- United States

- /

- Capital Markets

- /

- NYSE:BK

Bank of New York Mellon (BK): Assessing Valuation After Upbeat Q3 Results and Upgraded Outlook

Reviewed by Simply Wall St

Bank of New York Mellon (BK) delivered strong financial updates for the third quarter, with net income and earnings per share tracking higher versus last year. Off the back of these results, the company raised its full-year outlook for net interest income while keeping fourth quarter guidance steady, a move that has caught the attention of investors and analysts alike.

See our latest analysis for Bank of New York Mellon.

After raising its outlook and confirming new dividend payouts, Bank of New York Mellon has caught the market’s eye as momentum is clearly building. While share price has climbed 38.2% year-to-date, the one-year total shareholder return of 43.4% and remarkable 245.9% five-year total return stand out, especially as earnings rise and buybacks continue.

If you’re interested in capturing more of this momentum across the market, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

Yet with shares up nearly 40% this year and analyst targets still pointing higher, the big question for investors remains: Is Bank of New York Mellon still trading at an attractive valuation, or is the market already pricing in its next wave of growth?

Most Popular Narrative: 5.5% Undervalued

Bank of New York Mellon's estimated fair value of $113.23 is a step ahead of the last close at $107. That difference is fueling renewed debate over whether near-term catalysts have truly been priced in or if there is more room to run.

Accelerated investment in digital platforms (including digital asset custody, AI integration, and the NEXEN ecosystem), coupled with strong early adoption, positions BNY Mellon for improved operating leverage and net margin expansion over the coming years. Scalable technology can reduce costs and increase cross-selling opportunities.

Want to know what is driving this valuation gap? The narrative highlights a high-tech transformation and margin expansion fueled by bold digital bets. Curious which future financial leap the consensus sees powering this fair value? Find out what numbers and strategic wagers set this estimate apart.

Result: Fair Value of $113.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained fee pressure and potential outflows in investment management could challenge BNY Mellon's growth outlook. This may prompt investors to re-examine long-term expectations.

Find out about the key risks to this Bank of New York Mellon narrative.

Another View: Comparing Valuation Benchmarks

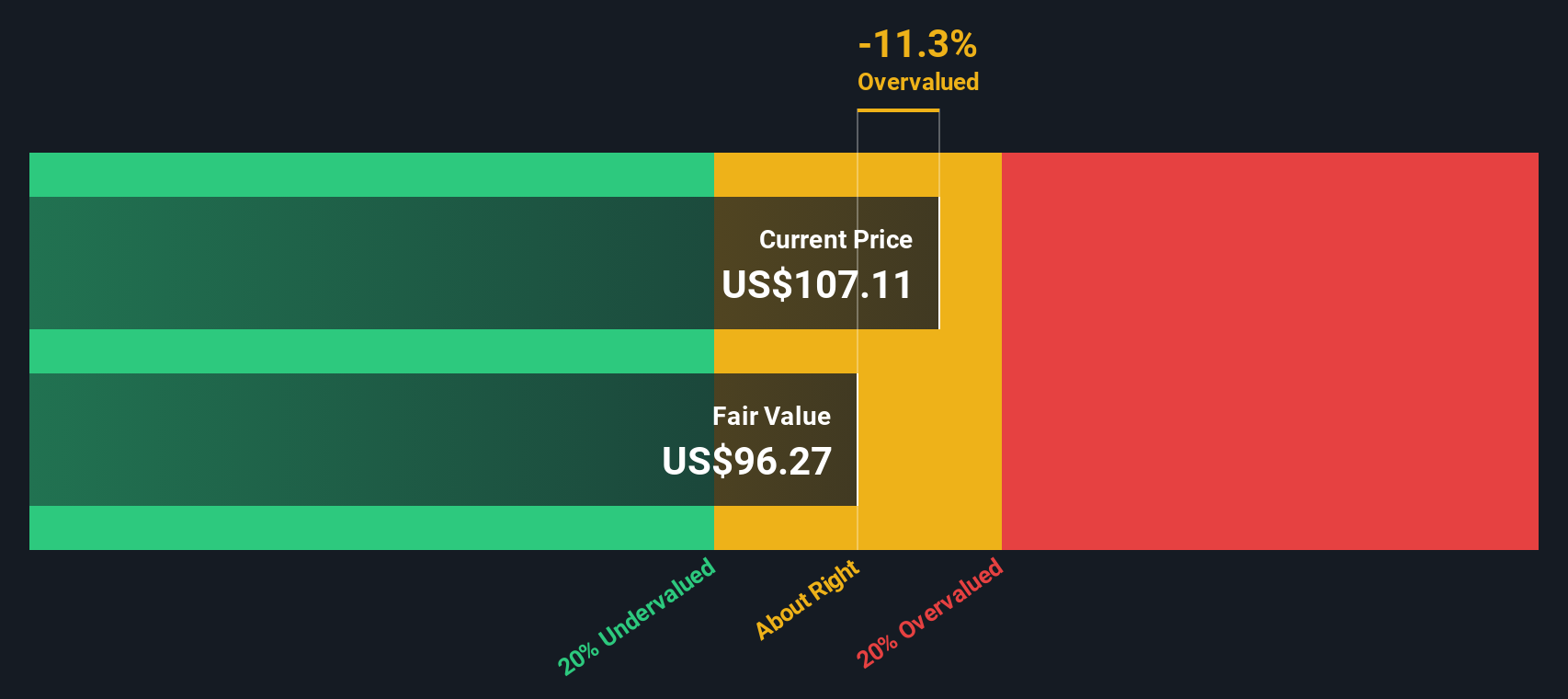

While analyst models suggest Bank of New York Mellon is attractively valued, our DCF model offers a less optimistic picture. According to this discounted cash flow analysis, the current share price actually sits above our fair value estimate. Does this suggest the market is getting ahead of itself, or are analysts seeing longer-term potential that others are missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of New York Mellon for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of New York Mellon Narrative

Feel free to dive into the numbers firsthand, challenge the perspectives you’ve read, and put together your own story in just a few minutes. Do it your way

A great starting point for your Bank of New York Mellon research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let the next big opportunity slip by. Supercharge your portfolio and tap into the hottest trends with a few smart moves:

- Capitalize on impressive yields by uncovering these 17 dividend stocks with yields > 3% with payouts above 3%, a choice suited for investors focused on strong, steady income.

- Catalyze your returns by following these 876 undervalued stocks based on cash flows that the market is overlooking. This may offer a chance at significant upside before others catch on.

- Join the AI revolution by targeting these 24 AI penny stocks poised to disrupt industries with technological growth and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of New York Mellon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BK

Bank of New York Mellon

Provides a range of financial products and services in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives