- United States

- /

- Consumer Finance

- /

- NYSE:BFH

Bread Financial (BFH) Rises on Earnings Beat and Dividend Hike but Is Its Capital Strategy Evolving?

Reviewed by Sasha Jovanovic

- Bread Financial Holdings recently announced third-quarter earnings that exceeded analyst expectations, a 10% increase in its quarterly dividend to US$0.23 per share, and an expansion of its share repurchase authorization by US$200 million for a total of US$400 million.

- Raymour & Flanigan also revealed a new long-term credit partnership with Bread Financial, aiming to launch a private label credit program integrated into Raymour & Flanigan's retail platforms later this year.

- Given the substantial increase in the dividend, we'll examine how Bread Financial's latest capital actions may shift its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Bread Financial Holdings Investment Narrative Recap

To be a shareholder in Bread Financial Holdings, you need to believe that its investments in digital innovation and new retail partnerships can offset industry-wide pressures on yields and margins. The latest earnings and capital returns are encouraging, but management’s 2025 guidance for flat revenue growth means the key short-term catalyst remains expanding customer relationships through embedded finance, while the greatest risk is the potential for credit losses to rise if consumer health deteriorates, this new information does not materially change those drivers.

Among recent announcements, the partnership with Raymour & Flanigan stands out as most relevant. By deepening integration with retail clients and launching private label credit programs, Bread Financial is leaning into its catalyst of digital product expansion and improved retailer reach, though success here depends on maintaining healthy consumer credit performance.

In contrast, investors should be aware that tighter credit standards and a high net loss rate could still limit loan growth if consumer headwinds persist...

Read the full narrative on Bread Financial Holdings (it's free!)

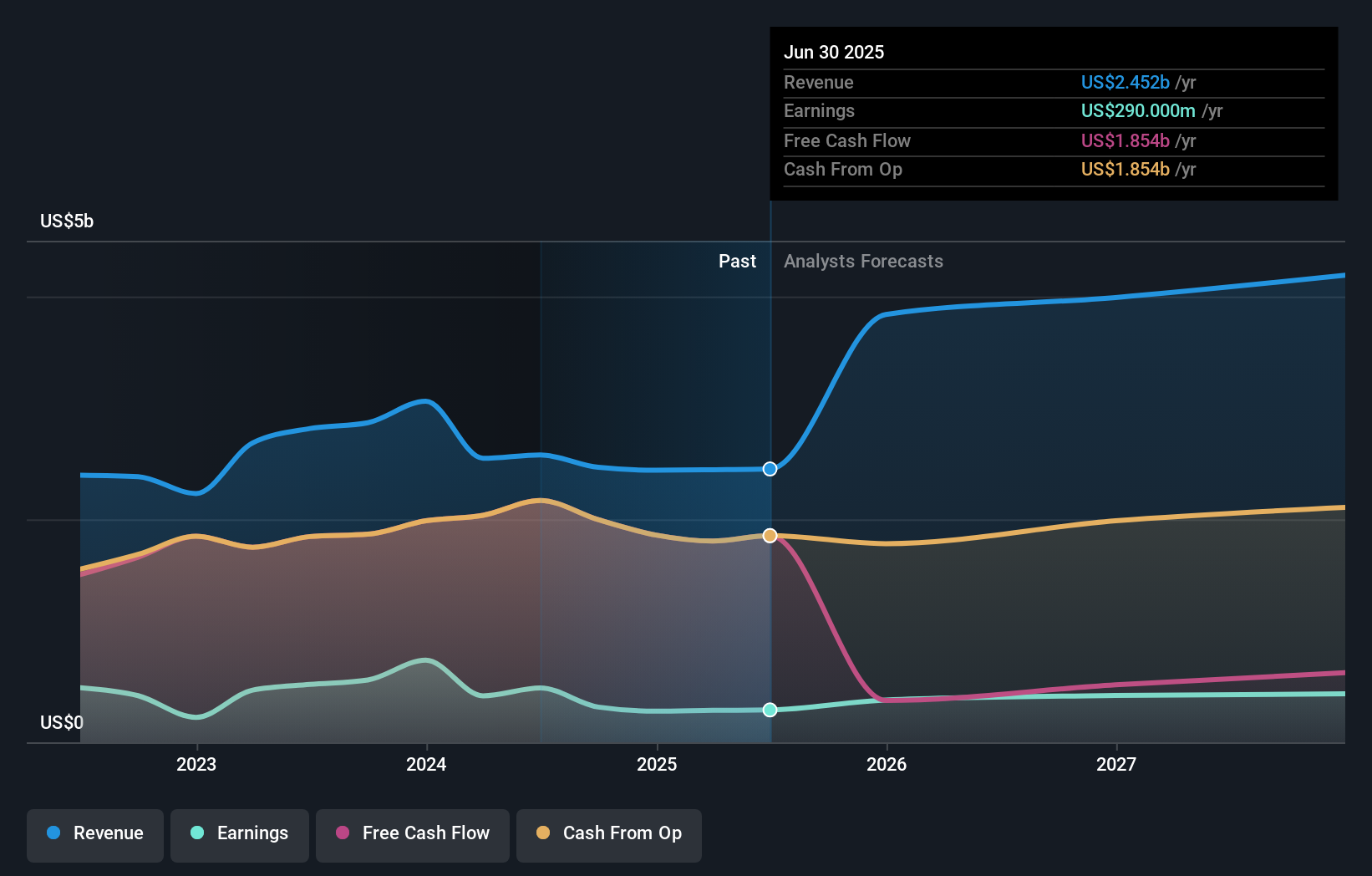

Bread Financial Holdings' outlook anticipates $4.3 billion in revenue and $379.5 million in earnings by 2028. This implies a 20.3% annual revenue growth rate and a $89.5 million increase in earnings from the current $290.0 million.

Uncover how Bread Financial Holdings' forecasts yield a $67.33 fair value, a 3% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community offered one fair value estimate before recent news, placing Bread Financial at US$67.33. While investor opinions can still differ, flat revenue growth guidance prompts several alternative viewpoints on the company's ability to deliver earnings resilience ahead.

Explore another fair value estimate on Bread Financial Holdings - why the stock might be worth just $67.33!

Build Your Own Bread Financial Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bread Financial Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bread Financial Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bread Financial Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bread Financial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BFH

Bread Financial Holdings

Provides tech-forward payment and lending solutions to customers and consumer-based industries in North America.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives