- United States

- /

- Diversified Financial

- /

- NYSE:CODI

Compass Diversified (CODI) Q1 Loss Narrows, Testing Bearish Profitability Narratives

Reviewed by Simply Wall St

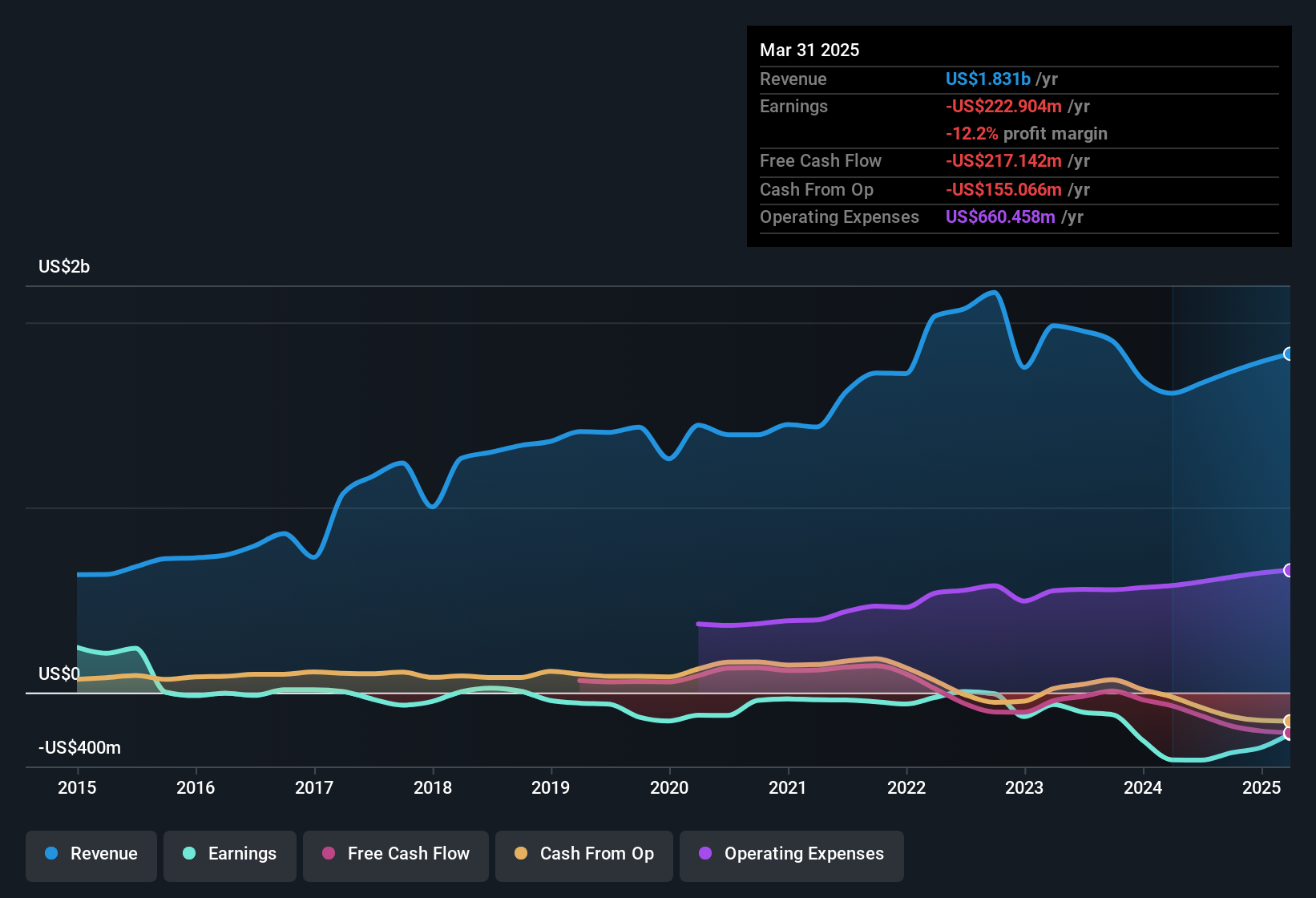

Compass Diversified (CODI) opened 2025 with Q1 revenue of about $453.8 million and basic EPS of roughly -$0.59, alongside net income from continuing operations of around -$44.0 million, marking a narrower loss than the -$118.3 million booked a year earlier on $410.8 million of revenue. Over the past few quarters, the company has seen revenue move between roughly $410.8 million and $582.6 million while basic EPS has swung from -$1.57 to $0.08 and back into the red, underscoring a business that is still working to stabilize margins even as top line has expanded. With revenue now running at about $1.8 billion on a trailing twelve month basis, this latest print puts the spotlight firmly on whether CODI can convert scale into more resilient profitability.

See our full analysis for Compass Diversified.With the headline numbers on the table, the next step is to line them up against the dominant market narratives around Compass Diversified to see which stories hold up and which ones the latest margins and loss profile start to challenge.

See what the community is saying about Compass Diversified

Losses Narrow on Trailing Basis

- On a trailing 12 month view, net loss improved from about $365.7 million a year ago to roughly $222.9 million, while revenue rose from about $1.6 billion to $1.8 billion over the same span.

- Analysts' consensus narrative leans on cost discipline and operational efficiency to lift margins, and the recent shift in trailing EPS from around -$5.0 to about -$3.0 per share,

- supports the idea that profitability is moving in the right direction even though earnings are still negative at about -$222.9 million over the last year.

- lines up with the view that better controls and a revised management agreement can gradually turn higher revenue into improved net margins.

Investors watching this gradual EPS recovery may want to see how it lines up with detailed margin drivers and portfolio moves in the bullish case narrative: 🐂 Compass Diversified Bull Case

Fast Revenue Outlook versus Deep Five Year Losses

- Revenue is forecast to grow at about 19.6 percent per year, yet net losses have worsened by roughly 42 percent per year over the past five years and remain at about -$222.9 million on a trailing 12 month basis.

- Bears argue that ongoing portfolio churn and higher financing costs threaten earnings stability, and the persistence of negative trailing EPS of about -$2.95

- reinforces worries that even with revenue growth, the business has not yet shown consistent positive net income in the recent six quarter history.

- echoes concerns that frequent acquisitions and divestitures can keep consolidated earnings volatile, making it harder to rely on the 19.6 percent growth forecast translating into durable profits.

For skeptics focused on that long history of deepening losses, the bearish narrative digs further into how deal activity and costs might keep pressure on earnings: 🐻 Compass Diversified Bear Case

Cheap 0.2x Sales Multiple with Dividend Strain

- CODI trades at about 0.2 times sales versus roughly 2.0 times for peers and 2.6 times for the broader industry, while also carrying a dividend yield near 20.9 percent that is not covered by earnings or free cash flow.

- Consensus narrative highlights disciplined capital deployment and a permanent capital structure as strengths, yet the combination of a sub one year cash runway and a trailing 12 month net loss of about $222.9 million

- challenges the idea that the current dividend level is comfortably supported by the business as it stands today.

- suggests that even with an apparently low 0.2 times sales valuation, investors need to weigh balance sheet pressure alongside the growth and acquisition story.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Compass Diversified on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers from another angle? Take a couple of minutes to turn that viewpoint into a concise, data backed story of your own: Do it your way

A great starting point for your Compass Diversified research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Explore Alternatives

Compass Diversified pairs rapid revenue growth with heavy ongoing losses, an uncovered dividend and a short cash runway that leaves its balance sheet under pressure.

If that mix of deep losses, dividend strain and limited liquidity feels risky, use our solid balance sheet and fundamentals stocks screener (1944 results) to quickly narrow in on financially stronger businesses built to endure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CODI

Compass Diversified

A private equity firm specializing in add on acquisitions, buyouts, industry consolidation, recapitalization, late stage, and middle market investments.

Slight risk and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion