- United States

- /

- Diversified Financial

- /

- NYSE:BRK.B

Is Berkshire Hathaway Still a Bargain After 12.8% Year-to-Date Climb?

Reviewed by Bailey Pemberton

- Wondering if Berkshire Hathaway is still a smart buy or if the price has finally outpaced the value? You are not alone. This stock is a perennial favorite for investors looking for both growth and security.

- The stock has climbed 2.0% over the past week and is up 12.8% year-to-date, with a massive 124.2% return over the last five years. This momentum keeps both bulls and cautious investors on their toes.

- Recent headlines highlight Berkshire’s steady acquisition activity and Warren Buffett's long-term approach, which continue to draw attention from institutional buyers. These moves are shaping perceptions of both its safety and growth potential, influencing how investors are reacting to the current market landscape.

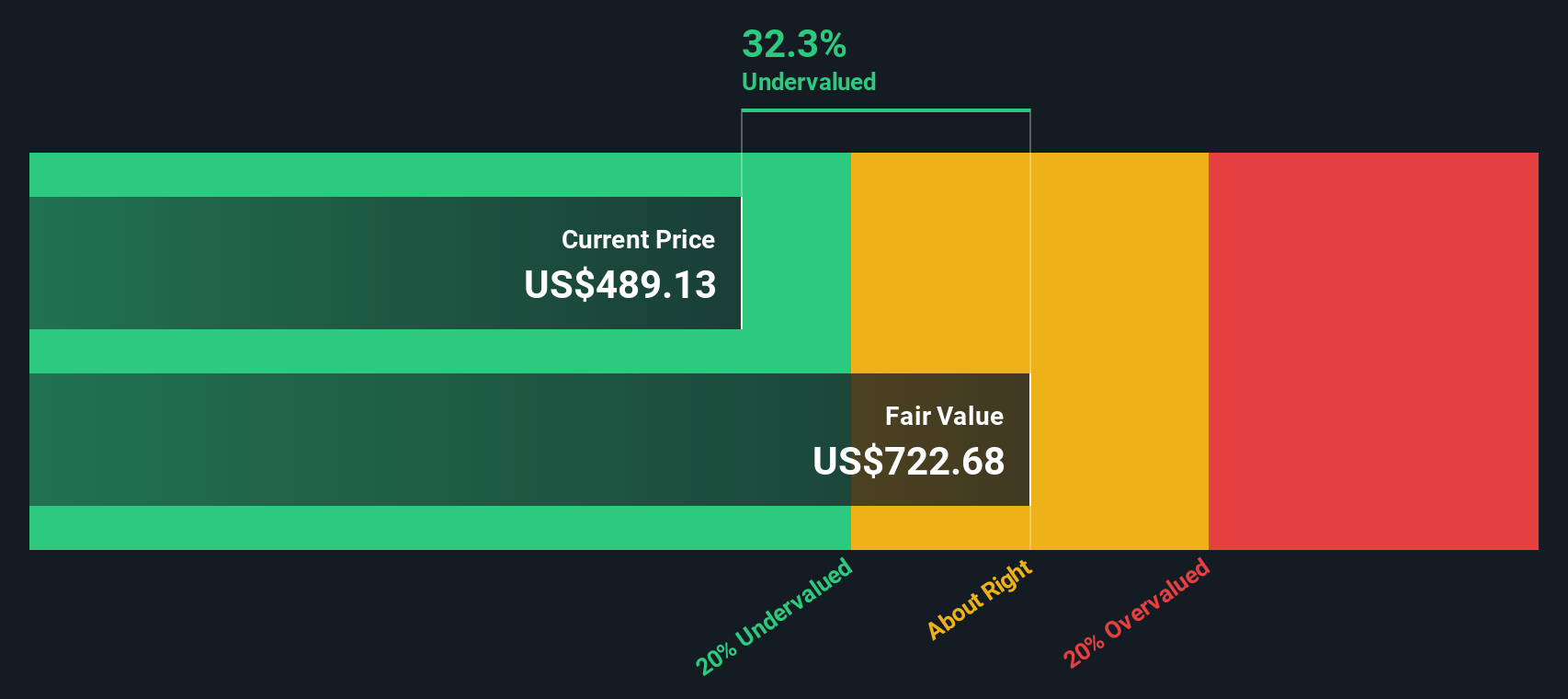

- According to our valuation checks, Berkshire Hathaway scores a 4 out of 6 on our value scorecard. This means it looks undervalued in several key areas. Next, let’s break down how we arrive at that number and hint at a smarter, more comprehensive way to evaluate the company’s true value by the end of this article.

Approach 1: Berkshire Hathaway Excess Returns Analysis

The Excess Returns model is a method for assessing how much profit a company generates beyond the basic cost of equity capital. It focuses on the returns that Berkshire Hathaway creates over and above what investors require, factoring in both the company's underlying profitability and its growth in book value over time.

For Berkshire Hathaway, the numbers are impressive. The current Book Value stands at $485,274.36 per share. Its Stable Earnings Per Share (EPS) is $66,154.88, calculated based on the median Return on Equity over the last five years. The Cost of Equity, or the minimum return investors expect, is $38,818.25 per share. Subtracting this from the stable EPS gives an Excess Return of $27,336.63 per share. This indicates that the company is consistently generating profits well above its cost of capital, supported by a healthy average Return on Equity of 12.85%. Looking ahead, analysts project the Stable Book Value will grow to $514,986.06 per share.

Based on this model, Berkshire Hathaway’s intrinsic value comes out higher than its current trading price, suggesting a 33.8% discount. This points to the stock being solidly undervalued relative to the returns it is generating and its long-term growth prospects.

Result: UNDERVALUED

Our Excess Returns analysis suggests Berkshire Hathaway is undervalued by 33.8%. Track this in your watchlist or portfolio, or discover 886 more undervalued stocks based on cash flows.

Approach 2: Berkshire Hathaway Price vs Earnings

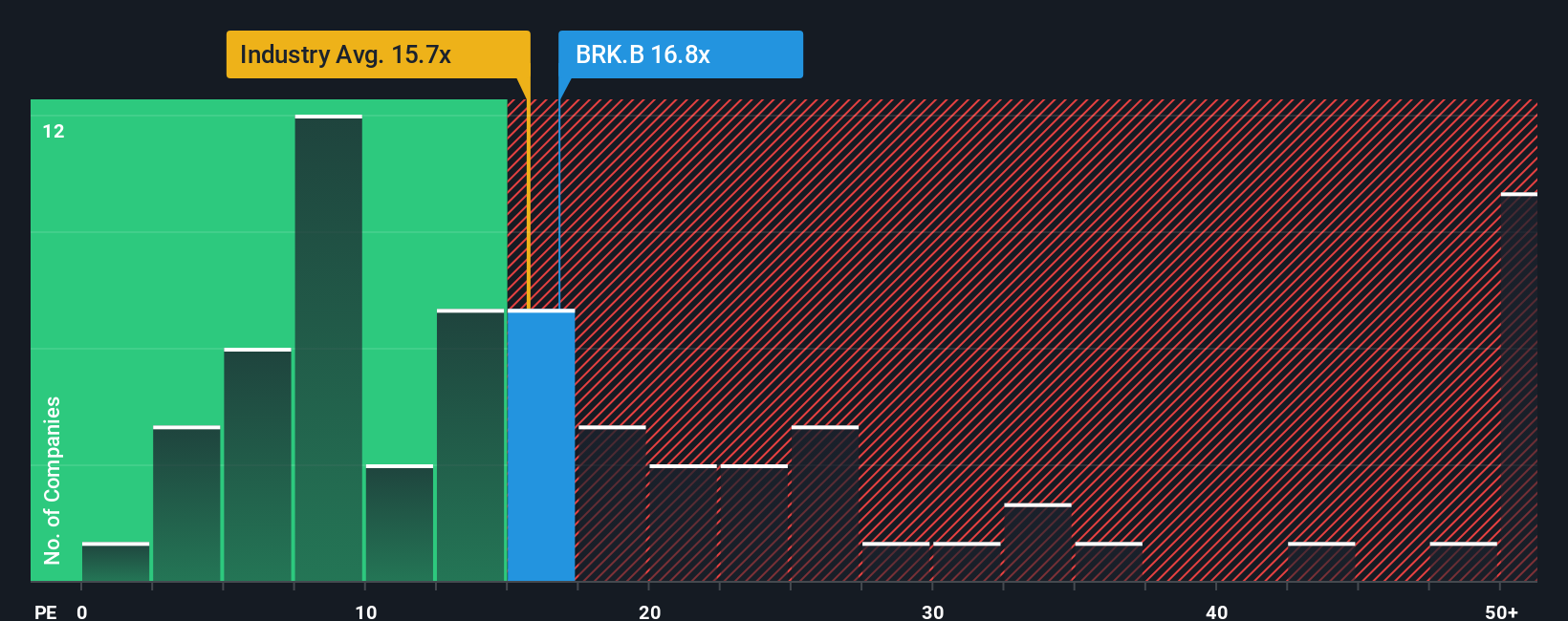

The Price-to-Earnings (PE) ratio is often the preferred way to value established, profitable companies like Berkshire Hathaway because it directly compares the market price to current earnings. This makes it a useful shorthand for how much investors are willing to pay for each dollar of the company’s profit.

What counts as a “fair” PE ratio depends on growth expectations and the risk profile of the business. Companies expected to grow faster or with lower risk typically command higher PE multiples, while those facing more uncertainty or slower growth tend to trade at lower ones.

Berkshire Hathaway currently trades at a 16.29x PE ratio. This sits notably above the Diversified Financial industry average of 13.16x, but is below the peer group’s average of 24.66x. This puts Berkshire in a mid-range spot, not the cheapest in its sector, but certainly not expensive compared to major peers.

Here is where Simply Wall St’s proprietary “Fair Ratio” comes in. Unlike simple industry or peer comparisons, the Fair Ratio (17.03x) is tailored to Berkshire’s unique mix of earnings growth, scale, industry dynamics, margins, and risk factors. As a result, it offers a more holistic and context-rich benchmark to judge value.

Since Berkshire’s actual PE ratio is just below the Fair Ratio, the data suggests that its shares are nearly in line with their underlying value based on earnings. The difference is less than 0.10x, meaning the valuation is right where it should be.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Berkshire Hathaway Narrative

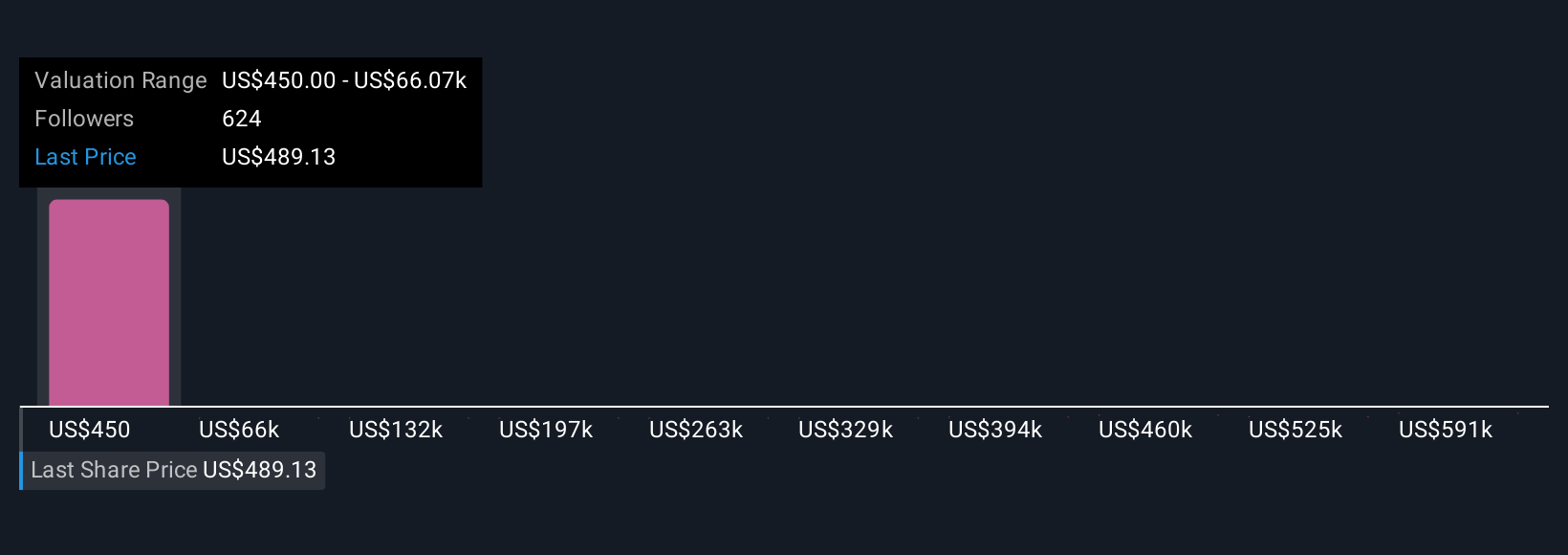

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, powerful way for investors to connect their personal story or perspective on a company with the numbers by mapping their views on future revenue, earnings, profit margins and a fair value estimate. This approach links Berkshire Hathaway’s story to a financial forecast and then to what you think is a fair price, making each investment thesis uniquely yours.

Narratives are easy to use and available right now to millions of investors on Simply Wall St’s Community page, where you can create or explore different perspectives from other investors. Comparing your Narrative’s Fair Value to the current Price helps you decide whether it’s the right moment to buy, sell, or hold. Best of all, Narratives update automatically as fresh information such as earnings releases or major news comes in, keeping your analysis relevant and up to date.

For example, some investors see Berkshire’s future fair value as high as $630,000 per share, while others estimate it as low as $420,000, showing how Narratives incorporate a wide range of outlooks and strategies.

Do you think there's more to the story for Berkshire Hathaway? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Berkshire Hathaway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRK.B

Berkshire Hathaway

Through its subsidiaries, engages in the insurance, freight rail transportation, and utility businesses.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives