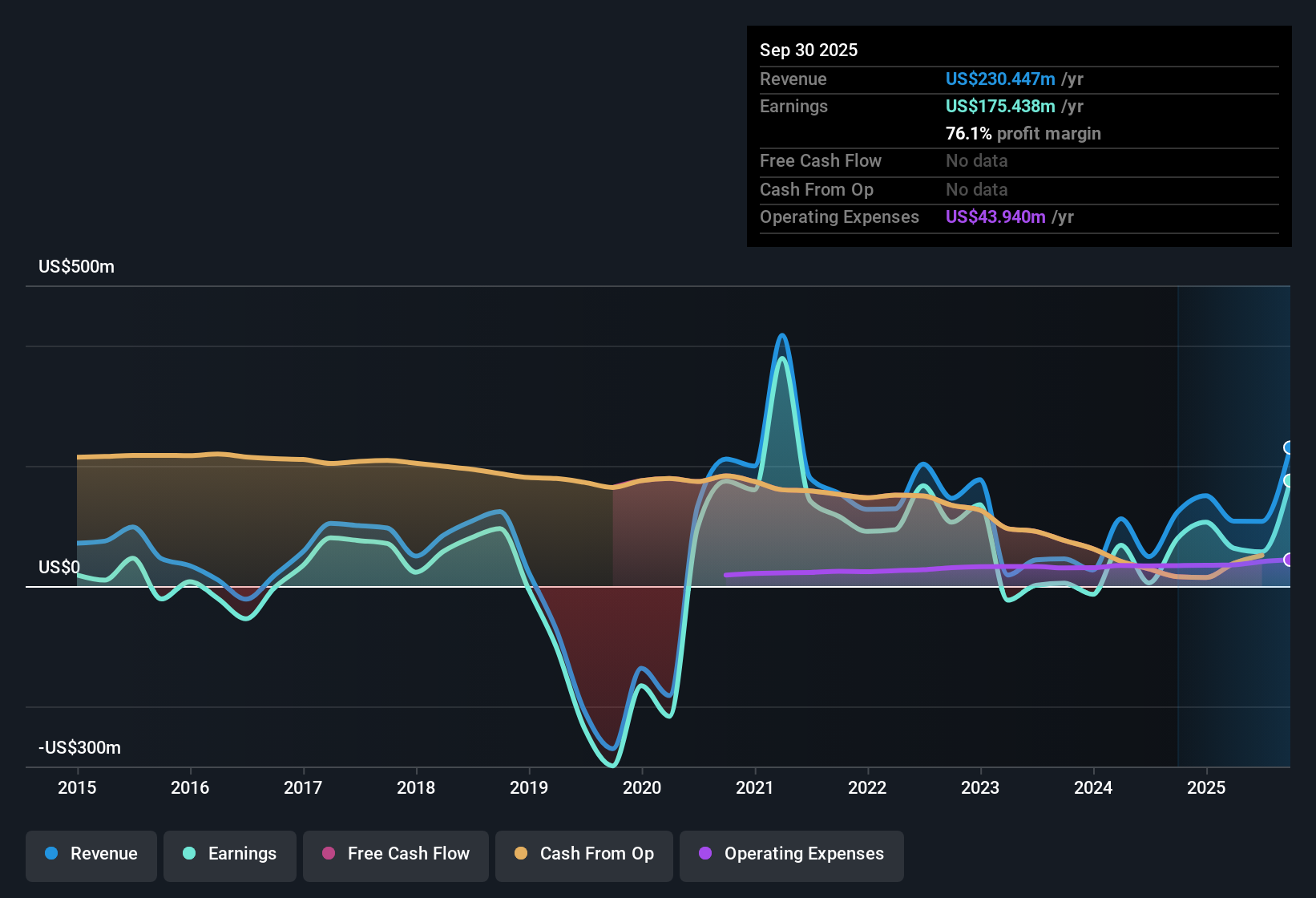

Dynex Capital (DX) Profit Margin Rebound Challenges Bearish Narratives on Core Earnings Quality

Reviewed by Simply Wall St

Dynex Capital (DX) posted impressive net profit margins of 76.1%, up from 64.5% a year ago. Earnings soared 120.9% year-over-year after several years of decline. Even as revenue is expected to fall by 11.7% annually over the next three years, forecasts suggest earnings will keep accelerating at a rapid 105.4% pace per year. With margins climbing and profit trends sharply reversing, investors are weighing robust earnings growth against projected revenue declines and the impact of recent equity dilution.

See our full analysis for Dynex Capital.The next section will put these results head-to-head with the market’s prevailing narratives to reveal where the numbers confirm or contradict what investors expect.

Curious how numbers become stories that shape markets? Explore Community Narratives

Turnaround in Net Margin Signals Stronger Core Profitability

- Dynex Capital’s net profit margins have increased to 76.1% from 64.5% last year, showing a significant improvement in core profitability after years of struggles.

- What is notable in the prevailing market view is that this margin expansion, despite previous multi-year declines in earnings, strongly supports the case for lasting gains and adds weight to the recovery narrative.

- The 120.9% rise in annual earnings over the last twelve months stands out against a previous five-year decline of 26.8% per year.

- While consensus highlights margin strength as a signal that cost discipline and scale efficiencies may be driving renewed confidence, investors are watching to see if these improvements persist as revenue trends shift.

Revenue Guidance Implies a High-Wire Act for Sustained Profit Growth

- While profits are rising, revenue is actually expected to fall by 11.7% per year over the next three years, creating a challenging path for continued earnings acceleration.

- The prevailing market view focuses on this tension: bulls are encouraged by guidance showing forecasted annual earnings growth of 105.4%. However, the risk is that shrinking revenues could eventually pressure profitability or make profit targets harder to reach.

- Consensus highlights how the divergence between falling top-line and rising bottom-line results makes Dynex especially sensitive to changes in market rates or sector dynamics.

- This dynamic has surprised investors, as ongoing profit momentum might not be sustainable if cost efficiency gains or portfolio adjustments cannot offset declining revenue.

Valuation Attractive Versus Peers but Dilution and Dividend Risks Linger

- Dynex shares trade at a Price-To-Earnings Ratio of 11.2x, below the mortgage REIT industry average of 12.8x, indicating perceived value versus peers even as the company’s own profit trajectory recovers.

- The prevailing view emphasizes that while valuation is a positive talking point, supported by recent high quality earnings, investors remain focused on risks around the company’s financial position and whether equity dilution and questions about dividend sustainability could threaten the stock’s appeal.

- The recent episode of equity dilution over the past year adds a cautionary note that could weigh on future earnings per share growth.

- Concerns are also tied to future dividends, as investors worry that strong profit metrics may not translate into stable or growing payouts if underlying fundamentals come under pressure.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Dynex Capital's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Dynex Capital’s recovery in earnings and margins, its shrinking revenues and questions about dividend sustainability highlight underlying risks to stable future performance.

If consistent, predictable income matters more to you, consider companies offering reliable payouts and check out these 2011 dividend stocks with yields > 3% for attractive alternatives yielding over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DX

Dynex Capital

A mortgage real estate investment trust, invests in mortgage-backed securities (MBS) in the United States.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives