- United States

- /

- Mortgage REITs

- /

- NYSE:BXMT

Blackstone Mortgage Trust (BXMT) Returns to Profitability, Testing Market’s Patience With Premium Valuation

Reviewed by Simply Wall St

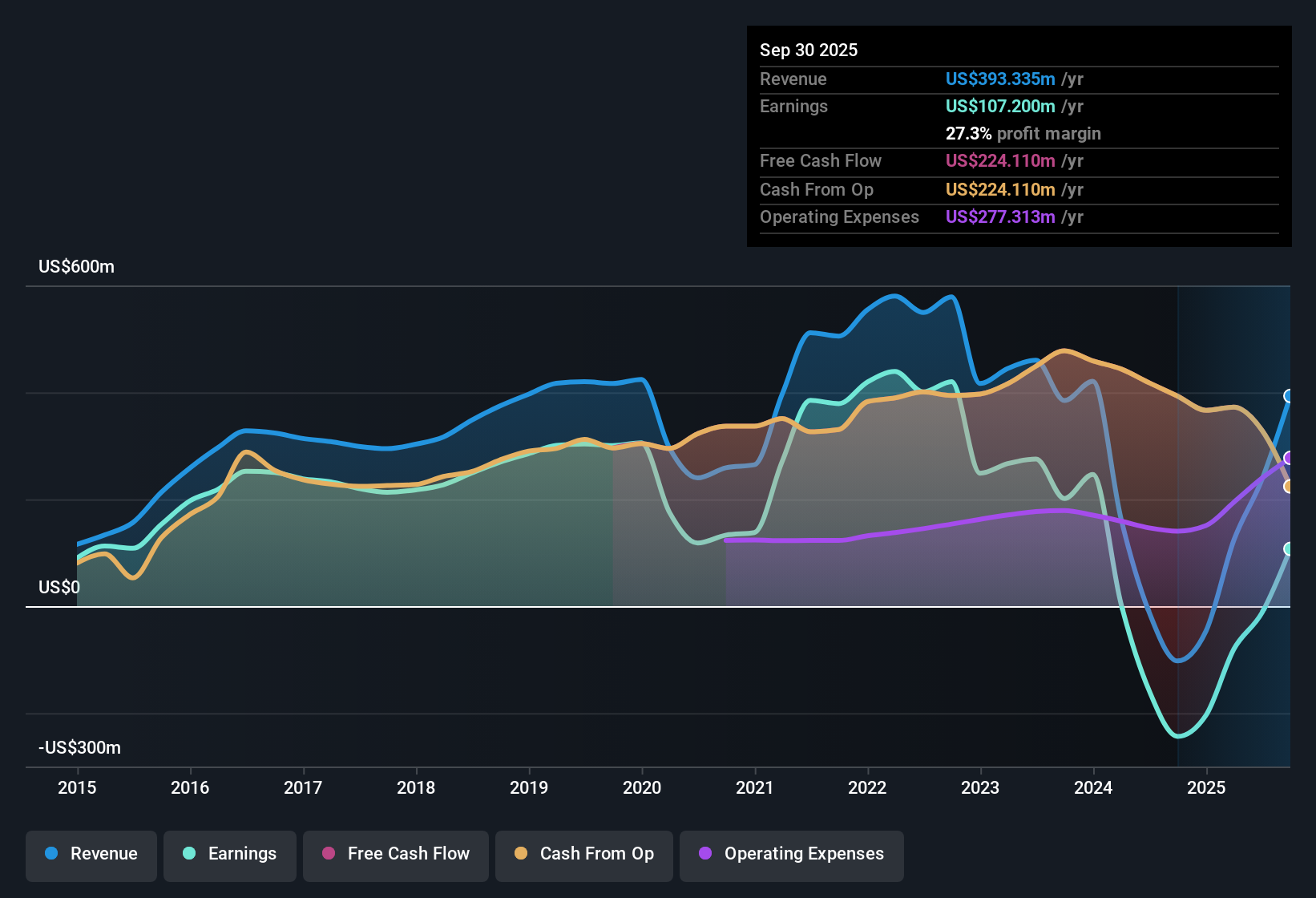

Blackstone Mortgage Trust (NYSE:BXMT) posted an earnings turnaround, with EPS now in positive territory after previously falling by 38.5% per year over the past five years. Annual earnings are forecast to jump 40.7% for the next three years, while revenue growth is set at 4.9% per year, trailing the broader US market’s 10.3% pace. Investors will be weighing this return to profitability and robust growth expectations against high valuation multiples and ongoing concerns about financial stability and dividend sustainability.

See our full analysis for Blackstone Mortgage Trust.With the financial results in place, the next step is to see how these numbers compare to the market’s biggest narratives for BXMT and whether the story is shifting.

See what the community is saying about Blackstone Mortgage Trust

Margin Expansion Forecast: 93.8% by 2028

- Analysts expect profit margins to rise dramatically from -5.3% today to 93.8% in three years. If actual results track these projections, this would suggest a powerful shift in core earnings power.

- Analysts' consensus view places significant weight on anticipated balance sheet optimization and the transition to net lease strategies in defensive sectors, aiming to deliver stable and resilient cash flows.

- Consensus narrative notes that improving credit quality through capital redeployment and addressing impaired loans could create room for margin expansion and recurring income.

- However, the push for portfolio turnover relies substantially on successful repayment timing and stable market conditions. These could be undermined by external shocks or prolonged loan resolution periods.

Remaining $970 Million in Impaired Loans Raises Caution

- The company still has $970 million in impaired loans that continue to incur interest expense without generating income. This amount makes up a material portion of the portfolio and poses a major risk to margin improvement and future earnings growth.

- According to the analysts' consensus view, while resolution of $1.5 billion of impaired assets over six months is seen as a positive signal, the remaining balance could linger if market volatility persists. This may potentially affect both revenue and net margins.

- Critics highlight that extended asset resolutions could not only undermine expectations for growth but also weigh on near-term earnings visibility and dividend sustainability.

- Consensus further observes that a timing mismatch between loan repayments and redeployment could reduce the average portfolio size, hampering distributable earnings.

P/E Ratio of 29.3x Signals Premium, Not Bargain

- Blackstone Mortgage Trust currently trades at a Price-to-Earnings ratio of 29.3x, which is well above the US Mortgage REITs industry average of 12.3x and the peer average of -8.3x. This places the stock at a significant valuation premium that investors must consider against potential upside.

- The analysts' consensus view argues that with the current share price at $18.5 and the consensus analyst price target at $20.43, the implied potential upside is just 10.4%. This highlights limited room for error if growth or margin expansion falls short of expectations.

- Consensus notes that the relatively small difference between the current share price and the analyst target supports the view that the stock is fairly valued, making future outperformance reliant on exceeding already-high expectations.

- This valuation tension is further complicated by ongoing questions around the company’s financial stability and ability to sustain its dividend, increasing the focus on risk versus reward for potential new buyers.

To see how the full narrative landscape could impact BXMT’s outlook, dive into the balanced analyst view and fuller set of forecasts: 📊 Read the full Blackstone Mortgage Trust Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Blackstone Mortgage Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh angle on the numbers? Shape your perspective and craft your own narrative in just a few minutes: Do it your way

A great starting point for your Blackstone Mortgage Trust research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite improving earnings prospects, Blackstone Mortgage Trust faces above-average valuation, impaired loan risks, and persistent concerns over dividend sustainability and financial strength.

For investors seeking more reliable balance sheets and fewer questions about financial stability, discover solid balance sheet and fundamentals stocks screener (1986 results) built for resilience in every market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackstone Mortgage Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BXMT

Blackstone Mortgage Trust

A real estate finance company, originates senior loans collateralized by commercial properties in North America, Europe, and Australia.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives