- United States

- /

- Mortgage REITs

- /

- NYSE:BXMT

Will Blackstone Mortgage Trust’s (BXMT) Board Addition Shape Its Approach to Complex Credit Markets?

Reviewed by Sasha Jovanovic

- Blackstone Mortgage Trust, Inc. recently appointed experienced institutional investor Jean Hsu to its Board of Directors, bringing more than 25 years of global expertise in fixed income, real estate, private credit, and structured products to the company.

- Hsu’s background leading CalPERS’ private debt and real estate lending strategies is expected to add depth to BXMT’s board, potentially influencing future decisions across its lending and investment operations.

- We’ll explore how her appointment could affect the company’s investment narrative, especially considering her experience in complex credit markets.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Blackstone Mortgage Trust Investment Narrative Recap

To be a Blackstone Mortgage Trust shareholder, one should believe in the company’s ability to manage credit risk while resolving impaired assets and redeploying capital into higher quality investments. The appointment of Jean Hsu brings seasoned oversight to these ongoing efforts, but the news does not materially alter the near-term outlook; the successful resolution of impaired loans remains the most important short-term catalyst, while the risk of prolonged asset workouts still looms over earnings stability.

One relevant recent announcement is the consistent dividend payout, with the company declaring a Q3 2025 dividend of US$0.47 per share. This reflects management’s intent to maintain shareholder returns, even as the company addresses portfolio risks and seeks to recapture earnings potential by resolving impaired loans and redeploying capital into new investments.

By contrast, investors should be aware that the remaining US$970 million in impaired loans could continue to weigh on margins if resolution efforts stall or market conditions worsen...

Read the full narrative on Blackstone Mortgage Trust (it's free!)

Blackstone Mortgage Trust's outlook anticipates $547.4 million in revenue and $513.3 million in earnings by 2028. This is based on an expected 32.2% annual revenue growth rate and a $525.9 million increase in earnings from the current level of -$12.6 million.

Uncover how Blackstone Mortgage Trust's forecasts yield a $20.50 fair value, a 11% upside to its current price.

Exploring Other Perspectives

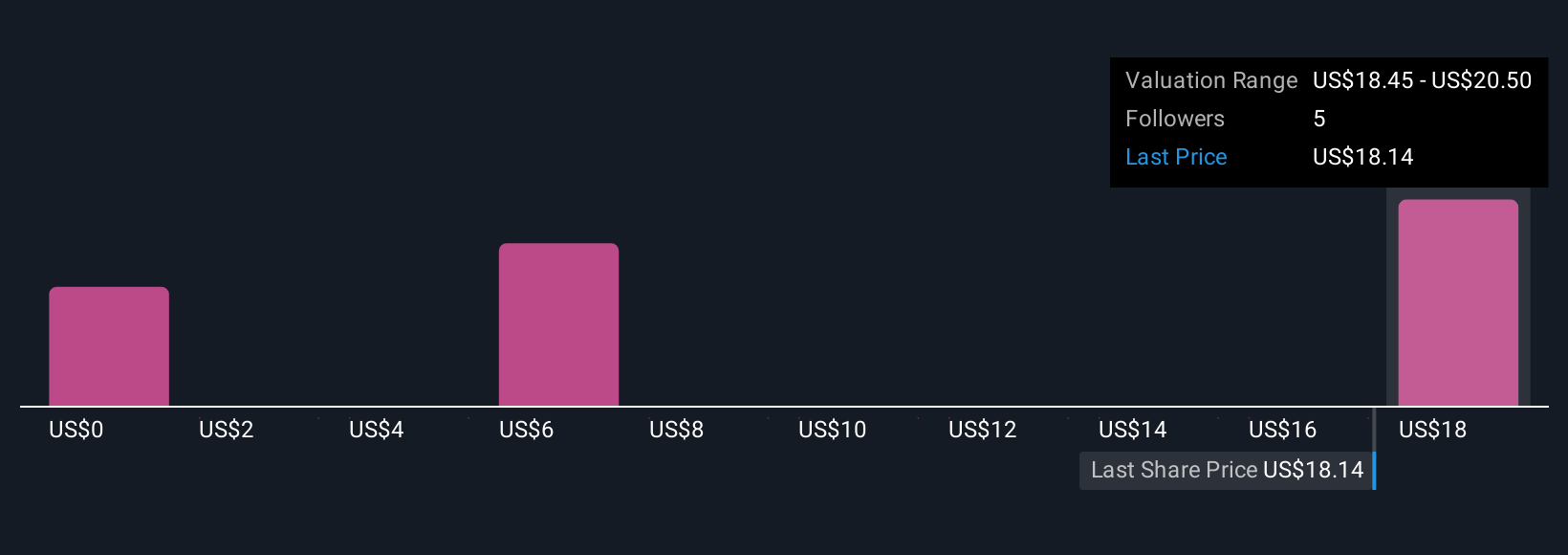

Fair value estimates for Blackstone Mortgage Trust from five Simply Wall St Community members span a wide US$2.05 to US$20.50 range. While new board expertise may support improved asset management, impaired loans are a key issue affecting performance outlooks, see how your views align with this wide spectrum.

Explore 5 other fair value estimates on Blackstone Mortgage Trust - why the stock might be worth as much as 11% more than the current price!

Build Your Own Blackstone Mortgage Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blackstone Mortgage Trust research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Blackstone Mortgage Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Blackstone Mortgage Trust's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackstone Mortgage Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BXMT

Blackstone Mortgage Trust

A real estate finance company, originates senior loans collateralized by commercial properties in North America, Europe, and Australia.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives