- United States

- /

- Diversified Financial

- /

- NYSE:BRK.B

Berkshire Hathaway (BRK.B): Assessing Valuation After Recent Multi-Year Shareholder Returns

Reviewed by Simply Wall St

Berkshire Hathaway (BRK.B) continues to capture investor attention as its stock maintains a steady upward trend this month. The company's broad exposure across insurance, transportation, and utilities often influences market conversations about its value over the long term.

See our latest analysis for Berkshire Hathaway.

This month's steady climb comes after a robust year for Berkshire Hathaway, with a recent 4.75% 1-month share price return reflecting continued momentum from earlier gains. The stock's three-year total shareholder return stands out at 60.46%, reinforcing its reputation as a long-term compounder. Its 1-year total return of 5.83% suggests that some shorter-term excitement has cooled after previous highs.

If you want to keep up the search for resilient businesses or hidden growth stories, now's a great time to branch out and discover fast growing stocks with high insider ownership

As Berkshire Hathaway’s share price edges higher, investors are left wondering whether there is more room for upside from here or if the market has already factored in all of the company’s future growth potential.

Price-to-Earnings of 16.4x: Is it justified?

Berkshire Hathaway’s shares trade at a Price-to-Earnings (P/E) ratio of 16.4x, which is notably lower than the average P/E of its peer group at 25x. This signals that the market currently places a more conservative value on Berkshire’s earnings, despite the company’s long-term compounding record and diversified business model.

The P/E ratio measures how much investors are willing to pay for each dollar of earnings. For a storied conglomerate like Berkshire Hathaway, which spans insurance, transportation, utilities, and manufacturing, a lower P/E could reflect market caution about future growth, recent negative earnings growth, or simply a more risk-averse stance compared to fast-growing industry peers.

Interestingly, while the P/E looks attractive versus peer averages, the company’s recent earnings trajectory has softened, with earnings declining over the past year but showing moderate growth over five years. Berkshire also trades at a P/E below what our fair multiple estimate suggests is justified (17x). This means there may be scope for re-rating should earnings growth re-accelerate or market sentiment turn more favorable.

Explore the SWS fair ratio for Berkshire Hathaway

Result: Price-to-Earnings of 16.4x (UNDERVALUED)

However, softer annual net income growth and potential headwinds from economic shifts still present risks that could temper Berkshire Hathaway’s current momentum.

Find out about the key risks to this Berkshire Hathaway narrative.

Another View: What Does the SWS DCF Model Say?

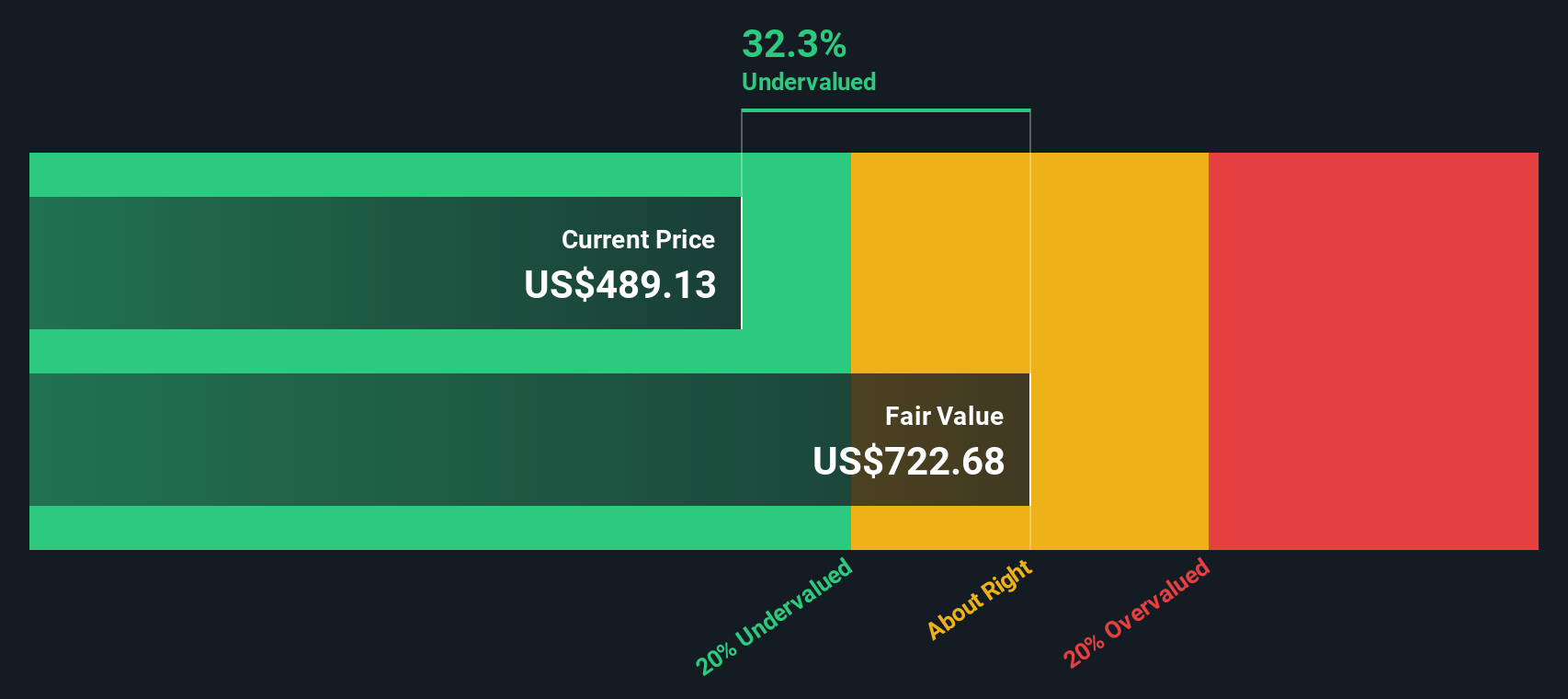

While Berkshire Hathaway appears undervalued based on its price-to-earnings ratio, our SWS DCF model takes a different approach. The DCF method estimates Berkshire’s fair value at $766.23 a share, which is about 33% higher than its current price. This suggests even greater potential upside than the market’s multiple comparison shows. Where does the truer value lie?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Berkshire Hathaway for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 925 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Berkshire Hathaway Narrative

For those who like to dive deeper or have a different take on Berkshire Hathaway’s story, creating your own unique view is always an option. It only takes a few minutes to get started Do it your way

A great starting point for your Berkshire Hathaway research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their options open. Don’t miss out on well-researched opportunities that could add diversity and growth to your portfolio today.

- Supercharge your returns by prioritizing stable income streams. Tap into these 15 dividend stocks with yields > 3% delivering yields above 3% to see which stocks are rewarding shareholders right now.

- Fuel your portfolio with next-level innovation. Scan these 25 AI penny stocks that are reshaping industries with artificial intelligence breakthroughs and fast-paced growth.

- Accelerate your search for value. Zero in on these 925 undervalued stocks based on cash flows that the market may have overlooked, and seize your next potential bargain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Berkshire Hathaway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRK.B

Berkshire Hathaway

Through its subsidiaries, engages in the insurance, freight rail transportation, and utility businesses.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success