- United States

- /

- Diversified Financial

- /

- NYSE:CPAY

Will Corpay's (CPAY) USCIS Navigator Launch Shift Its Role in Legal Payment Solutions?

Reviewed by Sasha Jovanovic

- Corpay, Inc. recently launched the USCIS Navigator, an automated payment solution that helps U.S. immigration law firms comply with new regulations requiring electronic payments to the U.S. Citizenship and Immigration Services (USCIS) as of October 28, 2025.

- This solution replaces manual check-based methods with a secure, card-enabled system that simplifies compliance and payment processing, and is already being used by several leading immigration law firms.

- We'll explore how Corpay's rapid response to regulatory change and technology integration with USCIS Navigator could influence its investment outlook.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Corpay Investment Narrative Recap

To be a shareholder in Corpay, it’s important to believe in the company’s ability to innovate and adapt quickly within the global B2B payments arena, especially as clients increasingly seek automation and compliance solutions. The launch of USCIS Navigator underscores Corpay’s agility, but the most important short-term catalyst remains the acceleration of workflow automation across enterprises. The biggest risk right now continues to be disruption from open banking and new payment ecosystems, and while this product launch is positive, its direct impact on those structural risks is not considered material.

The recent multi-year agreement with BLAST as Corpay’s Official Foreign Exchange Partner aligns with the company’s strategy to broaden its international cross-border footprint. This deal highlights Corpay’s emphasis on winning enterprise contracts and scaling transaction volumes, two trends that underpin its main growth catalysts and may provide greater earnings resilience, especially when paired with innovative workflow products like USCIS Navigator.

But amid these recent steps forward, investors should be aware that the risk of payment ecosystem disruption from open banking and blockchain technology remains a …

Read the full narrative on Corpay (it's free!)

Corpay's narrative projects $5.7 billion revenue and $1.8 billion earnings by 2028. This requires 10.9% yearly revenue growth and an $0.8 billion earnings increase from $1.0 billion today.

Uncover how Corpay's forecasts yield a $351.25 fair value, a 19% upside to its current price.

Exploring Other Perspectives

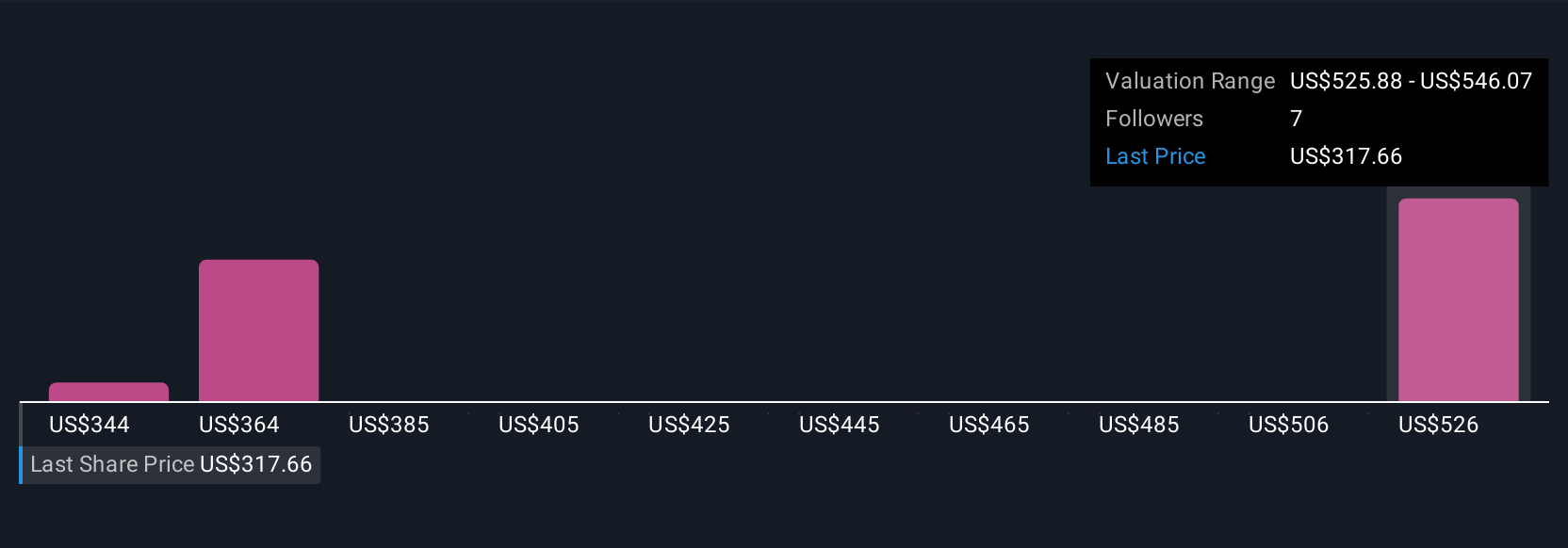

Five fair value estimates from the Simply Wall St Community range widely from US$344.17 to US$513.72 per share. These contrasting opinions highlight how quickly new automation offerings may matter, or not, for a business operating in a fast-evolving payments sector, so it’s worth exploring several viewpoints.

Explore 5 other fair value estimates on Corpay - why the stock might be worth as much as 74% more than the current price!

Build Your Own Corpay Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Corpay research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Corpay research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Corpay's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPAY

Corpay

Operates as a payments company that helps businesses and consumers manage vehicle-related expenses, lodging expenses, and corporate payments in the United States, Brazil, the United Kingdom, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026