- United States

- /

- Capital Markets

- /

- NYSE:BX

Blackstone (BX): Assessing Valuation After Recent Share Price Decline and Updated Capital Inflows

Reviewed by Simply Wall St

See our latest analysis for Blackstone.

While Blackstone’s share price has cooled with a 12.9% drop over the past month, bigger picture momentum remains solid when you zoom out. Its 1-year total shareholder return is nearly flat, but long-term holders have enjoyed a remarkable 91% gain over three years and more than 280% over five years. This is evidence that volatility has not derailed its growth story.

If you’re weighing your next move, now is a great moment to broaden your perspective and discover fast growing stocks with high insider ownership

With Blackstone's long-term track record still impressive and shares now below analyst targets, is the market offering a value entry point, or are expectations for future growth already reflected in the price?

Most Popular Narrative: 11% Undervalued

Blackstone’s most widely followed narrative points to a fair value of $181.68 per share, which is about 11% higher than the last close at $161.72. With this gap, the focus shifts to what is driving the optimistic view: capital inflows, alliances, and projected earnings expansion.

Blackstone has raised $62 billion of inflows in Q1 2025, marking the highest level in three years, which boosts assets under management (AUM) and gives the company a strong foundation for future revenue growth. The firm is well-positioned to benefit from market dislocation with $177 billion of dry powder available for opportunistic investments, potentially increasing future earnings as capital is deployed in undervalued assets.

Want to know the math behind this bold valuation? The narrative builds its case on a forecast of rapid profit expansion, aggressive revenue growth, and a future multiple that tells its own story. What if these assumptions are the secret sauce that analysts believe justifies a premium price? Are you ready to see what numbers are being baked in?

Result: Fair Value of $181.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks around trade tensions and real estate market fluctuations could quickly derail Blackstone’s optimistic outlook and trigger a shift in investor sentiment.

Find out about the key risks to this Blackstone narrative.

Another View: Looking at Earnings Multiples

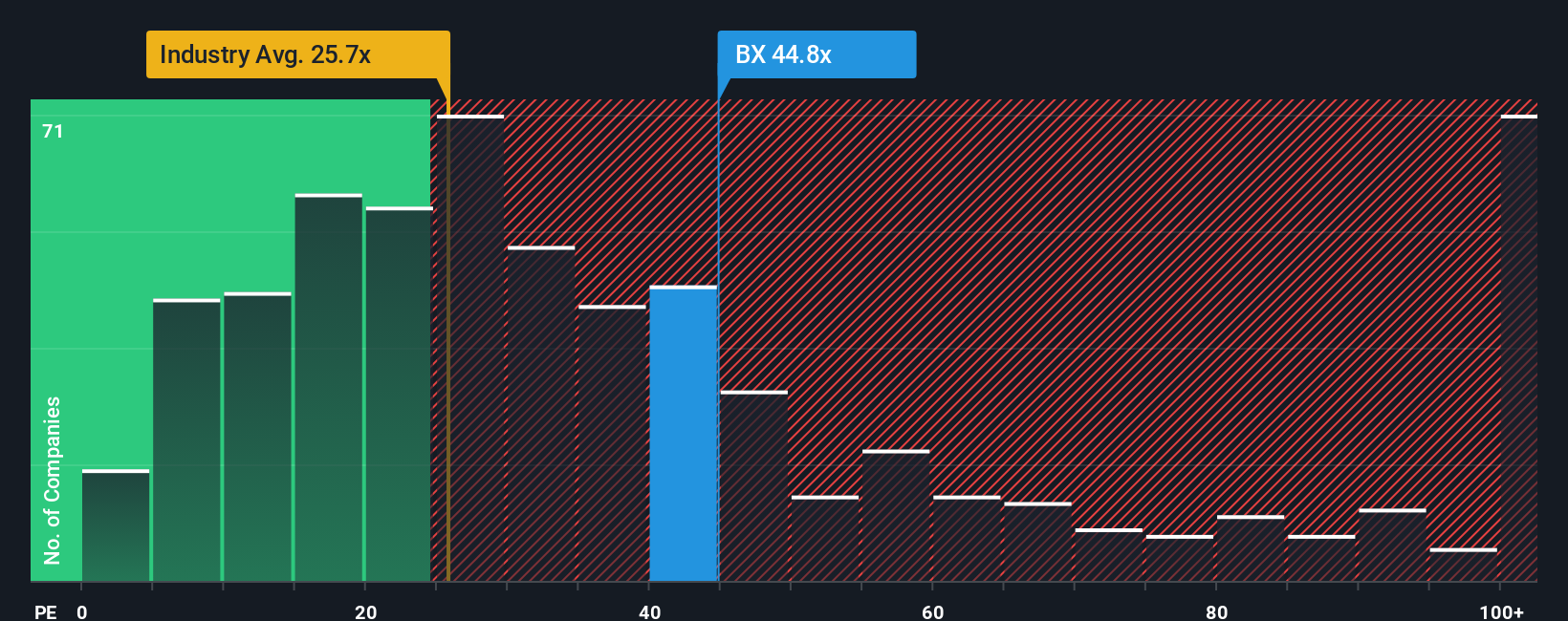

Taking a different approach, Blackstone’s current price values the company much higher than its industry peers and our fair ratio based on earnings. Its price-to-earnings multiple is 44.2x, while the US Capital Markets industry average is 25.9x and the fair ratio sits at 26.5x. This wide gap hints at valuation risk. Is Blackstone’s premium truly justified, or is there room for a rethink?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Blackstone Narrative

If you see things differently or enjoy drawing your own conclusions from the data, our tools make it quick and easy to craft your own perspective in just minutes. Go ahead and Do it your way.

A great starting point for your Blackstone research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Smart Investing Moves?

Don’t let opportunity pass you by. The right stock screen can reveal new winners and sharpen your edge with expert insights tailored to your goals.

- Catch market momentum by uncovering these 878 undervalued stocks based on cash flows, packed with potential and often overlooked by the crowd.

- Target steady cash flow and future payouts when you review these 17 dividend stocks with yields > 3%, featuring impressive yields and consistent performance.

- Seize the future of innovation as you tap into these 26 AI penny stocks and discover companies driving breakthroughs in automation, data, and intelligent technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackstone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BX

Blackstone

An alternative asset management firm specializing in private equity, real estate, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives