Stock Analysis

- United States

- /

- Diversified Financial

- /

- NYSE:CNF

CNFinance Holdings (NYSE:CNF) stock falls 12% in past week as five-year earnings and shareholder returns continue downward trend

Some stocks are best avoided. We don't wish catastrophic capital loss on anyone. Spare a thought for those who held CNFinance Holdings Limited (NYSE:CNF) for five whole years - as the share price tanked 74%. And some of the more recent buyers are probably worried, too, with the stock falling 51% in the last year. Shareholders have had an even rougher run lately, with the share price down 27% in the last 90 days.

Since CNFinance Holdings has shed US$14m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for CNFinance Holdings

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

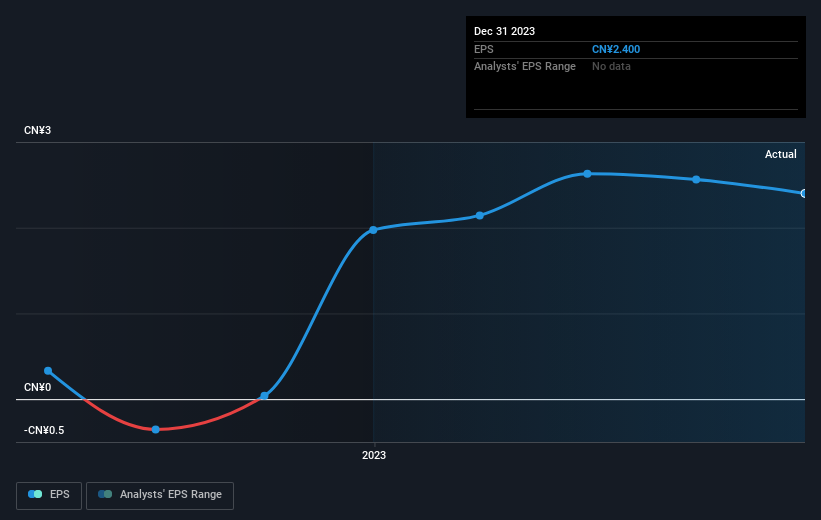

Looking back five years, both CNFinance Holdings' share price and EPS declined; the latter at a rate of 29% per year. The share price decline of 23% per year isn't as bad as the EPS decline. So investors might expect EPS to bounce back -- or they may have previously foreseen the EPS decline.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that CNFinance Holdings has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

CNFinance Holdings shareholders are down 51% for the year, but the market itself is up 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 12% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand CNFinance Holdings better, we need to consider many other factors. For instance, we've identified 2 warning signs for CNFinance Holdings that you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether CNFinance Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether CNFinance Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNF

CNFinance Holdings

Through its subsidiaries, provides home equity loan services in the People’s Republic of China.

Proven track record with mediocre balance sheet.