- United States

- /

- Diversified Financial

- /

- NYSE:CNNE

Cannae Holdings (CNNE): Assessing Valuation as Activist Proxy Battle Heats Up

Reviewed by Simply Wall St

Cannae Holdings (CNNE) is in the spotlight after Carronade Capital Management filed a preliminary proxy statement. The filing urges shareholders to back its board nominees and oppose current leadership as well as recent executive compensation plans.

See our latest analysis for Cannae Holdings.

This latest activist push arrives on the heels of moves like a dividend hike and notable insider selling, adding to the year’s drama for Cannae Holdings. Even with a 2% bump in the past month, momentum is mixed. The stock’s share price has retreated over the last quarter, and its total shareholder return is nearly flat for the year and deep in the red long-term.

If leadership shakeups have you looking beyond the headlines, it could be the perfect time to discover fast growing stocks with high insider ownership

The company’s lackluster long-term returns and sharp recent decline set up a classic investing dilemma. This raises the question of whether Cannae Holdings is trading at a true discount or if the market has already priced in any turnaround potential.

Most Popular Narrative: 15% Undervalued

Compared to Cannae Holdings’ recent close of $18.71, the narrative-fair value stands notably higher at $22. This sets the stage for a potential re-rating if key drivers play out as anticipated.

“Ongoing portfolio optimization, shifting from public to private, tech-enabled, and proprietary investments positions Cannae to capitalize on the accelerating adoption of digital platforms and data-driven businesses. This benefits from robust long-term demand and is likely to drive higher revenue growth and increased portfolio company valuations.”

Curious about the math behind this bullish outlook? The headline number is just the start. Underneath, it relies on a set of aggressive growth strategies and profit transformation assumptions the market may be missing. What is the secret mix analysts expect to drive value? Click to uncover the full perspective behind the fair value calculation.

Result: Fair Value of $22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent underperformance at key holdings and reduced transparency from shifts into private assets could undermine the bullish narrative for Cannae Holdings.

Find out about the key risks to this Cannae Holdings narrative.

Another View: Are Multiples Telling a Different Story?

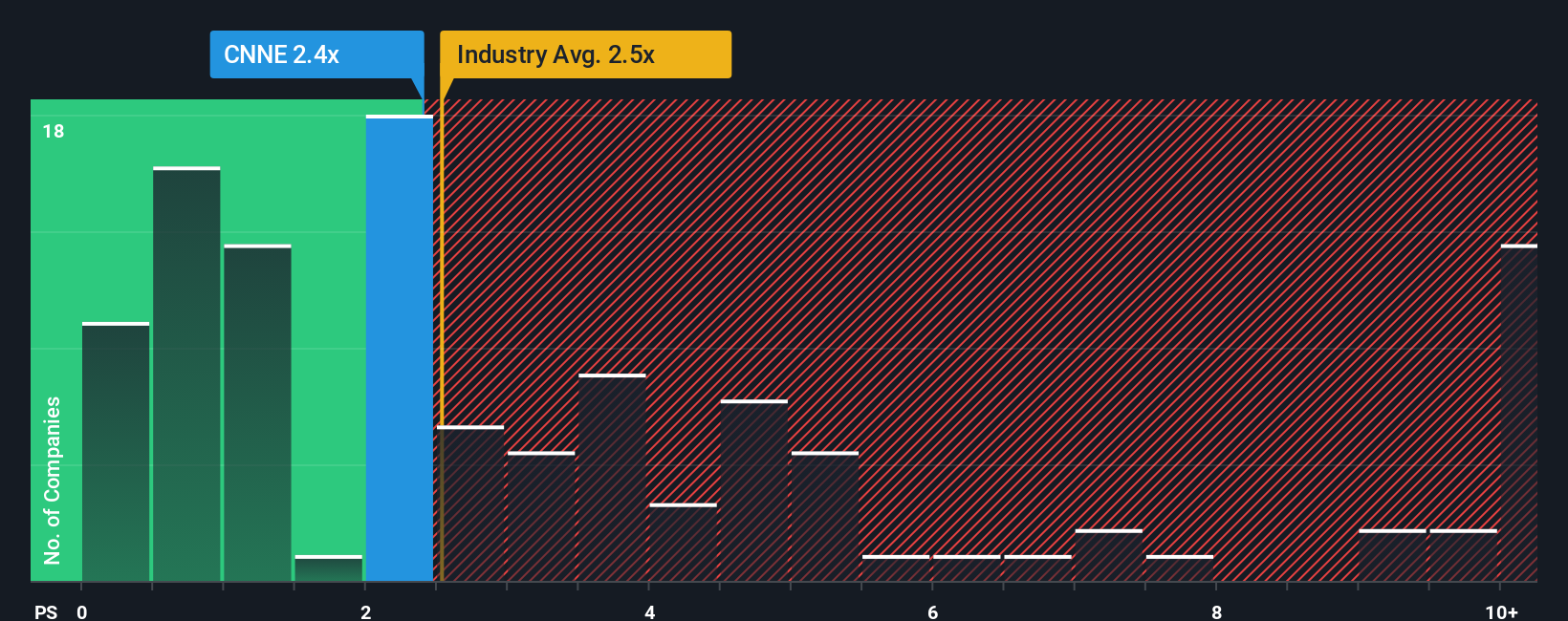

While the fair value narrative points to upside, the market’s ratio tells a more cautious tale. Cannae Holdings trades at a price-to-sales multiple of 2.4x, which is more expensive than both the peer average (1x) and the fair ratio of 0.9x that the market could move toward over time. This signals a valuation risk if expectations reset. Are the narrative optimists missing something, or is the multiple lagging reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cannae Holdings Narrative

If you want to dig deeper or find your own angle on Cannae Holdings, it only takes a few minutes to generate your personal take. Do it your way.

A great starting point for your Cannae Holdings research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the market with stock ideas that match your investing style. You do not want to miss the next opportunity driving real results.

- Tap into the momentum of financial innovation by reviewing these 80 cryptocurrency and blockchain stocks, which shape the future of decentralized markets and blockchain adoption.

- Capture potential value with these 872 undervalued stocks based on cash flows, offering attractive price points based on underlying cash flow fundamentals.

- Grab an edge in generative tech by checking out these 27 AI penny stocks, showcasing companies leading artificial intelligence advancement and commercial transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNNE

Mediocre balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives