- United States

- /

- Mortgage REITs

- /

- NYSE:CIM

Chimera Investment’s (CIM) Sudden Swing to Quarterly Net Loss Could Be a Game Changer

Reviewed by Sasha Jovanovic

- Chimera Investment Corporation recently reported a net loss of US$0.58 million for the third quarter of 2025, a sharp reversal from the net income of US$136.46 million recorded in the same period last year, with basic and diluted losses per share from continuing operations at US$0.27.

- This significant drop in earnings follows a period of profitability, signifying a substantial change in the company's financial performance and potentially impacting investor sentiment going forward.

- We’ll examine how Chimera Investment’s unexpected swing to a quarterly net loss could influence its investment narrative and outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Chimera Investment Investment Narrative Recap

To own Chimera Investment Corporation stock, investors need confidence in the company’s ability to adapt its portfolio toward higher-yielding, non-agency mortgage assets, while managing increased credit risk. The recent swing to a quarterly net loss highlights the volatile earnings profile and brings the biggest short-term risk, sustained credit losses or underperformance from new investments, into sharper focus, but does not materially alter the immediate catalyst, which remains the successful integration and earnings contribution from HomeXpress.

Amid this earnings setback, the board’s declaration of multiple preferred stock dividends for Q4 2025 stands out. This continuing dividend activity signals a maintained commitment to returning some capital to investors, even as recent results suggest tighter coverage and underline the key risk that pressured earnings could affect these distributions if profitability does not recover.

Yet, alongside these dividend moves, investors should be aware that greater exposure to non-agency mortgage credit means Chimera’s results can change quickly if...

Read the full narrative on Chimera Investment (it's free!)

Chimera Investment's narrative projects $382.2 million in revenue and $168.2 million in earnings by 2028. This requires 7.0% yearly revenue growth and a $62.8 million earnings increase from $105.4 million today.

Uncover how Chimera Investment's forecasts yield a $15.50 fair value, a 29% upside to its current price.

Exploring Other Perspectives

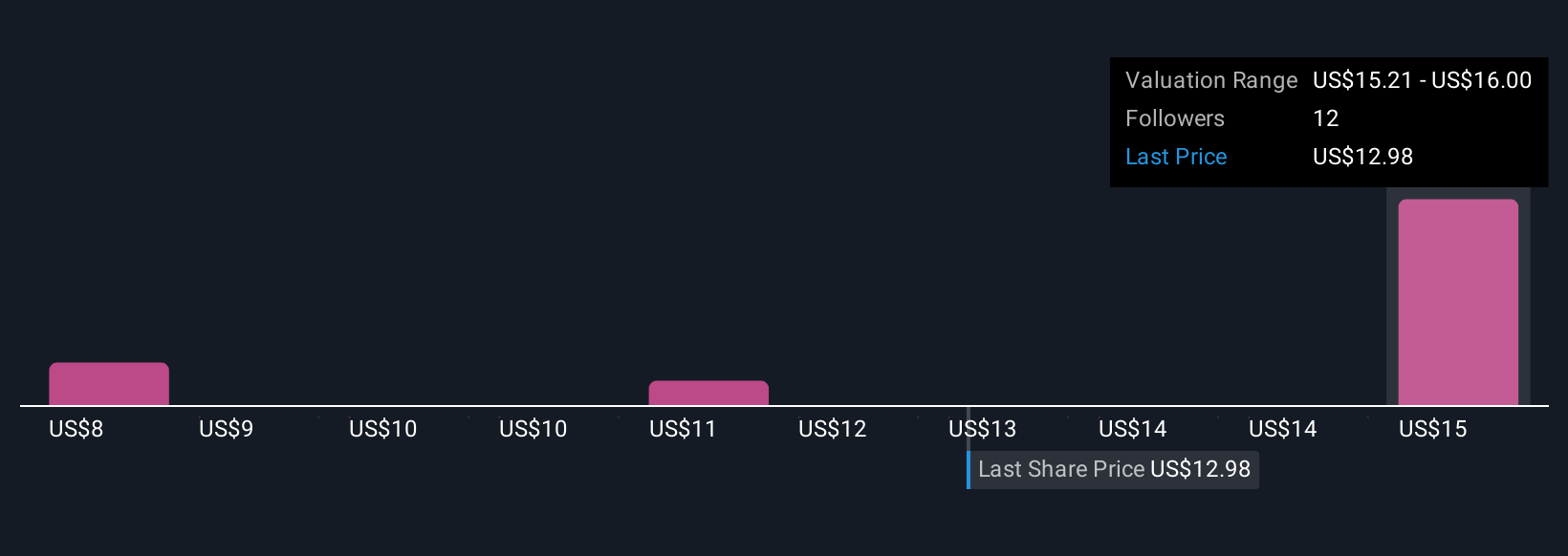

Six fair value estimates from the Simply Wall St Community range from US$11.36 to US$16, showing views that both under- and over-valuation are possible. With Chimera’s riskier asset mix now translating into earnings volatility, consider these varied forecasts as you review the recent quarterly loss and future potential.

Explore 6 other fair value estimates on Chimera Investment - why the stock might be worth 6% less than the current price!

Build Your Own Chimera Investment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chimera Investment research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Chimera Investment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chimera Investment's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CIM

Chimera Investment

Operates as a real estate investment trust (REIT) in the United States.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives