- United States

- /

- Diversified Financial

- /

- NYSE:CODI

Compass Diversified (NYSE:CODI) Will Pay A Dividend Of $0.25

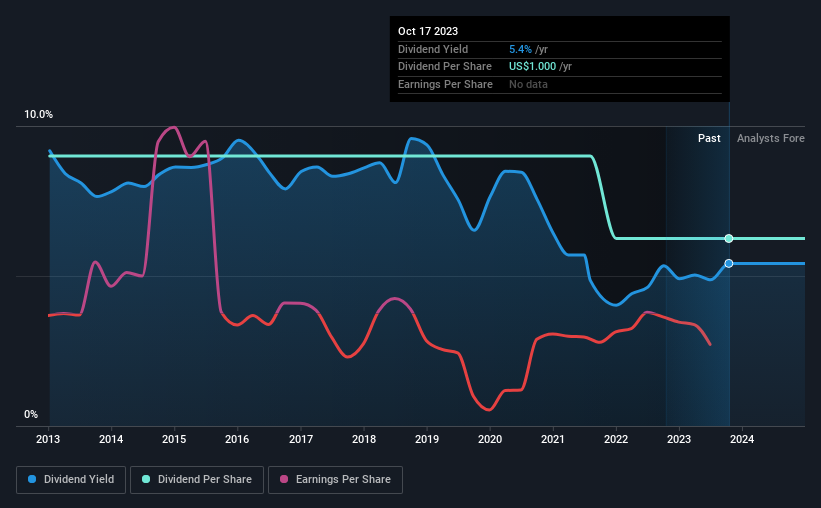

Compass Diversified (NYSE:CODI) has announced that it will pay a dividend of $0.25 per share on the 26th of October. The dividend yield will be 5.4% based on this payment which is still above the industry average.

Check out our latest analysis for Compass Diversified

Compass Diversified Might Find It Hard To Continue The Dividend

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Even in the absence of profits, Compass Diversified is paying a dividend. The company is also yet to generate cash flow, so the dividend sustainability is definitely questionable.

Analysts expect the EPS to grow by 98.9% over the next 12 months. This is the right direction to be moving, but it is not enough to achieve profitability. Unless this happens fairly soon, the dividend could start to come under pressure.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The annual payment during the last 10 years was $1.44 in 2013, and the most recent fiscal year payment was $1.00. Doing the maths, this is a decline of about 3.6% per year. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Company Could Face Some Challenges Growing The Dividend

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. We are encouraged to see that Compass Diversified has grown earnings per share at 15% per year over the past five years. Unprofitable companies aren't normally our pick for a dividend stock, but we like the growth that we have been seeing. As long as the company becomes profitable soon, it is on a trajectory that could see it being a solid dividend payer.

Compass Diversified's Dividend Doesn't Look Sustainable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. While we generally think the level of distributions are a bit high, we wouldn't rule it out as becoming a good dividend payer in the future as its earnings are growing healthily. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 1 warning sign for Compass Diversified that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CODI

Compass Diversified

A private equity firm specializing in add on acquisitions, buyouts, industry consolidation, recapitalization, late stage, and middle market investments.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026