- United States

- /

- Diversified Financial

- /

- NYSE:BRK.A

Berkshire Hathaway (BRK.A): A Fresh Look at Valuation After Recent 14% Year-to-Date Share Price Climb

Reviewed by Simply Wall St

Berkshire Hathaway (BRK.A) continues to draw steady interest as investors take stock of its year-to-date performance. Shares have edged up roughly 14% since January, which has fueled conversations about the company’s long-term value and diverse holdings.

See our latest analysis for Berkshire Hathaway.

Momentum has been building for Berkshire Hathaway, with the share price climbing 14% so far this year and a three-year total shareholder return topping 64%. At the same time, the company’s steady performance and recent all-time highs are fueling fresh debates about both its growth prospects and the premium investors are willing to pay.

If Berkshire’s latest moves have you curious about what else is on the rise, now is the perfect time to broaden your outlook and discover fast growing stocks with high insider ownership

With shares hitting new highs and long-term returns remaining strong, the core debate now centers on valuation. Does Berkshire Hathaway offer investors a rare buying opportunity, or is the market already pricing in years of future growth?

Price-to-Earnings of 16.4x: Is it justified?

Berkshire Hathaway trades on a price-to-earnings (P/E) ratio of 16.4x, positioning the stock in line with recent highs and reflecting investors’ willingness to pay above current sector benchmarks.

The P/E ratio compares a company’s share price to its earnings per share. It is one of the most widely used yardsticks to gauge whether a stock is valued fairly relative to its profitability, especially in the diversified financial sector where earnings quality can differ between holdings.

For Berkshire Hathaway, this figure signals that the market is currently pricing future earnings with more optimism than the average U.S. diversified financial stock, which sits at 14x. However, this level is just below the estimated fair P/E ratio of 16.9x. This suggests modest room for upward adjustment should results surprise on profitability or growth. Compared with the peer group average of 25.2x, Berkshire appears to trade at a relative discount, making its valuation look reasonable despite slower near-term profit growth.

Explore the SWS fair ratio for Berkshire Hathaway

Result: Price-to-Earnings of 16.4x (ABOUT RIGHT)

However, slowing net income growth and a slight discount to analyst price targets could present challenges to the optimistic case for Berkshire Hathaway in the near term.

Find out about the key risks to this Berkshire Hathaway narrative.

Another View: What Does Our DCF Model Suggest?

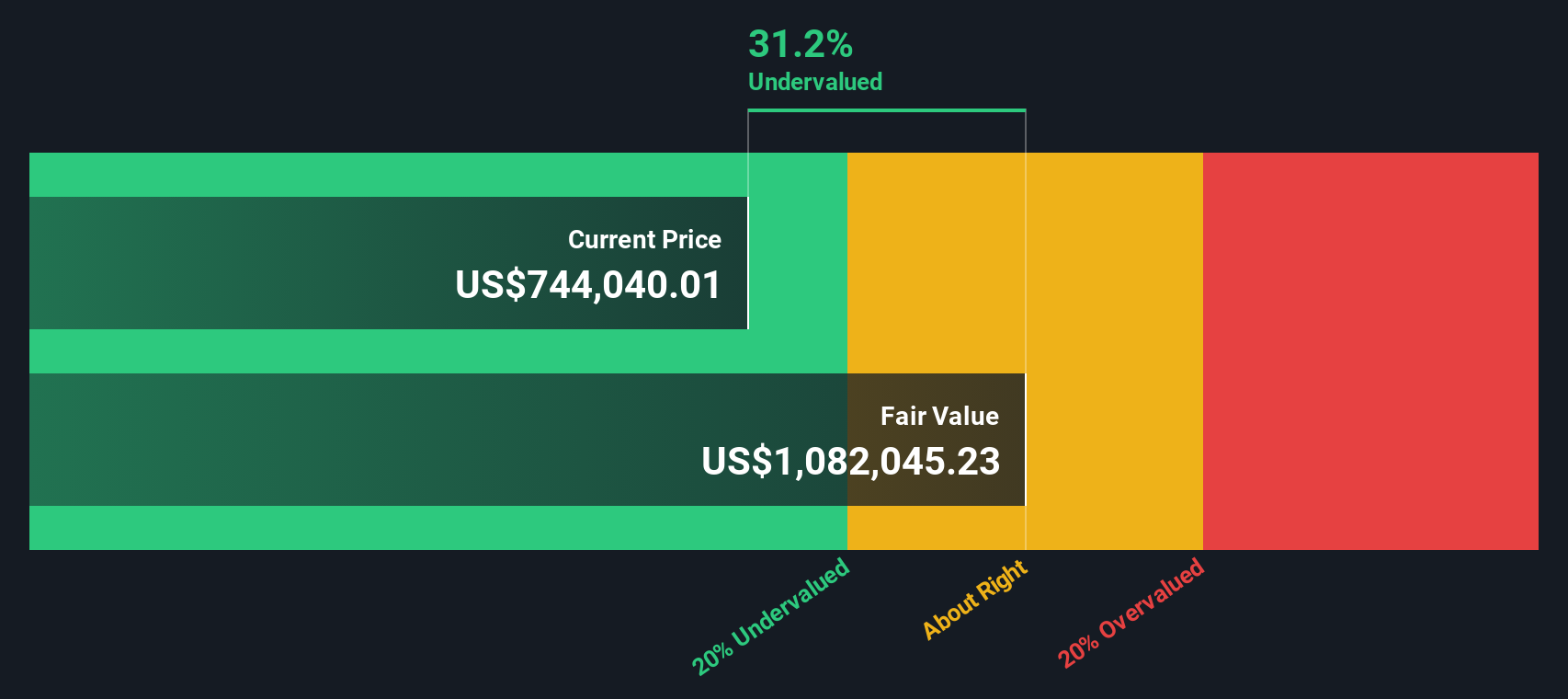

While the price-to-earnings approach shows Berkshire Hathaway trading around fair value, our SWS DCF model tells a very different story. Based on a detailed cash flow forecast, Berkshire’s shares are trading roughly 33% below what our DCF model considers fair value. This suggests a significant margin of safety for long-term investors.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Berkshire Hathaway for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Berkshire Hathaway Narrative

If you see things differently or want to dive deeper into Berkshire Hathaway’s numbers, why not build your own perspective in just a few minutes? Do it your way

A great starting point for your Berkshire Hathaway research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the curve by using Simply Wall Street’s Screener to unlock new opportunities and uncover stocks outside the usual headlines. Your portfolio will thank you.

- Spot tomorrow’s tech disruptors by evaluating these 25 AI penny stocks that are already tapping into real-world AI demand and securing leadership in emerging markets.

- Capture potential bargains by reviewing these 913 undervalued stocks based on cash flows that have strong fundamentals yet remain overlooked by the broader market.

- Earn income while investing for growth by checking out these 15 dividend stocks with yields > 3% offering consistent yields above 3% for greater financial stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Berkshire Hathaway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRK.A

Berkshire Hathaway

Through its subsidiaries, engages in the insurance, freight rail transportation, and utility businesses.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026