- United States

- /

- Capital Markets

- /

- NYSE:BK

What Bank of New York Mellon (BK)'s Upgraded Net Interest Income Guidance Means For Shareholders

Reviewed by Sasha Jovanovic

- The Bank of New York Mellon Corporation reported strong third quarter 2025 earnings, with net income rising to US$1.45 billion and diluted earnings per share from continuing operations reaching US$1.88, compared to the previous year.

- The company also issued full-year guidance projecting net interest income to be up 12% year-over-year, underscoring ongoing earnings momentum and operational strength.

- We'll review how BNY Mellon's upgraded net interest income guidance could influence its digital transformation and long-term earnings narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Bank of New York Mellon Investment Narrative Recap

To be a Bank of New York Mellon shareholder, you need to have confidence in the firm's ability to drive robust, long-term fee revenue growth from its scale, institutional footprint, and expanding digital platform, even as the business contends with industry fee pressure and secular shifts toward passive investing. The latest quarterly results and raised net interest income outlook reinforce near-term earnings momentum but do not fundamentally address longer-term risks around deposit sustainability and market-driven revenue sensitivity, which remain the key issues to watch.

Among recent announcements, BNY Mellon's selection by TIAA Wealth Management to power its unified digital wealth platform stands out, showcasing how digital infrastructure investments can accelerate fee-driven growth and help offset market and margin pressure. If the company executes well on these digital initiatives, it may unlock new efficiencies and reinforce its leadership as client needs evolve, even as near-term deposit and revenue trends remain in focus.

In contrast, investors should be aware that the durability of current net interest income depends on factors like client activity and market conditions, not just...

Read the full narrative on Bank of New York Mellon (it's free!)

Bank of New York Mellon's narrative projects $21.3 billion in revenue and $5.8 billion in earnings by 2028. This requires 3.4% yearly revenue growth and a $1.0 billion increase in earnings from $4.8 billion today.

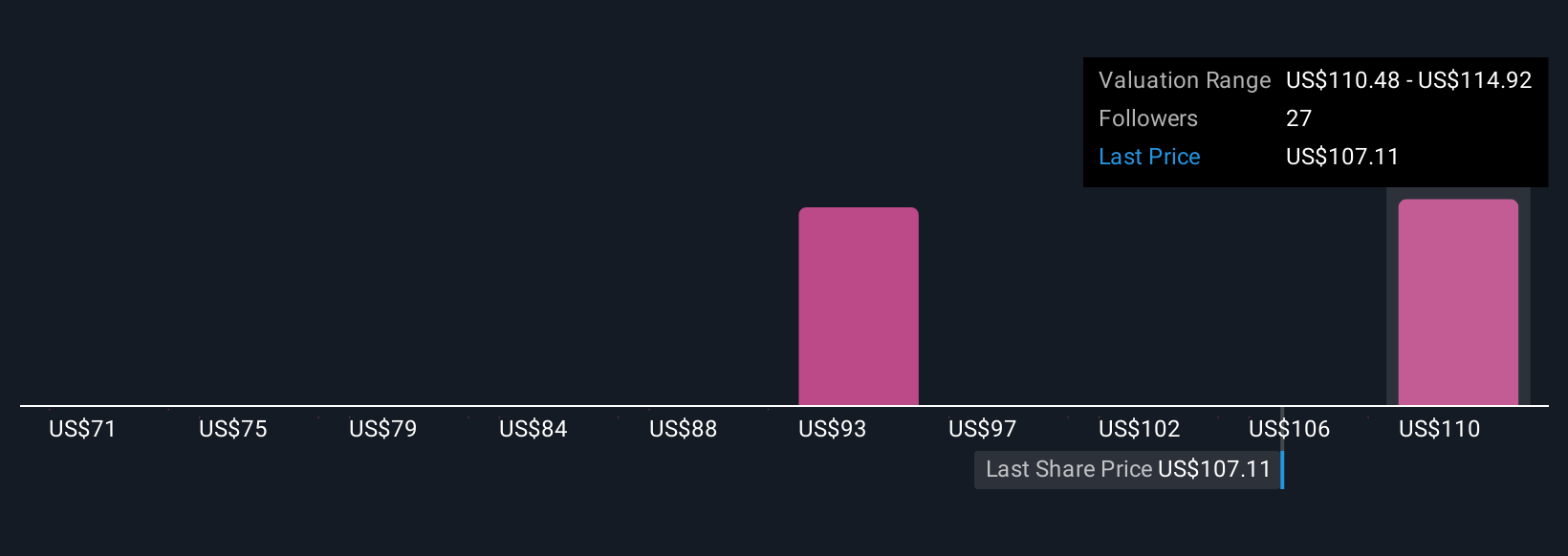

Uncover how Bank of New York Mellon's forecasts yield a $113.23 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Six community members from Simply Wall St submitted fair value estimates for BNY Mellon ranging from as low as US$52 to above US$74,000. While some see considerable upside, ongoing structural risks from industry fee compression and client outflows could weigh on future revenue growth, consider these diverse opinions as you review your own outlook.

Explore 6 other fair value estimates on Bank of New York Mellon - why the stock might be a potential multi-bagger!

Build Your Own Bank of New York Mellon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank of New York Mellon research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bank of New York Mellon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank of New York Mellon's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of New York Mellon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BK

Bank of New York Mellon

Provides a range of financial products and services in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives