- United States

- /

- Diversified Financial

- /

- NYSE:BUR

Is Now the Right Time to Reassess Burford Capital After 13% Drop This Month?

Reviewed by Bailey Pemberton

Thinking about whether to hold, buy, or move on from Burford Capital? You're not alone. The past year has been a wild ride, with the stock dropping 20.4%, and more recently, a dip of 13.3% over the last month alone. At first glance, those numbers might raise some eyebrows, but any seasoned investor will tell you that sometimes sell-offs create opportunity rather than signal real trouble.

What's been driving these moves? Well, the legal finance sector has been under the spotlight, with growing discussion about regulatory clarity and the future role of litigation funding in global markets. For Burford, some of these shifts have actually underlined the company’s unique positioning and potential for long-term growth. While the short-term swings may reflect shifting risk perceptions, the bigger picture tells a different story. For example, there was a 36.6% rise over three years and an impressive 27.6% gain over five years.

But let’s get right to what matters most: is Burford Capital undervalued now? According to a variety of valuation approaches, it absolutely is. The company scores a perfect 6 out of 6 on our valuation checks, suggesting there could be meaningful upside others are missing. Next, let's break down what those valuation methods reveal, and later, I’ll show you a more holistic way to think about Burford’s real worth.

Why Burford Capital is lagging behind its peers

Approach 1: Burford Capital Excess Returns Analysis

The Excess Returns model evaluates how much value Burford Capital creates above its cost of capital, focusing on how efficiently the company invests its equity to generate profits. Rather than simply looking at reported earnings or cash flows, this approach zeroes in on the sustainable returns the business can achieve on each dollar it retains and reinvests, relative to what shareholders require.

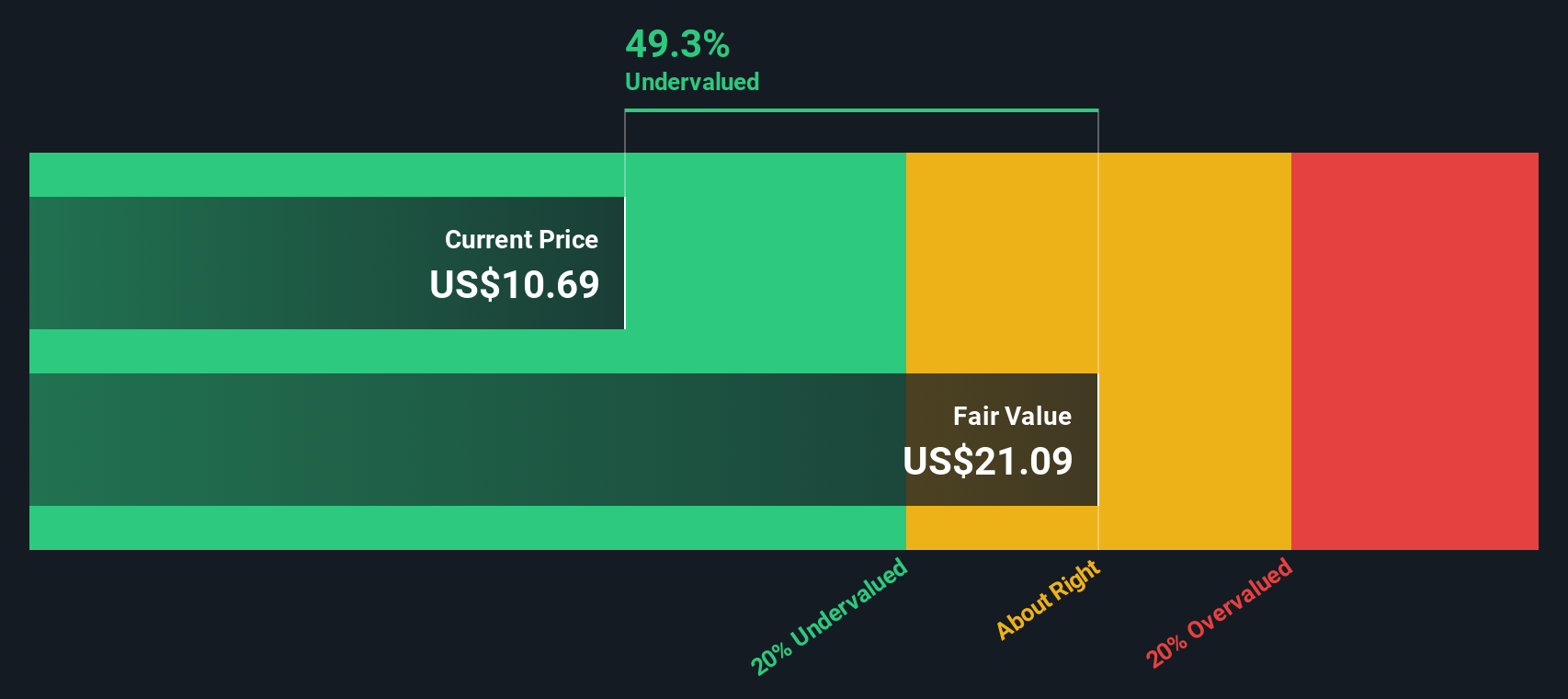

According to this model, Burford Capital has a Book Value of $11.44 per share and a Stable Earnings Per Share (EPS) of $1.39, based on the median return on equity from the past five years. Its Cost of Equity stands at $1.04 per share, resulting in a meaningful Excess Return of $0.35 per share. The company’s average return on equity clocks in at a solid 10.30%. Looking ahead, analysts estimate a Stable Book Value reaching $13.51 per share.

Factoring all these components, the Excess Returns model estimates the stock's intrinsic value to be about $21.10 per share. With the current market price sitting below this, which implies the stock is trading at a 49.3% discount, it suggests Burford Capital is notably undervalued on this measure.

Result: UNDERVALUED

Our Excess Returns analysis suggests Burford Capital is undervalued by 49.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Burford Capital Price vs Earnings

For profitable companies like Burford Capital, the price-to-earnings (PE) ratio is often the go-to valuation metric because it captures how much investors are willing to pay for each dollar of earnings. A reasonable PE ratio balances not just current profitability but also growth expectations and risk. This means faster-growing and lower-risk businesses can generally support higher multiples, while riskier or slower-growing ones might command less.

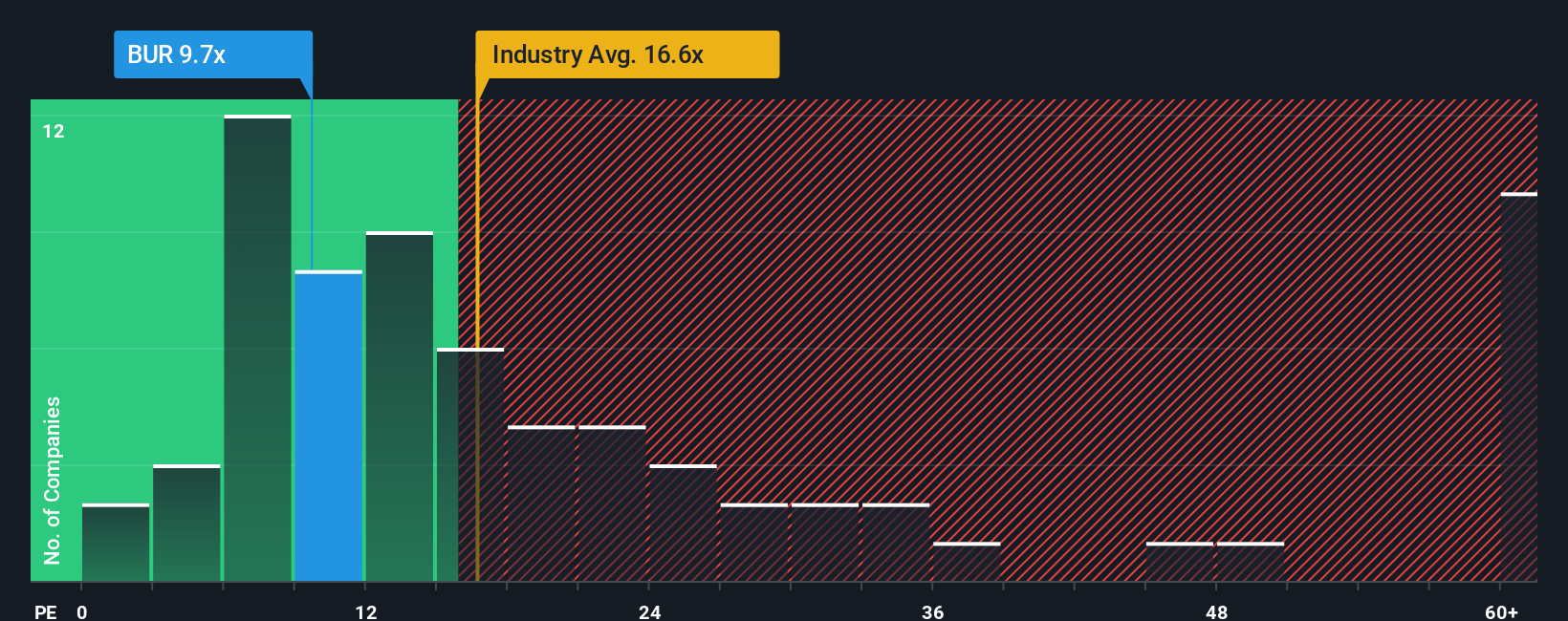

Burford Capital currently trades at a PE ratio of 9.7x, which stands out when compared to the Diversified Financial industry average of 16.5x and a peer group average of 51.0x. Both the industry and peer numbers suggest the market generally expects higher valuations for firms in this category, possibly reflecting stronger future growth or lower perceived risk elsewhere.

Simply Wall St calculates a “Fair Ratio” for each company. In Burford’s case, this fair ratio is 17.7x. This proprietary metric is more informative than a simple industry or peer comparison because it considers Burford’s specific growth potential, risks, market capitalization, profit margins, and industry context. Essentially, it tailors the PE benchmark to Burford’s own situation, which makes it a more reliable guide for fair value.

With Burford trading at 9.7x earnings versus a fair ratio of 17.7x, the stock appears undervalued on this measure. The numbers indicate the market may be underappreciating its potential, leaving a significant margin of safety for new or existing shareholders.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Burford Capital Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, dynamic story you create about a company, connecting your assumptions for its future revenue, earnings, and profit margins with a fair value estimate. This allows you to clearly see the link between your outlook and what you think the stock is worth.

On Simply Wall St's Community page, Narratives make it easy for anyone to set their own expectations and see them brought to life, joining millions of investors who use these as part of their investment process. Narratives are not just static guesses; they automatically update when new news or earnings come in, keeping your perspective aligned with the latest facts. This empowers you to confidently compare your Narrative's Fair Value to the current share price, helping you quickly spot opportunities to buy or sell based on your belief, rather than just the herd’s view.

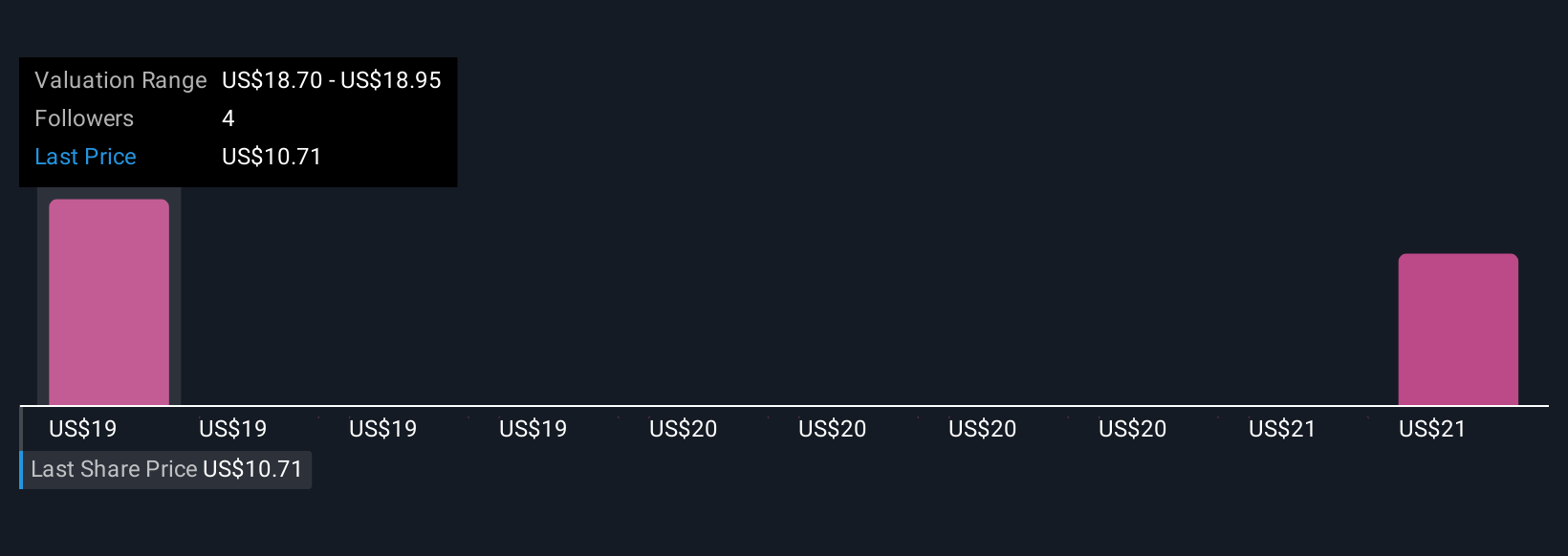

For example, one Burford Capital Narrative might assume high growth and stable margins, resulting in a fair value of $22.5. Another, more cautious Narrative with slower growth and higher risks might suggest a fair value as low as $18.0. This allows you to explore a range of credible outlooks and see exactly what would need to happen for the stock to be a bargain or a risk.

Do you think there's more to the story for Burford Capital? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Burford Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BUR

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives