- United States

- /

- Diversified Financial

- /

- NYSE:BRK.A

Should Analyst Downgrade and CEO Succession Uncertainty Prompt Action From Berkshire Hathaway (BRK.A) Investors?

Reviewed by Sasha Jovanovic

- Earlier this week, analysts at Keefe, Bruyette & Woods assigned Berkshire Hathaway a rare "underperform" rating, citing business headwinds in key subsidiaries and the upcoming CEO transition, with Warren Buffett set to retire at year-end while remaining chairman.

- This marks a pivotal moment, as succession planning for one of the world's largest conglomerates draws heightened attention from investors after decades of Buffett's leadership.

- We’ll explore how concerns around Warren Buffett’s leadership transition are shaping Berkshire Hathaway’s investment narrative at this crucial juncture.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Berkshire Hathaway's Investment Narrative?

Berkshire Hathaway shareholders are essentially buying into a vast, diversified conglomerate and the enduring philosophy that Warren Buffett has championed for decades. The recent "underperform" rating from Keefe, Bruyette & Woods is rare for the company and signals that concerns around near-term earnings pressure and the transition from Buffett to Greg Abel as CEO are top of mind. While Buffett is retaining the chairman role, this clear handover has put succession and management execution into sharper focus as a risk that may eclipse previous catalysts like new acquisitions or ongoing share buybacks. Analysts specifically point to pressure on margins in core units such as GEICO and energy, a less favorable rate backdrop, and slowing consumer activity as intensifying headwinds, sentiments that knocked shares nearly 1 percent after the downgrade. While the downgrade itself hasn't triggered a drastic stock reaction, it has elevated the CEO transition and operational headwinds to the top of the watchlist, potentially muting the impact of usual catalysts until investors see more clarity on leadership and earnings trends.

But with the CEO transition now front and center, leadership stability is a risk current shareholders can’t afford to ignore.

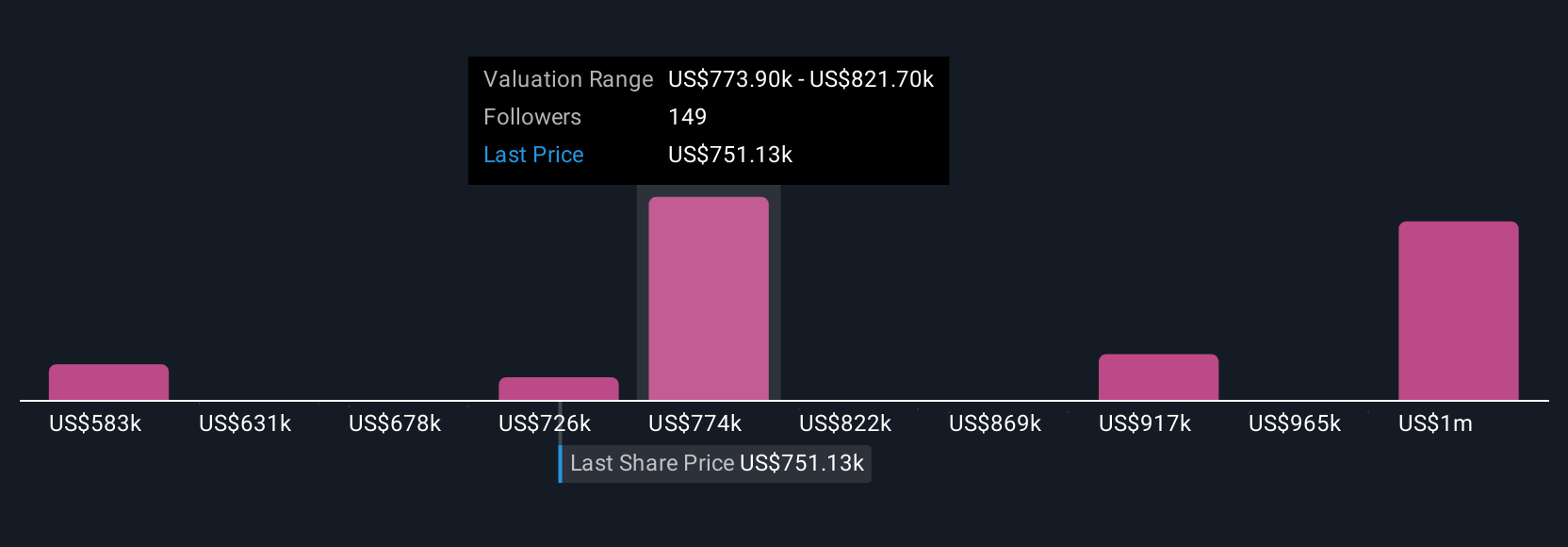

Despite retreating, Berkshire Hathaway's shares might still be trading 34% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 27 other fair value estimates on Berkshire Hathaway - why the stock might be worth as much as 51% more than the current price!

Build Your Own Berkshire Hathaway Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Berkshire Hathaway research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Berkshire Hathaway research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Berkshire Hathaway's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Berkshire Hathaway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRK.A

Berkshire Hathaway

Through its subsidiaries, engages in the insurance, freight rail transportation, and utility businesses.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives