- United States

- /

- Capital Markets

- /

- NYSE:CNS

Cohen & Steers (CNS): Assessing Current Valuation Following Continued Share Price Weakness

Reviewed by Simply Wall St

See our latest analysis for Cohen & Steers.

After a steady drop earlier in the year, Cohen & Steers’ momentum has continued to fade. The latest share price closed at $65.49, and the year-to-date share price return now sits at a challenging -28.32%. Looking at the bigger picture, the stock’s 1-year total shareholder return is down 32.44%, though investors with a longer-term view have still seen positive gains over three and five years.

If this recent downtrend has you thinking about where to look next, it might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

But with shares now trading well below analyst targets and the company showing double-digit earnings growth, the big question is whether the stock represents a genuine bargain or if the market has already factored in all the upside.

Most Popular Narrative: 9.5% Undervalued

Cohen & Steers’ latest consensus narrative suggests the shares are trading below fair value, even after several downward price target adjustments. With renewed focus on potential catalysts, the story behind this valuation is anything but ordinary.

“Strategic expansion into active ETFs and broader product diversification (including the launch of integrated listed/private real estate strategies) is expected to attract new investor segments and improve client retention, supporting future AUM growth and revenue stability. Recovery in real estate valuations, following several quarters of declines and evidence that real estate prices have bottomed, is likely to spur increased allocations from both institutional and retail investors seeking diversification and inflation protection, bolstering future revenue and AUM.”

Want to know the bold assumptions that set this price apart? This fair value is built on a combination of future margin expansion, a shift in global investment trends, and a surprising profit jump. Some forecasts might catch even seasoned market-watchers off guard. Find out which numbers tip the scales.

Result: Fair Value of $72.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing net outflows from clients and heightened expenses related to global expansion may undermine the growth and margin story that analysts are forecasting.

Find out about the key risks to this Cohen & Steers narrative.

Another View: What Do Valuation Ratios Say?

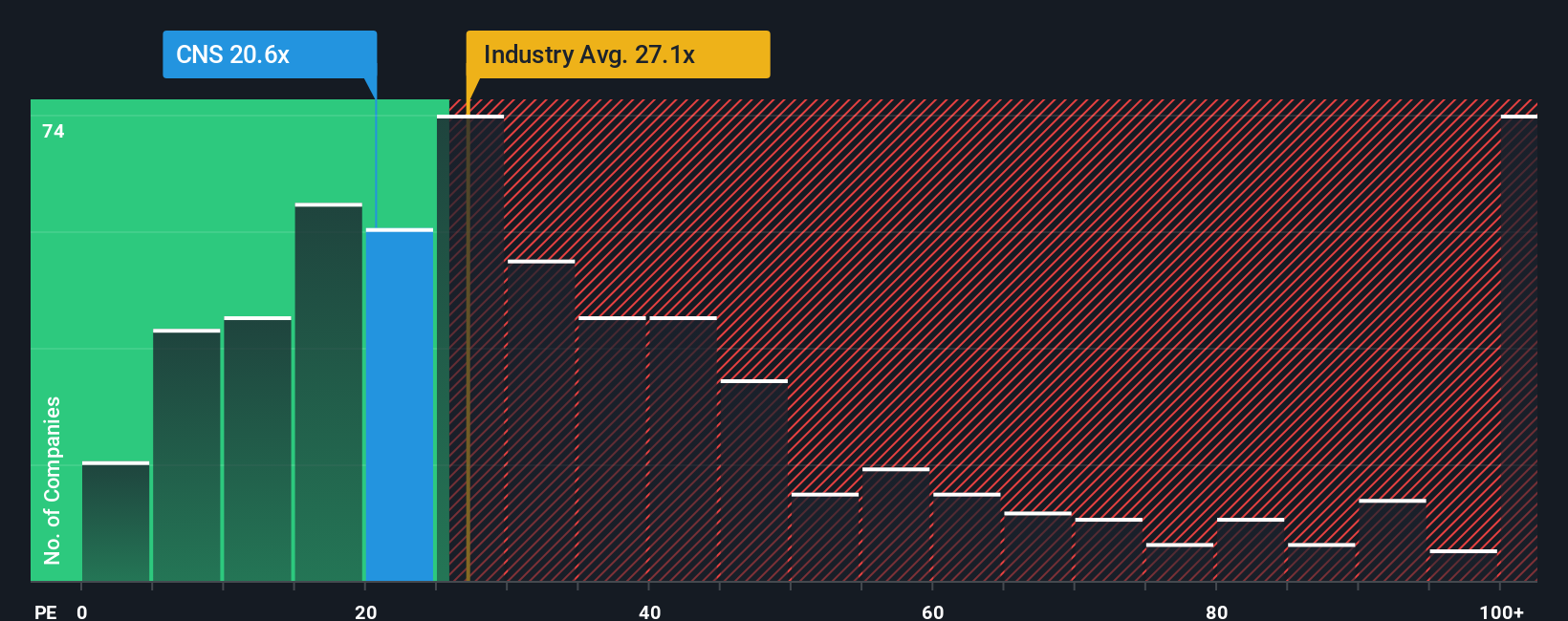

Looking at Cohen & Steers through the lens of valuation ratios, the company's price-to-earnings ratio stands at 20.3x. This is noticeably higher than the peer average of 11.6x and also above the fair ratio of 14.9x, which the market could eventually revert toward. While current earnings growth is solid, this premium means investors are paying up for expected performance. This raises the question: is the optimism warranted, or does it point to valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cohen & Steers Narrative

If you think there’s more to the story or want to dig deeper into the numbers, you can craft your own analysis in just minutes: Do it your way

A great starting point for your Cohen & Steers research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss an opportunity that could put you ahead. Now is the time to spot standout stocks with real momentum before everyone else does.

- Unlock the power of stable income and growth by checking out these 15 dividend stocks with yields > 3% that consistently outperform with yields above 3%, blending payout potential with strong fundamentals.

- Seize your chance to capitalize on game-changing healthcare breakthroughs when you tap into these 31 healthcare AI stocks driving innovation with AI-powered solutions and long-term growth prospects.

- Catch tomorrow’s leaders early by sizing up these 3589 penny stocks with strong financials packed with financial strength and the potential to deliver outsized returns as they break into new markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNS

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives