- United States

- /

- Capital Markets

- /

- NYSE:BLK

Assessing BlackRock’s Valuation After Tech Expansion and a Recent 2.5% Price Jump

Reviewed by Bailey Pemberton

- Ever wondered whether BlackRock is truly worth its current price tag? Let’s break down what is happening beneath the surface so you can judge for yourself.

- In just the last week, BlackRock’s stock climbed 2.5% even after a dip of 5.3% over the last month. This shows some lively movement as investors weigh its growth prospects and risks.

- Recent headlines highlight BlackRock’s push into new tech-enabled investment services and its strategic acquisitions. Both of these factors have fueled discussion about where the company could be headed next. These moves are helping to shape market expectations and may explain some of the volatility in the share price.

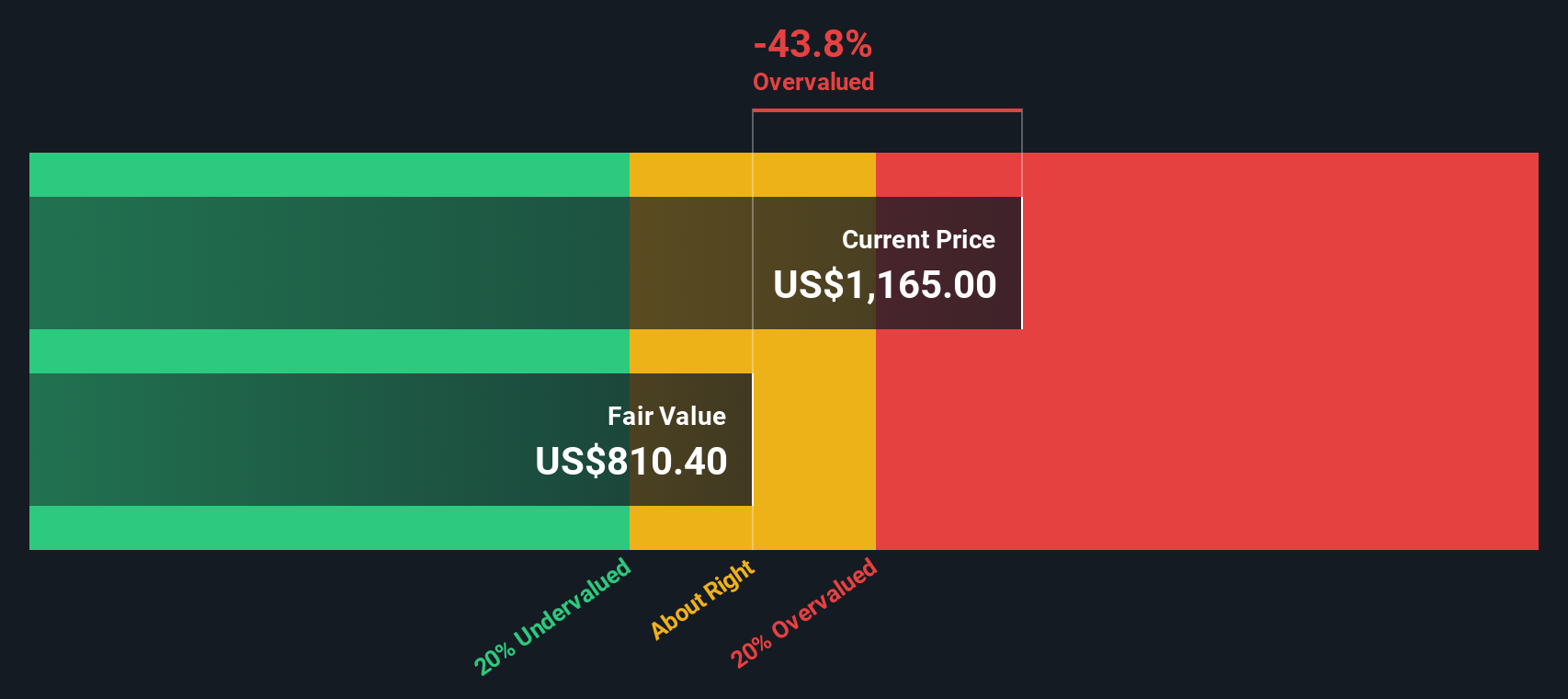

- On our valuation checks, BlackRock scored 2 out of 6, meaning it is considered undervalued by a couple of key measures but not across the board. We will walk through those different approaches to valuation shortly. Stay tuned, because there is an even more insightful way to frame value that we will share before we wrap up.

BlackRock scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: BlackRock Excess Returns Analysis

The Excess Returns model evaluates a company by comparing the returns it generates on its investments to the cost of equity required by shareholders. If a business consistently earns a return above its cost of equity, it is creating value. This is known as "excess return." BlackRock’s excess return is determined using key metrics that reflect how effectively it turns invested capital into profits over time.

For BlackRock, the latest figures show:

- Book Value: $357.90 per share

- Stable Earnings Per Share: $49.41 per share (Source: Weighted future Return on Equity estimates from 4 analysts.)

- Cost of Equity: $25.02 per share

- Excess Return: $24.39 per share

- Average Return on Equity: 16.40%

- Stable Book Value: $301.21 per share (Source: Weighted future Book Value estimates from 3 analysts.)

This model estimates BlackRock’s intrinsic value at $784.38 per share. Compared to the current market price, BlackRock appears about 32.6% overvalued on this metric, suggesting the market may be pricing in higher growth or profitability than what analysts currently expect.

Result: OVERVALUED

Our Excess Returns analysis suggests BlackRock may be overvalued by 32.6%. Discover 932 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: BlackRock Price vs Earnings

For companies like BlackRock that generate steady profits, the Price-to-Earnings (PE) ratio is a popular and reliable way to gauge valuation. The PE ratio captures how much investors are willing to pay for each dollar of earnings, making it a key benchmark for established, profitable firms in the capital markets sector.

Growth expectations and risk play central roles in shaping what a “normal” or “fair” PE should be. Companies expected to grow faster, or those seen as less risky, typically command higher multiples because investors are optimistic about future earnings. In contrast, riskier or slower-growing firms usually trade at lower PE ratios.

Currently, BlackRock trades at a PE of 26.5x. Compared to the industry average of 23.6x and a peer average of 42.8x, BlackRock sits somewhere in the middle, slightly above the industry but well under the peer benchmark. Simply Wall St’s “Fair Ratio” for BlackRock is 19.9x, balancing factors like its growth outlook, profit margins, risk profile, industry, and market size.

The Fair Ratio offers a more nuanced perspective than simply using peer or industry comparisons. It reflects not just market sentiment, but objectively considers company-specific fundamentals to estimate what multiple the stock should be trading at right now.

Since BlackRock’s actual PE of 26.5x is well above its Fair Ratio of 19.9x, this approach suggests the stock is overvalued at present.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BlackRock Narrative

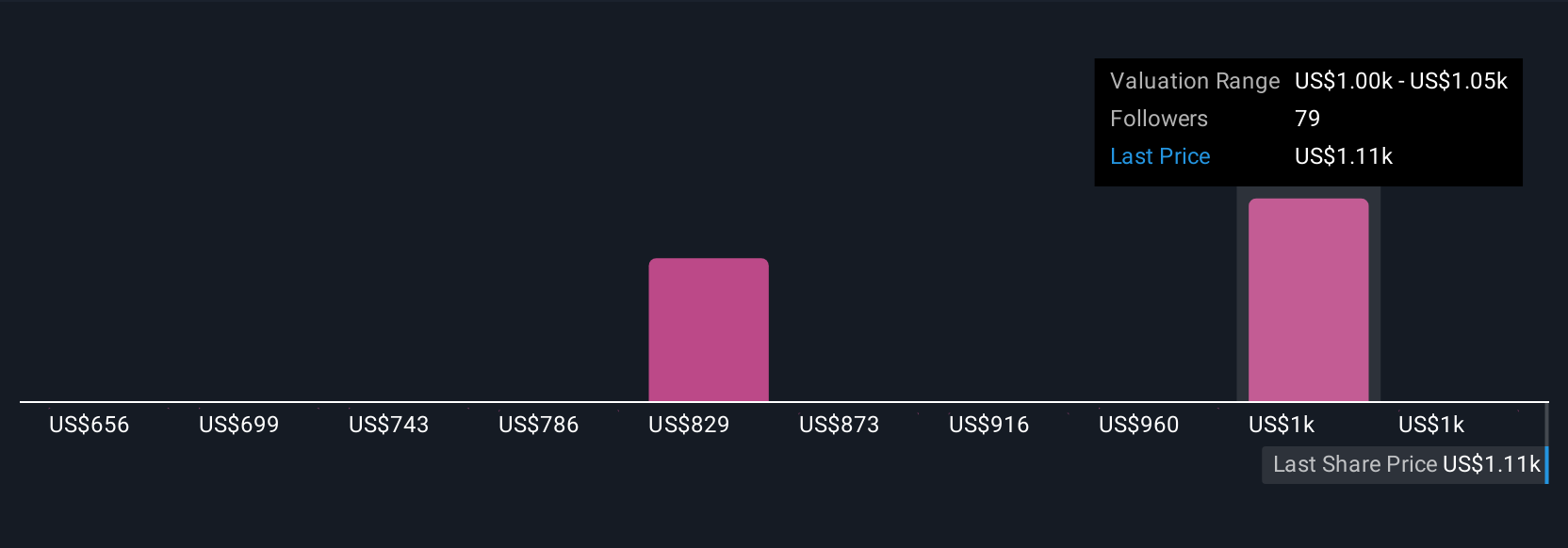

Earlier, we mentioned that there is an even better way to think about valuation, so let us introduce Narratives. A Narrative is more than numbers; it is your own story about a company, where you combine your expectations for its future growth, profits, and margins into a personal outlook, and then connect that perspective to a fair value.

On Simply Wall St’s platform, Narratives give every investor an easy and dynamic way to translate their views about BlackRock’s future into a concrete forecast and fair valuation. This takes place directly within our Community page, where millions of investors share and refine their ideas. Narratives clearly show how your belief in BlackRock’s strengths or challenges translates into a ‘Fair Value’ and allows you to easily compare that with the current price, so you can decide whether it is time to buy, hold, or sell.

Whenever major news or fresh earnings data is released, Narratives update automatically, helping you stay on top of your investment thesis as the facts change. For example, one Narrative might be bullish, expecting BlackRock’s share price to reach $1,252 based on continued global expansion and new tech ventures. Another could be more cautious, with a fair value closer to $1,000 if margin pressures and integration risks persist. Narratives let you follow your own logic, check your numbers against others, and make smarter, faster decisions in real time.

Do you think there's more to the story for BlackRock? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackRock might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLK

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.