- United States

- /

- Capital Markets

- /

- NYSE:DFIN

Rebuilt Venue Virtual Data Room Could Be a Game Changer for Donnelley Financial Solutions (DFIN)

Reviewed by Sasha Jovanovic

- In September 2025, Donnelley Financial Solutions launched a fully rebuilt version of its Venue virtual data room, featuring a modern architecture, streamlined navigation, enhanced collaboration tools, and integration with DFIN’s other compliance software solutions to support M&A, IPO, and capital raising work.

- This upgrade highlights DFIN’s commitment to simplifying complex financial transactions and accelerating its transition from print to scalable, software-based services for clients across strategic deal-making sectors.

- We’ll examine how Venue’s comprehensive software overhaul could reinforce DFIN’s efforts to grow recurring revenue and expand margins through greater digital adoption.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Donnelley Financial Solutions Investment Narrative Recap

To be a shareholder in Donnelley Financial Solutions, you need to believe that software-based solutions will outpace the shrinking print business, driving more consistent growth and profitability as clients migrate to digital platforms. The full rebuild of Venue strengthens DFIN’s software portfolio and aligns with the most important short-term catalyst, accelerating digital adoption, but does not immediately offset the current drag from depressed capital market activity, which remains the biggest near-term risk for revenue stability.

Among recent announcements, the March 2025 launch of the EDGAR Next Enrollment Portal stands out alongside Venue, as it supports regulatory compliance transitions for clients, reinforcing DFIN’s broader push into workflow automation and recurring software revenue. Both products exemplify how the company aims to support deal teams and compliance professionals, yet the overall impact depends on sustained uptake in capital markets and client willingness to transition from legacy offerings.

By contrast, investors should also be aware that ongoing structural decline in print revenue could continue to pressure top-line performance if...

Read the full narrative on Donnelley Financial Solutions (it's free!)

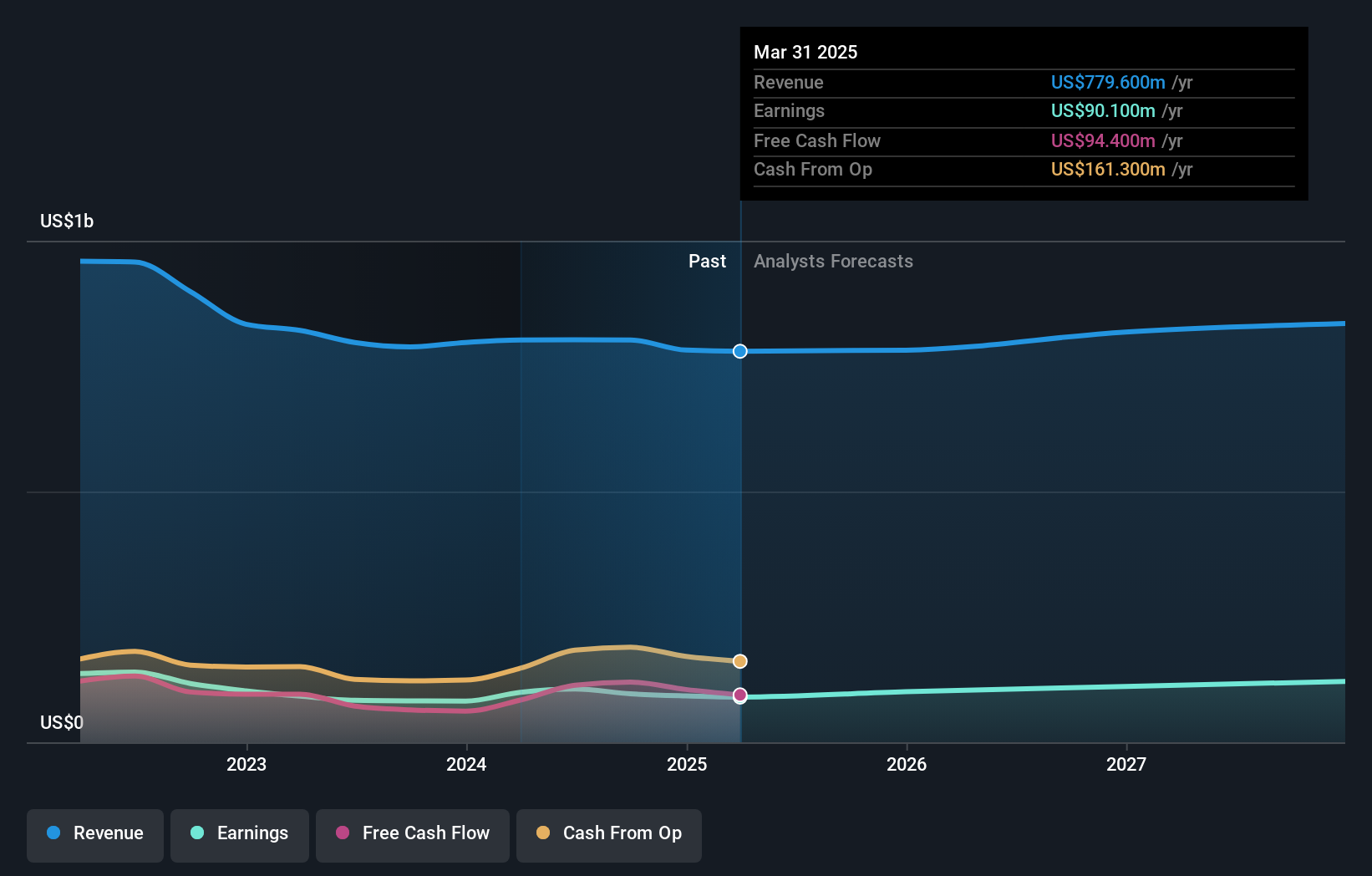

Donnelley Financial Solutions is projected to reach $830.2 million in revenue and $127.7 million in earnings by 2028. This forecast is based on an anticipated annual revenue growth rate of 3.2% and reflects a $45.6 million increase in earnings from the current level of $82.1 million.

Uncover how Donnelley Financial Solutions' forecasts yield a $70.67 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate DFIN’s fair value between US$57.16 and US$70.67 from two analyses. As the shift to software is seen as the key catalyst for recurring revenue and margin expansion, perspectives on the timing and degree of digital adoption can materially shape views on the company’s outlook, highlighting just how differently investors can assess the same business opportunity.

Explore 2 other fair value estimates on Donnelley Financial Solutions - why the stock might be worth just $57.16!

Build Your Own Donnelley Financial Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Donnelley Financial Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Donnelley Financial Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Donnelley Financial Solutions' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DFIN

Donnelley Financial Solutions

Provides innovative software and technology-enabled financial regulatory and compliance solutions in the United States, Asia, Europe, Canada, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives