- United States

- /

- Diversified Financial

- /

- NYSE:BRK.A

Berkshire Hathaway (BRK.A) Valuation Check as Buffett Hands CEO Role to Greg Abel

Reviewed by Simply Wall St

Warren Buffett's decision to step down as CEO of Berkshire Hathaway (BRK.A) while staying on as chair finally puts a date on succession, but it also underlines how little is actually changing day to day.

See our latest analysis for Berkshire Hathaway.

The leadership clarity has come after a strong run, with Berkshire’s share price delivering an 11.1% year to date share price return and a powerful 62.5% three year total shareholder return. This suggests momentum in the story remains very much intact.

If Buffett’s transition has you thinking about where the next compounding stories might emerge, it could be worth exploring fast growing stocks with high insider ownership for other owner led businesses building long runways.

Yet with the stock up strongly in recent years and trading only slightly below analyst targets, investors now face a familiar Berkshire puzzle: is this still a compounding machine at a discount, or is future growth already priced in?

Price-to-Earnings of 16x: Is it justified?

On a headline valuation, Berkshire Hathaway trades on a 16x price to earnings multiple at a last close of $750,560, signaling a modest premium to its own industry but a discount to close peers.

The price to earnings ratio compares the current share price with the company’s earnings per share, making it a natural lens for a diversified financial and insurance led conglomerate whose value still rests heavily on the cash it can generate. For Berkshire, that 16x multiple sits just below our estimated fair price to earnings ratio of 16.9x, suggesting the market is not paying far above what long run fundamentals might support.

Relative to other diversified financials in the US, however, Berkshire does screen as more expensive on this metric, with the sector averaging around 13.7x earnings. At the same time, its 16x price to earnings ratio remains well below the peer group average of 26.7x, implying investors are paying less per dollar of earnings for Berkshire than for many comparable giants, and that over time the market could drift closer to our fair ratio estimate if the company continues to execute.

Explore the SWS fair ratio for Berkshire Hathaway

Result: Price to earnings of 16x (ABOUT RIGHT)

However, sustained net income pressure, alongside a modest analyst upside, could challenge Berkshire’s premium rating if operating performance or capital allocation disappoints.

Find out about the key risks to this Berkshire Hathaway narrative.

Another View: DCF Points to Deeper Value

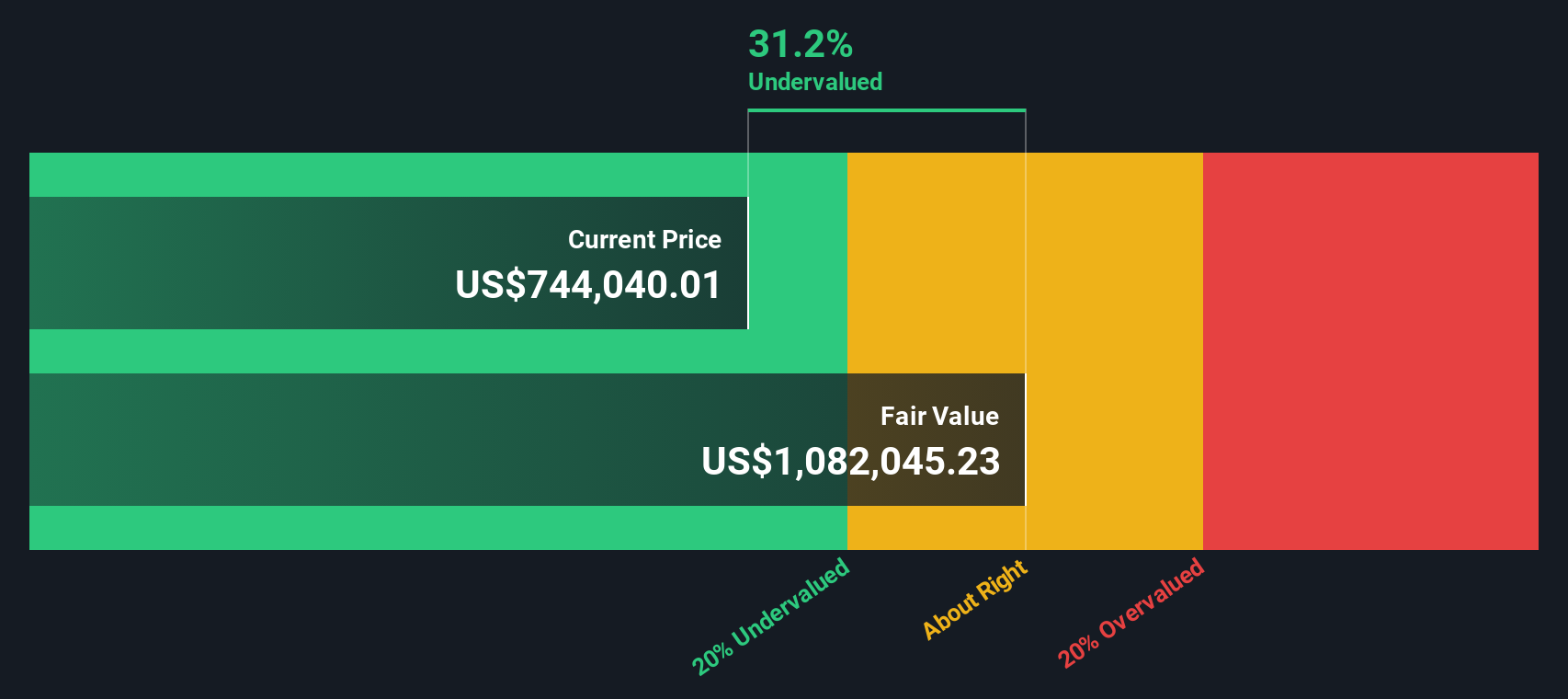

While a 16x earnings multiple suggests Berkshire is roughly fairly priced, our DCF model paints a very different picture, with shares trading around 34.5% below an estimated fair value of $1,145,503.64. If that gap closes even partially, how long can today’s discount last?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Berkshire Hathaway for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Berkshire Hathaway Narrative

If your view of Berkshire’s long term potential differs from this analysis, you can quickly build a personalized thesis of your own in minutes, Do it your way.

A great starting point for your Berkshire Hathaway research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at Berkshire. Broaden your opportunity set now with targeted stock ideas that could sharpen your portfolio and keep you ahead of the crowd.

- Capture potential multi-baggers early by scanning these 3646 penny stocks with strong financials that already show financial strength rather than pure speculation.

- Ride structural growth in automation and machine learning with these 24 AI penny stocks, focusing on companies building real products and sticky enterprise demand.

- Seek resilient income streams by targeting these 10 dividend stocks with yields > 3% that combine meaningful yields with balance sheets built to endure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Berkshire Hathaway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRK.A

Berkshire Hathaway

Through its subsidiaries, engages in the insurance, freight rail transportation, and utility businesses.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion