- United States

- /

- Diversified Financial

- /

- NYSE:BRK.A

Berkshire Hathaway (BRK.A) Valuation in Focus After Buffett Successor Named and Portfolio Shifts

Reviewed by Simply Wall St

If you’re holding Berkshire Hathaway (BRK.A) or considering jumping in, there’s a lot to weigh right now. The company announced that Warren Buffett will officially step aside as CEO, naming Greg Abel as his successor before the year ends. This move is sending waves through investment circles. Combined with very recent portfolio shakeups, including a multi-million dollar bet on Nucor and adjustments in Sirius XM and VeriSign holdings, it’s no wonder investors are rethinking Berkshire’s future direction as the end of an era approaches.

All eyes are on the stock as this leadership transition creates headline risk, and the past month has seen a 3% gain despite the uncertainty. Over the year, Berkshire has delivered a roughly 9% return, outpacing many peers, while its performance over longer stretches stands out even more. Still, investors appear cautious as news of Buffett’s retirement introduces a degree of unpredictability not seen in decades. Recent shifts in Berkshire’s portfolio strategy, such as selectively adding leaders in steel and satellite radio while trimming tech infrastructure, add another layer to the narrative as market participants weigh both the risks and opportunities ahead.

After the recent climb, is Berkshire Hathaway trading at an attractive valuation for long-term buyers, or is the market already pricing in whatever comes next after Buffett?

Most Popular Narrative: 21.6% Undervalued

According to the most widely followed narrative, Berkshire Hathaway is currently trading at a notable discount to its fair value. The prevailing thesis suggests the market is underappreciating the company’s long-term prospects as it transitions leadership and builds on its financial foundation.

Warren Buffett’s mentorship of Greg Abel is a significant advantage for Berkshire Hathaway. Abel has had the opportunity to learn from one of the greatest investors of all time, gaining invaluable insights into investment strategy, corporate governance, and long-term value creation. This mentorship is likely to have a positive impact on Berkshire’s future performance. Abel’s understanding of Buffett’s investment philosophy and his ability to apply these principles to new opportunities can help the company continue to generate strong returns.

What underpins this bold undervaluation? The narrative points to future growth projections and a leadership playbook that promises more than just continuity. What are the surprising financial assumptions driving this claim that Berkshire could be worth far more than its current price? Discover the numbers and logic that set this target apart.

Result: Fair Value of $943785.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifts in market conditions or unforeseen hurdles during the leadership transition could challenge this outlook and put pressure on Berkshire’s shares in the period ahead.

Find out about the key risks to this Berkshire Hathaway narrative.Another View: Multiples Perspective Challenges the Discount

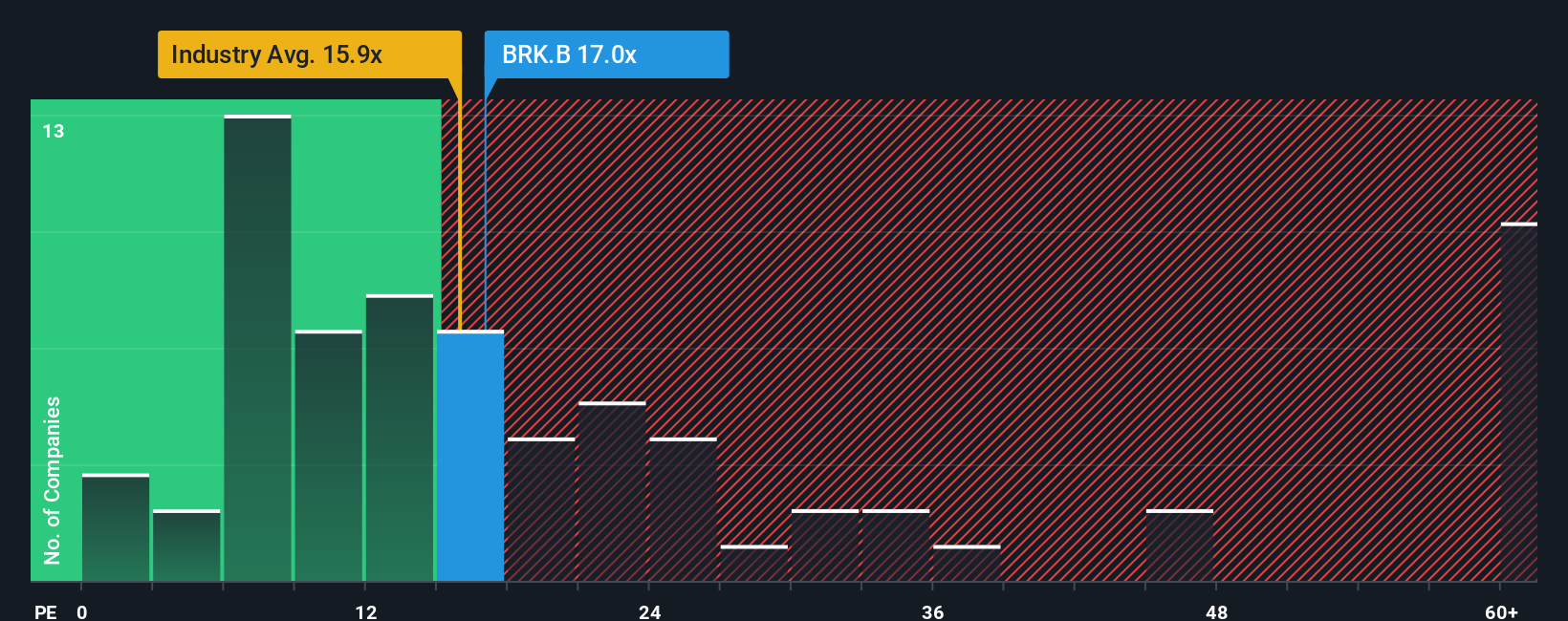

While one narrative claims Berkshire Hathaway is deeply undervalued, another valuation approach, using its price-to-earnings ratio relative to the industry, casts doubt. Does the story of significant upside hold up against this more cautious take?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Berkshire Hathaway to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Berkshire Hathaway Narrative

If you have a different perspective or want to dive into the numbers yourself, you can quickly craft your own Berkshire Hathaway narrative and see where your analysis leads. Do it your way.

A great starting point for your Berkshire Hathaway research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let your research end here. Broaden your opportunities by taking action with these ready-made ideas tailored to what serious investors are watching right now.

- Supercharge your watchlist by tracking high-yielding companies with stable track records in our selection of dividend stocks with yields > 3% for steady income streams.

- Seize the technology trend by uncovering trailblazers pushing the boundaries in artificial intelligence. Get ahead by checking out AI penny stocks making headlines in the new digital era.

- Spot undervalued potential and lock in gains sooner with undervalued stocks based on cash flows, and stay ahead of the market curve with well-priced opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Berkshire Hathaway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRK.A

Berkshire Hathaway

Through its subsidiaries, engages in the insurance, freight rail transportation, and utility businesses.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026