- United States

- /

- Capital Markets

- /

- NYSE:BK

BNY Mellon (BK) Earnings Soar 48.6%, Challenging Skepticism on Growth Quality and Valuation

Reviewed by Simply Wall St

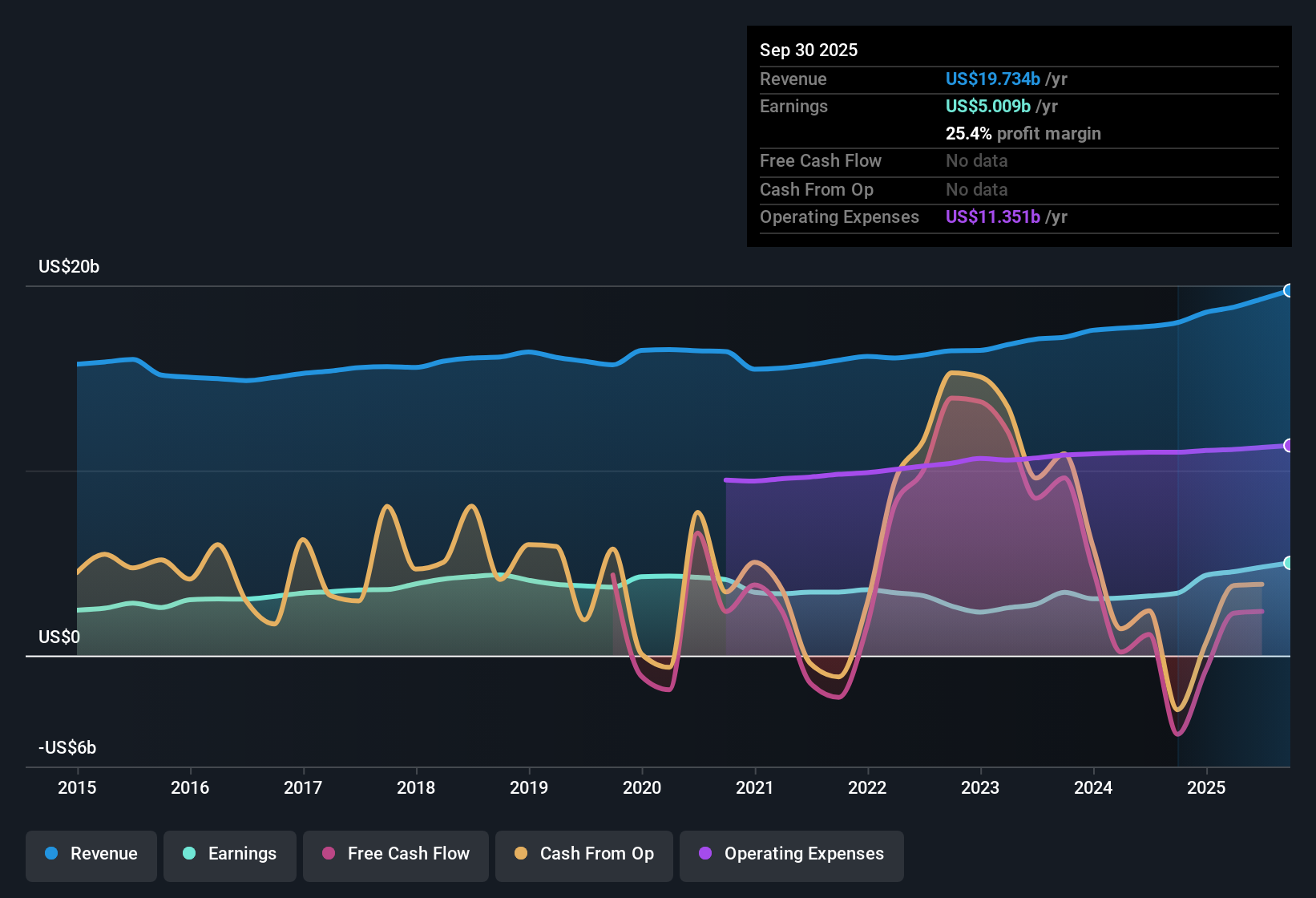

Bank of New York Mellon (BK) posted a remarkable surge in earnings for the past year, with net profit margins climbing to 24.8% from 18.1%. Annual earnings growth reached 48.6%, significantly ahead of its five-year compound rate of 3.5%. Looking ahead, analysts expect earnings to increase at 6.7% per year. However, this is forecast to trail both broader market profit and revenue growth. With high-quality earnings and well-supported profitability, the company’s continued momentum is driving investor interest, even as expectations for future growth have moderated.

See our full analysis for Bank of New York Mellon.Next, we will put these results into context by seeing how they compare with key market narratives and investor expectations for Bank of New York Mellon.

See what the community is saying about Bank of New York Mellon

Digital Platform Investments Boost Margins

- Profit margins climbed to 24.8% this year, with analysts expecting further growth to 27.3% over the next three years. This reflects efficiency gains from ongoing technology upgrades.

- The analysts' consensus view highlights that expanding digital capabilities and early adoption of AI are driving margin expansion and efficiency, but notes that true operational benefits are mostly expected in 2026 and beyond.

- Accelerated investment in digital platforms and early wins in digital asset custody support the expectation of scalable earnings growth as technology costs decrease.

- However, the consensus narrative cautions that many of these improvements are still in early stages, so most margin gains are yet to be realized.

To see how digital innovation and cost discipline are affecting profit margins and fee growth, read the full balanced narrative for Bank of New York Mellon. 📊 Read the full Bank of New York Mellon Consensus Narrative.

Valuation Attractive Versus Peers

- Bank of New York Mellon trades at a PE ratio of 15.7x, a notable discount to both peer (32.6x) and industry averages (25.7x). This is just above its DCF fair value of $82.33 with a current share price of $106.72.

- According to the analysts' consensus view, this price-to-earnings discount against sector benchmarks supports the investment case for value-conscious investors. However, current market pricing reflects analyst expectations for only moderate future growth.

- The consensus narrative points out that with the analyst price target at $115.13, close to the current share price, the market broadly agrees the stock is fairly valued for its underlying pace of margin expansion and fee growth.

- Continued investor interest in the company's high earnings quality and stable dividends is cited as supporting share price levels, even as growth moderates.

Fee Revenue Growth Anchored in New Client Demand

- Analysts forecast annual revenue growth of 3.4% over the next three years, driven by rising demand for ESG and regulatory solutions in high-margin, fee-based services.

- The analysts' consensus view asserts that these client-driven trends are enhancing resilience and supporting diversification, but also highlights dependency on favorable markets and risks related to episodic deposits.

- Sustained growth in institutional assets and increased uptake of ancillary services from ESG and regulatory reporting are expected to offset pressures from passive investment flows and industry-wide fee compression.

- However, ongoing net outflows and periods of market volatility could limit the pace of organic fee revenue growth. This introduces uncertainty in long-term projections.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bank of New York Mellon on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique perspective on the data? Share your insight and build your own narrative in just a few minutes. Do it your way

A great starting point for your Bank of New York Mellon research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Bank of New York Mellon's modest near-term growth outlook, together with its reliance on favorable markets and episodic deposits, puts its consistency in question.

If stable expansion is your priority, use stable growth stocks screener (2097 results) to discover companies with more reliable revenue and earnings growth across changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of New York Mellon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BK

Bank of New York Mellon

Provides a range of financial products and services in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives