- United States

- /

- Capital Markets

- /

- NYSE:CNS

Cohen & Steers (CNS): Assessing Fair Value After Recent Share Price Momentum

Reviewed by Simply Wall St

Cohen & Steers (CNS) has seen shifting momentum recently, which has sparked conversations among investors looking to unpack its valuation story. With performance fluctuating over the past month and year, CNS is drawing comparative attention in the diversified financials sector.

See our latest analysis for Cohen & Steers.

The recent upswing in Cohen & Steers’ share price, up 7.4% over the last month, suggests some renewed optimism after what’s been a tough year, highlighted by a 1-year total shareholder return of negative 26.5%. While momentum has picked up in the short term, the stock’s longer term returns still reflect the impact of shifting sentiment and sector headwinds.

If you’re watching moves like this and thinking about expanding your approach, now’s the perfect moment to explore fast growing stocks with high insider ownership.

With recent volatility fresh in mind, investors are left weighing whether Cohen & Steers is undervalued as it continues to rebound, or if its current price already reflects all expected growth and leaves little room for upside.

Most Popular Narrative: 1.4% Undervalued

With Cohen & Steers closing at $71.34 and the latest narrative fair value at $72.33, analysts see a slight premium, hinting at modest upside for shares. This evaluation balances an evolving earnings outlook against recent downward revisions to growth estimates.

Ongoing investments in global distribution, particularly in Asia-Pacific and Europe, and recent foreign office upgrades are expected to drive international client inflows and scale. There is potential for margin expansion as global business grows.

Want to know which global ambitions could tip the balance for Cohen & Steers? Discover the bold projections for higher margins and international growth that drive this calculated fair value. The full narrative reveals the numbers Wall Street is betting on.

Result: Fair Value of $72.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing client outflows and rising expenses related to global distribution efforts could challenge the pace of Cohen & Steers' expected recovery.

Find out about the key risks to this Cohen & Steers narrative.

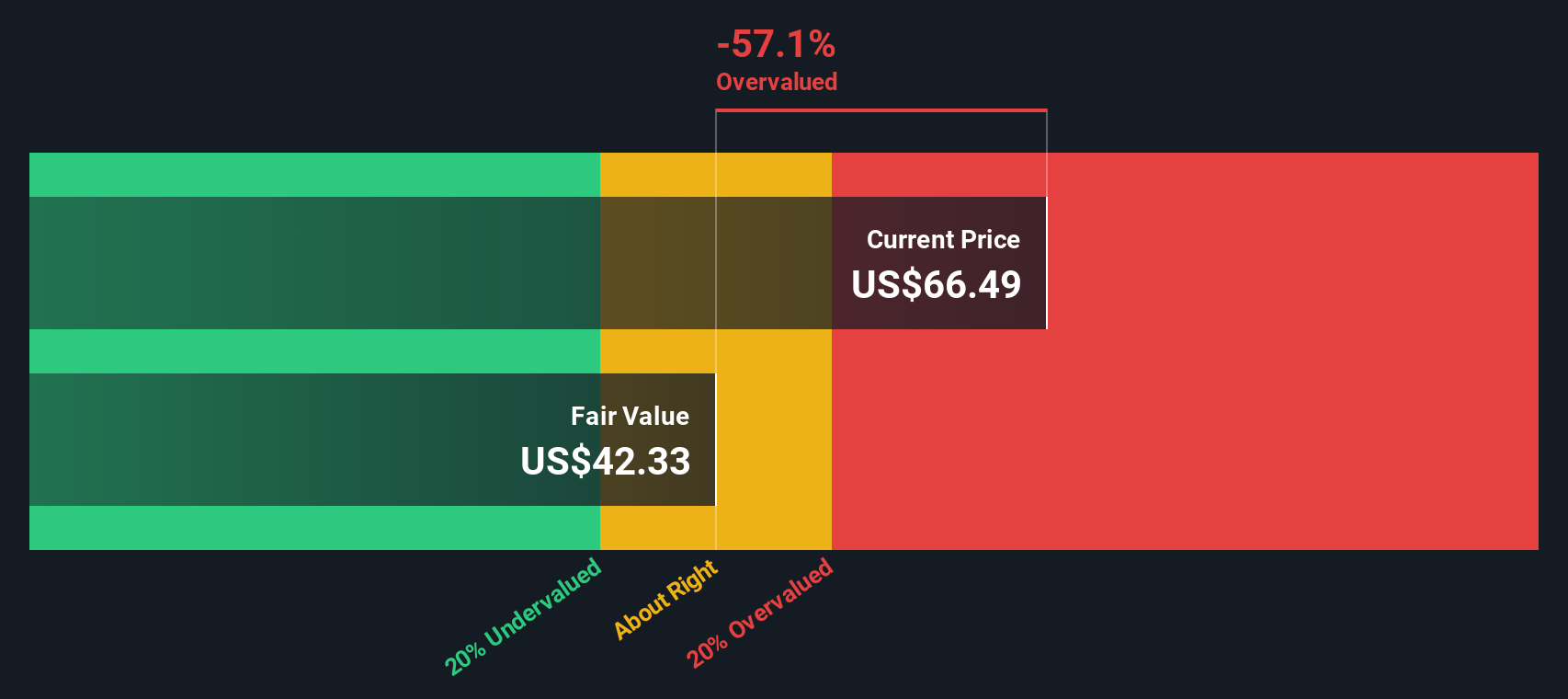

Another View: Our DCF Model Signals a Different Verdict

While the prevailing narrative suggests Cohen & Steers offers modest upside, our DCF model paints a starker picture. According to this approach, the shares are actually trading significantly above fair value. This sharp disconnect between methods highlights the critical role of assumptions in determining a "true" price. Which side of the debate strikes you as more convincing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cohen & Steers for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cohen & Steers Narrative

If the current story does not quite align with your perspective, you can always dive into the numbers and shape your own view in just minutes. Do it your way.

A great starting point for your Cohen & Steers research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep one step ahead by searching beyond the obvious. Use Simply Wall Street’s powerful screener tools to uncover market gems and diversify your approach right now.

- Accelerate your hunt for tomorrow’s tech leaders by checking out these 27 AI penny stocks, which are reshaping industries with machine learning and automation breakthroughs.

- Boost your portfolio’s resilience with steady income potential using these 17 dividend stocks with yields > 3%, highlighting companies delivering consistent yields above 3%.

- Capitalize on early-stage growth by tapping into these 3559 penny stocks with strong financials that boast strong fundamentals and real upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNS

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives