- United States

- /

- Capital Markets

- /

- NYSE:BK

Assessing BNY Mellon (BK) Valuation After a Strong 51% Share Price Gain Over the Past Year

Reviewed by Kshitija Bhandaru

Bank of New York Mellon (BK) has delivered a solid year with its shares up 51% over the past year and a 15% return in the past 3 months. Investors paying attention to the company’s momentum are likely curious about what is driving these gains in the context of a stable market environment.

See our latest analysis for Bank of New York Mellon.

Momentum has clearly been building for Bank of New York Mellon, with its one-year total shareholder return of 51% standing out against a backdrop of steady results and only modest recent share price moves. This signals investors see potential for further growth and resilience going forward, even if the last few weeks saw less dramatic gains.

If the recent run has you curious about what else is gathering steam, now is a great time to broaden your outlook and discover fast growing stocks with high insider ownership

With the stock up sharply and trading near analyst targets, investors may be wondering: does Bank of New York Mellon still have room to run, or is the market already factoring in its future growth prospects?

Most Popular Narrative: Fairly Valued

With Bank of New York Mellon's fair value narrative sitting at $104.82 and the latest closing price at $106.60, it's a tight valuation that signals the market is closely tracking analyst expectations.

Accelerated investment in digital platforms (including digital asset custody, AI integration, and the NEXEN ecosystem), coupled with strong early adoption, positions BNY Mellon for improved operating leverage and net margin expansion over the coming years. Scalable technology reduces costs and increases cross-selling opportunities.

Want to know what’s fueling this finely balanced price? The secret sauce: a surge in next-generation digital initiatives and a confident outlook for profit margins. Curious just how big the jump in future earnings could be? Unlock the full story and see what’s really driving the valuation behind the scenes.

Result: Fair Value of $104.82 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, client outflows in investment management or a prolonged downturn in global markets could quickly undermine these optimistic growth assumptions.

Find out about the key risks to this Bank of New York Mellon narrative.

Another View: Sizing Up Value with Multiples

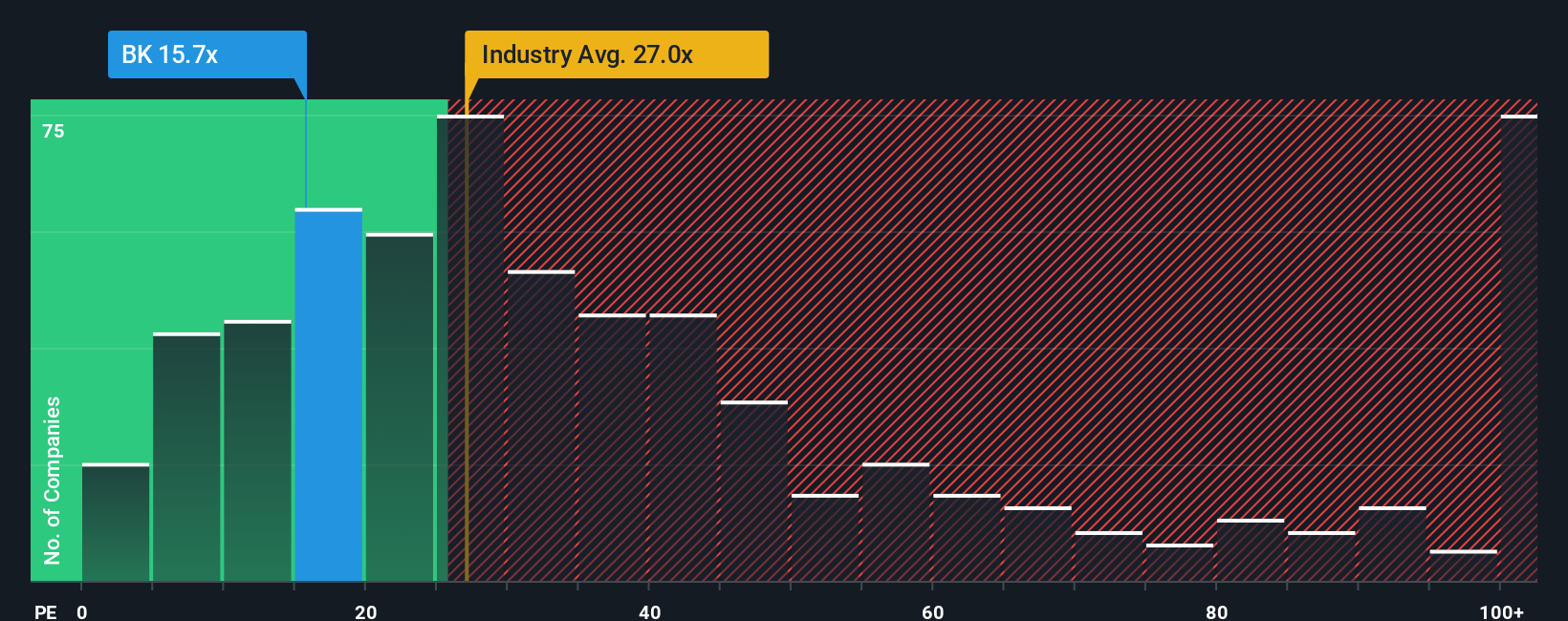

Looking at the price-to-earnings ratio as a reality check, Bank of New York Mellon's 15.7x figure is well below both its peers (33.8x) and the broader US Capital Markets industry average (27.1x). Even compared to its fair ratio of 18x, BK appears attractively valued. Could this gap point to a hidden opportunity or a sign the market is cautious for a reason?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bank of New York Mellon Narrative

If you see things differently or want to dig into the numbers yourself, you can easily build your own perspective in just a few minutes, then Do it your way

A great starting point for your Bank of New York Mellon research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for opportunities to come to you. Take control and track down stocks that match your strategy using the Simply Wall Street Screener. The next big winner might be just a click away.

- Uncover potential in digital innovation by tapping into these 24 AI penny stocks, which are reshaping industries through artificial intelligence and advanced automation.

- Pounce on undervalued gems with these 886 undervalued stocks based on cash flows that show real promise based on their cash flow fundamentals.

- Collect steady income and enjoy market resilience by reviewing these 19 dividend stocks with yields > 3%, delivering yields above 3% for savvy investors seeking consistent returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of New York Mellon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BK

Bank of New York Mellon

Provides a range of financial products and services in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.