- United States

- /

- Consumer Finance

- /

- NYSE:BFH

Bread Financial’s $500 Million Debt Move Might Change the Case for Investing in BFH

Reviewed by Sasha Jovanovic

- On November 6, 2025, Bread Financial Holdings closed a US$500 million offering of 6.750% Senior Notes due 2031, supported by guarantees from its key domestic subsidiaries and structured with multiple redemption options and terms balancing creditor and company interests.

- This move reflects Bread Financial’s focus on actively managing its capital structure and funding flexibility to support future growth and operational needs.

- We’ll examine how this expanded funding base could reinforce Bread Financial’s outlook on earnings stability and growth drivers.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Bread Financial Holdings Investment Narrative Recap

To be a shareholder in Bread Financial Holdings, one must believe in the company's ability to execute on its digital payment and lending platforms, capitalize on deepening co-brand and private label partnerships, and sustain credit quality in the face of evolving consumer trends. While the recent US$500 million senior notes offering enhances funding flexibility and could help support future growth initiatives, the transaction does not materially alter the importance of credit performance as the key short-term catalyst. The main risk remains Bread Financial’s exposure to credit cycle volatility and its effect on net margins in changing economic conditions.

Among the latest announcements, Bread Financial's 10 percent dividend increase is especially noteworthy in light of this debt issuance, underscoring the company’s commitment to returning capital to shareholders while managing its capital structure. This step, when viewed alongside strengthened balance sheet management, supports confidence in the company’s ability to maintain steady earnings and operational progress in the near term.

But while funding flexibility is growing, investors should not overlook Bread Financial's ongoing exposure to...

Read the full narrative on Bread Financial Holdings (it's free!)

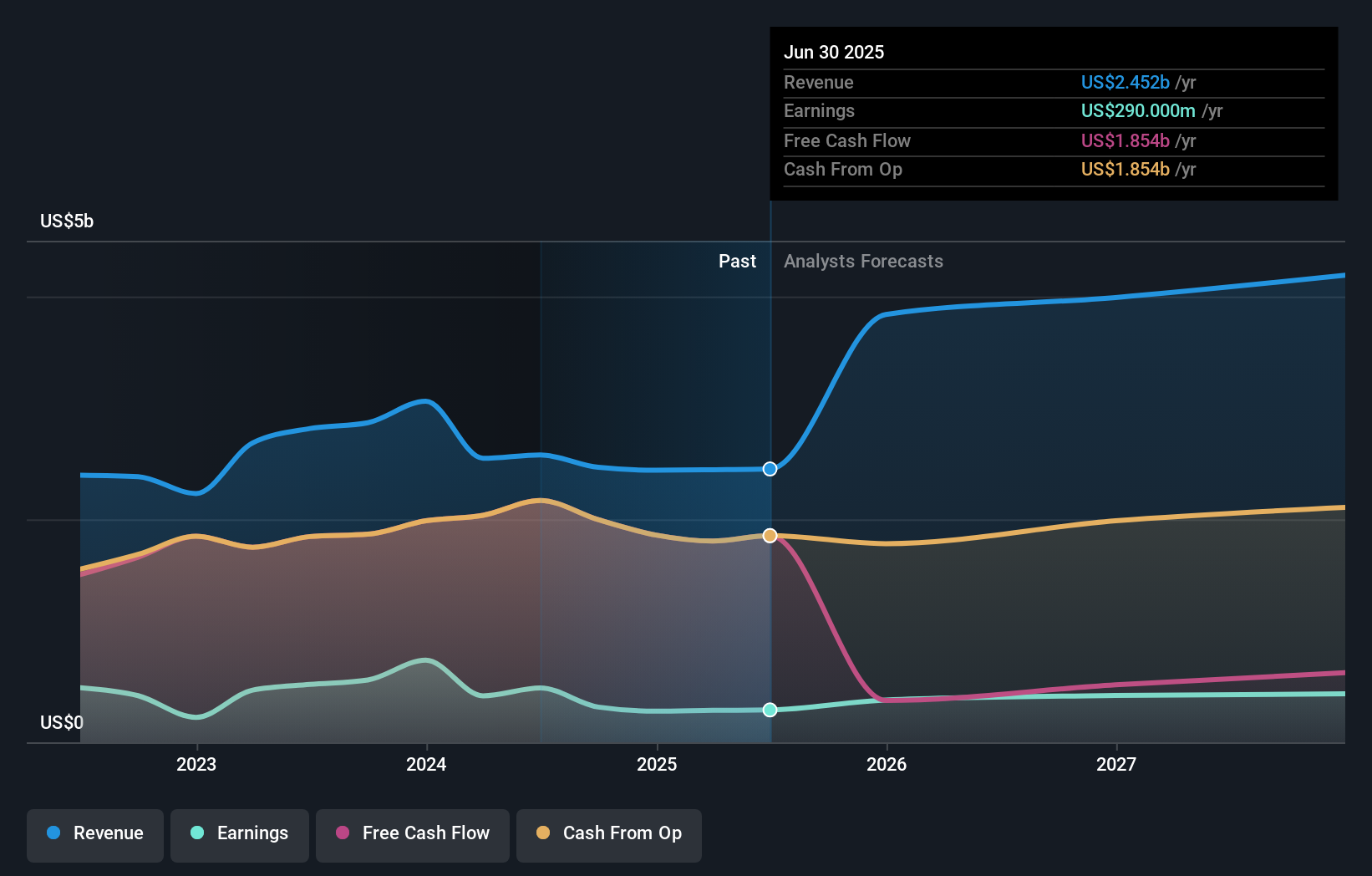

Bread Financial Holdings' outlook calls for $4.3 billion in revenue and $379.5 million in earnings by 2028. This is based on analysts forecasting 20.3% annual revenue growth and a $89.5 million increase in earnings from $290.0 million today.

Uncover how Bread Financial Holdings' forecasts yield a $70.20 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community stands at US$70.20 per share, reflecting a unified outlook among retail investors. Despite this consensus, persistent credit risk remains a significant factor influencing the company’s future results, urging you to consider a range of opinions on future performance.

Explore another fair value estimate on Bread Financial Holdings - why the stock might be worth just $70.20!

Build Your Own Bread Financial Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bread Financial Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bread Financial Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bread Financial Holdings' overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bread Financial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BFH

Bread Financial Holdings

Provides tech-forward payment and lending solutions to customers and consumer-based industries in North America.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives