- United States

- /

- Capital Markets

- /

- NYSE:DFIN

Reassessing Donnelley Financial Solutions (DFIN) Valuation as Software Transition and Retention Concerns Deepen

Reviewed by Simply Wall St

Fresh commentary on Donnelley Financial Solutions (DFIN) is flagging worsening customer retention and slowing ActiveDisclosure subscription growth. This is putting its push toward a majority software revenue mix under sharper scrutiny for current and prospective shareholders.

See our latest analysis for Donnelley Financial Solutions.

The stock has been feeling that pressure too, with a sharp year to date share price return of around minus 25 percent and a 1 year total shareholder return near minus 25 percent, even though the 5 year total shareholder return is still comfortably positive.

If this kind of volatility has you comparing options, it could be a good time to scan the market for other fast growing stocks with high insider ownership that might offer a stronger growth narrative.

With shares now trading at a steep discount to analyst targets, yet sentiment souring on its software transition, is Donnelley Financial Solutions an undervalued rebound play or is the market correctly pricing in weaker growth ahead?

Most Popular Narrative: 28.8% Undervalued

With the narrative fair value sitting well above DFIN's last close, the story hinges on whether its software pivot truly transforms future earnings power.

The ongoing global increase in regulatory complexity like the recent Tailored Shareholder Reports regulation and persistent, evolving ESG and financial disclosure demands is driving continued adoption of compliance software (e.g., Arc Suite and ActiveDisclosure), expected to boost recurring revenue and expand margins as compliance shifts from print to software based solutions.

Curious how modest revenue growth can still support a much higher valuation? The narrative leans on aggressive earnings expansion and richer margins over time. Want to see the exact roadmap behind that call? Dive into the full breakdown and test whether those assumptions stack up against your own view.

Result: Fair Value of $64.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent print declines and slower than expected software adoption could undermine margin expansion and leave earnings more vulnerable to cyclical transaction weakness.

Find out about the key risks to this Donnelley Financial Solutions narrative.

Another Angle on Valuation

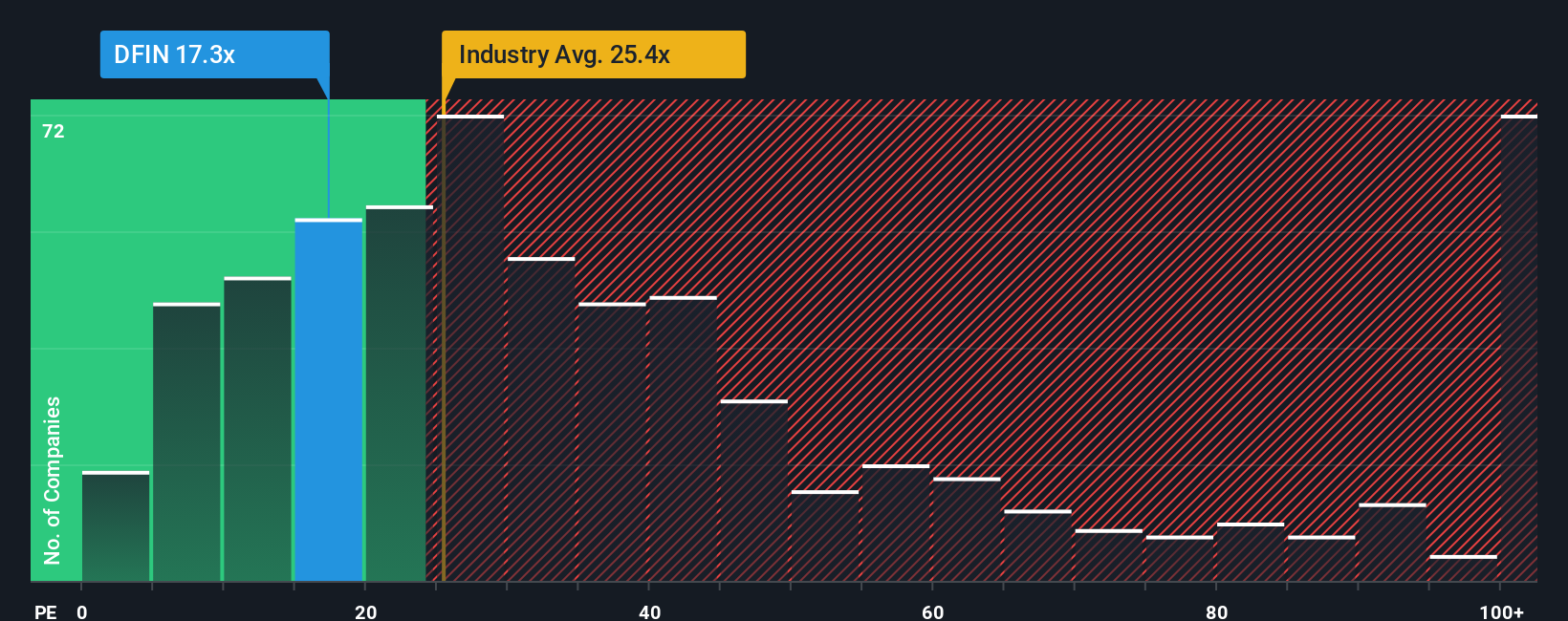

Multiples tell a different story. DFIN trades on a price to earnings ratio of 37.4 times, well above the US Capital Markets average of 25 times, the peer average of 18.1 times, and even its own fair ratio of 25 times. Is optimism here running too hot?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Donnelley Financial Solutions Narrative

If you see the numbers differently or want to stress test the assumptions yourself, you can build a fresh narrative in just minutes. Do it your way.

A great starting point for your Donnelley Financial Solutions research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in a stronger watchlist by targeting fresh opportunities that match your style, so you are not leaving potential returns on the table.

- Capture mispriced potential by scanning these 902 undervalued stocks based on cash flows that the market may be overlooking despite solid fundamentals.

- Ride structural tailwinds in medicine and automation with these 30 healthcare AI stocks reshaping how care is delivered and analyzed.

- Boost your income focus by targeting these 15 dividend stocks with yields > 3% offering attractive yields backed by established businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DFIN

Donnelley Financial Solutions

Provides innovative software and technology-enabled financial regulatory and compliance solutions in the United States, Asia, Europe, Canada, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026