- United States

- /

- Capital Markets

- /

- NYSE:BK

Is It Too Late to Consider BNY Mellon After Its 47% Year to Date Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether Bank of New York Mellon is still good value after its big run, you are not alone. This is exactly what we are going to unpack.

- The stock has climbed 2.3% over the last week, 5.5% over the last month and is now up a striking 47.2% year to date, with 42.9% over 1 year, 178.6% over 3 years and 218.3% over 5 years. This naturally raises the question of how much upside might be left.

- Recent headlines have focused on how large custody banks like BNY Mellon are benefiting from higher interest rates that lift net interest revenue and from growing institutional demand for more sophisticated asset servicing, especially in areas like ETFs and alternative investments. At the same time, ongoing regulatory discussions around capital requirements for big financial institutions have kept risk perceptions and valuation multiples in sharp focus.

- On our checks, Bank of New York Mellon scores a 3/6 valuation score, which suggests it looks undervalued on some measures but not all. Next we will walk through those different valuation approaches, before finishing with a way of thinking about value that can be even more powerful than any single model.

Approach 1: Bank of New York Mellon Excess Returns Analysis

The Excess Returns model looks at how much profit Bank of New York Mellon can generate above the return that investors demand on its equity. Instead of focusing on near term earnings alone, it asks whether the bank can consistently earn more on its book value than its cost of equity.

On this view, Bank of New York Mellon has a Book Value of $55.99 per share and is expected to deliver Stable EPS of $8.54 per share, based on weighted future Return on Equity estimates from 9 analysts. Against a Cost of Equity of $6.05 per share, that implies an Excess Return of $2.49 per share, supported by an Average Return on Equity of 13.86%. Analysts also expect Stable Book Value to rise to $61.58 per share, according to estimates from 8 analysts.

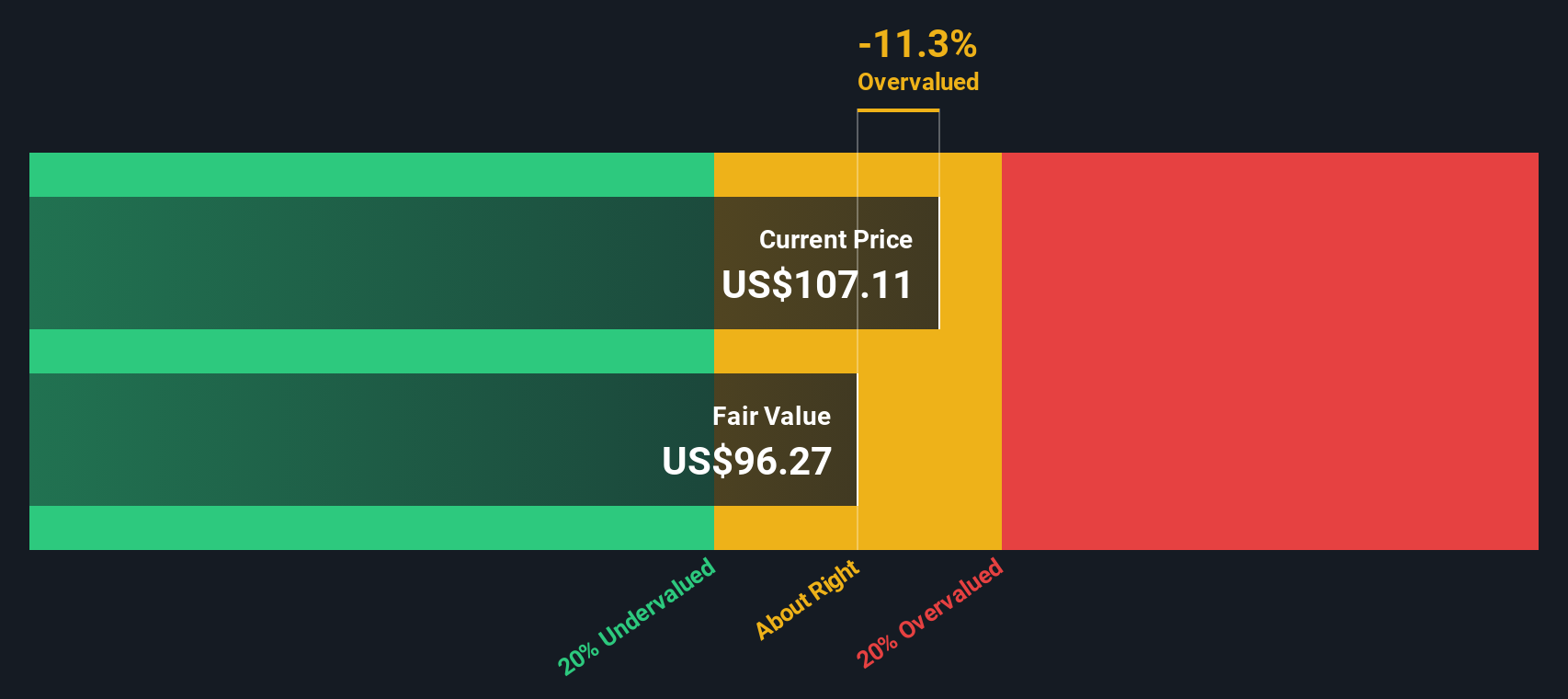

Putting these inputs through the Excess Returns framework produces an estimated intrinsic value of about $99.57 per share. The model implies the stock is roughly 14.4% overvalued relative to the current market price. This approach suggests the shares are pricing in more good news than the fundamentals justify for now.

Result: OVERVALUED

Our Excess Returns analysis suggests Bank of New York Mellon may be overvalued by 14.4%. Discover 914 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Bank of New York Mellon Price vs Earnings

For a consistently profitable company like Bank of New York Mellon, the price to earnings ratio is a straightforward way to gauge how much investors are willing to pay for each dollar of earnings. It naturally reflects both what the market expects for future growth and how much risk it sees in those earnings, with higher growth and lower perceived risk typically supporting a higher normal PE multiple.

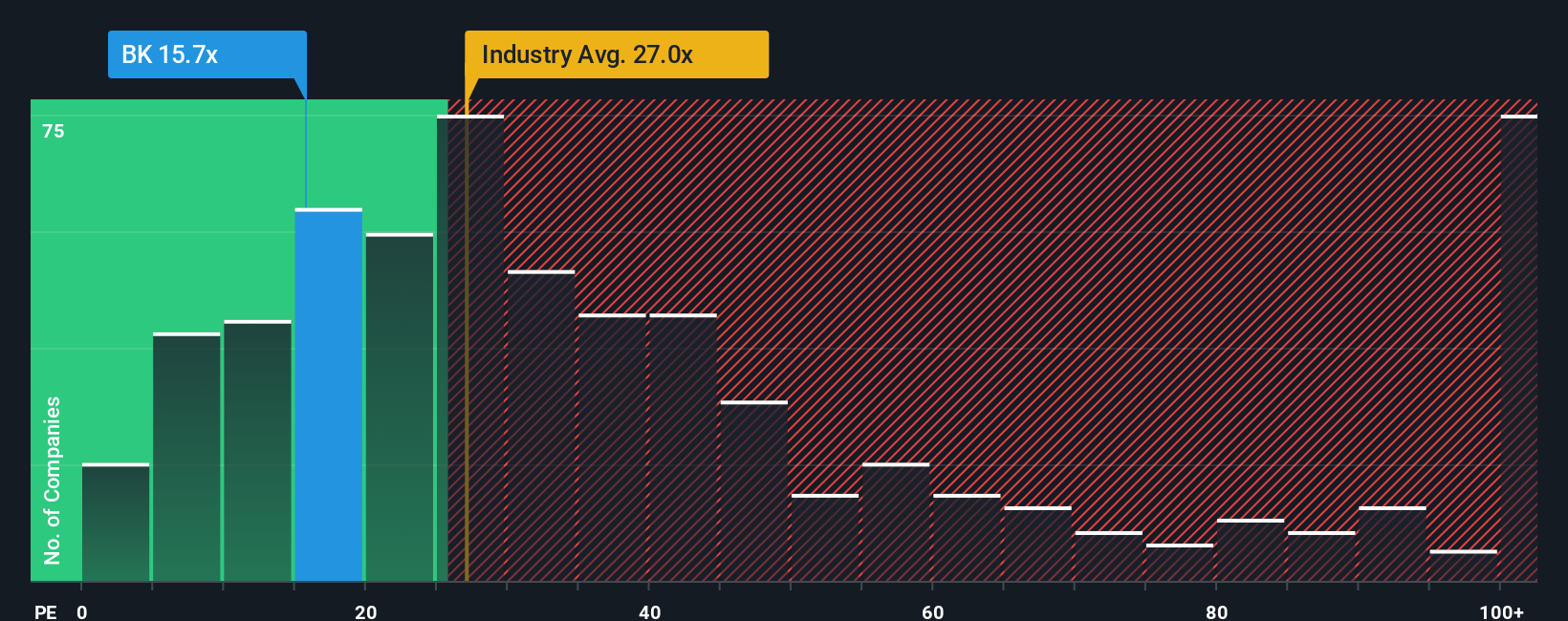

Bank of New York Mellon currently trades at about 15.86x earnings, which is below both the Capital Markets industry average of roughly 24.00x and the broader peer group average of around 29.10x. On the surface, that discount might suggest the stock is cheap, but relative comparisons alone can be misleading. Simply Wall St’s Fair Ratio, at 16.17x, estimates what a justified PE should be given Bank of New York Mellon’s specific earnings growth outlook, profitability, risk profile, industry positioning and market cap.

Because the Fair Ratio is tailored to the company, it provides a more nuanced view than a simple industry or peer comparison. With the actual PE of 15.86x sitting just below the Fair Ratio of 16.17x, the shares look modestly undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

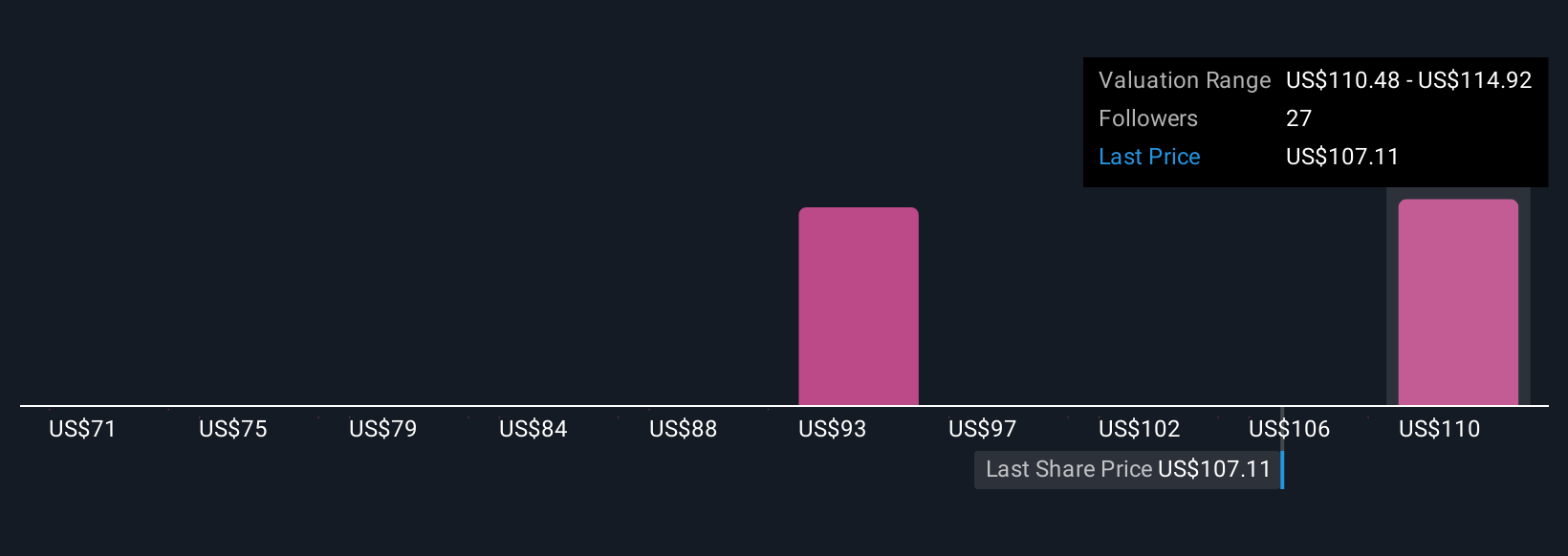

Upgrade Your Decision Making: Choose your Bank of New York Mellon Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your story about Bank of New York Mellon to the numbers behind its fair value. A Narrative is your view of the company’s future, where you spell out how you think revenue, earnings and margins will evolve, then link that story to a financial forecast and, from there, to an estimated fair value. On Simply Wall St’s Community page, used by millions of investors, Narratives are an easy, accessible tool that help you compare your Fair Value to today’s market Price, and they update dynamically as new information such as news or earnings arrives. For example, one Bank of New York Mellon narrative might assume digital asset expansion and share buybacks support a fair value near $118 per share, while a more cautious view could anchor closer to $85. Seeing where your own assumptions sit between those perspectives can clarify whether you think the stock is trading at an attractive level today.

Do you think there's more to the story for Bank of New York Mellon? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of New York Mellon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BK

Bank of New York Mellon

Provides a range of financial products and services in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026