- United States

- /

- Capital Markets

- /

- NYSE:BEN

A Fresh Look at Franklin Resources (BEN): Is There Untapped Value in the Current Market?

Reviewed by Simply Wall St

See our latest analysis for Franklin Resources.

Franklin Resources’ share price has edged down recently, yet zooming out shows a more nuanced picture. After some volatility and muted short-term momentum, the 1-year total shareholder return sits at 9.7%, while longer-term investors have seen a healthy 35.8% total return over five years. Short-term swings have not derailed the bigger story of value and resilience that has played out over time.

If you’re curious to widen your horizons beyond the financial sector, now’s a smart time to check out fast growing stocks with high insider ownership.

With the stock trading below some analyst targets and recent gains still intact, investors face a key question: Is Franklin Resources currently undervalued, or is the market already pricing in its future growth?

Most Popular Narrative: 9.9% Undervalued

The most followed narrative puts Franklin Resources’ fair value above its last close, signaling potential upside if current market expectations play out. This reflects positive sentiment on future earnings and global expansion momentum.

The company is actively expanding its presence in non-U.S. and emerging markets, now with $500 billion of AUM outside the US and new mandates in countries like Uzbekistan and Saudi Arabia. This positions Franklin Resources to benefit from the rising global wealth and the increasing allocation of institutional capital worldwide. This is likely to support future AUM growth and top-line revenue expansion.

What’s fueling this thesis? The key lies in bold profit forecasts and aggressive international moves. But there is a deeper financial story only revealed in the full narrative.

Result: Fair Value of $24.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent client outflows or ongoing fee pressure could offset Franklin Resources’ optimistic projections and create challenges for its ability to deliver sustained earnings growth.

Find out about the key risks to this Franklin Resources narrative.

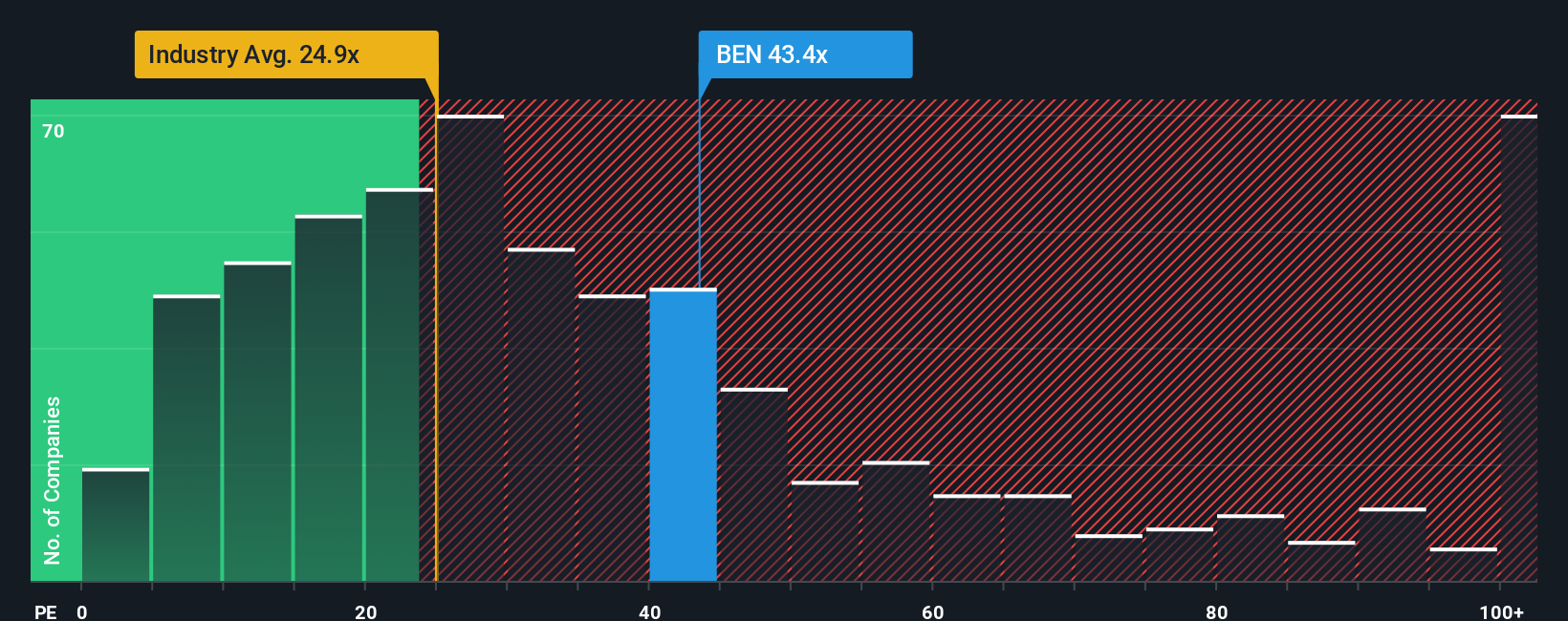

Another View: Multiples Paint a Different Picture

Looking at valuation from a different angle, Franklin Resources trades on a price-to-earnings ratio of 24.6x. This is slightly cheaper than the US Capital Markets industry average of 25.4x, but significantly higher than its closest peer group and well above its own fair ratio of 17.7x. The gap suggests that while investors may be pricing in growth or quality, it also introduces meaningful valuation risk, especially if future results disappoint. With that in mind, does this higher multiple signal hidden optimism or expose downside if expectations are not met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Franklin Resources Narrative

If you have a different view or want to look deeper into Franklin Resources’ numbers, you can craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Franklin Resources research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next big winner could be waiting in a sector you haven’t yet considered. Use these smart filters to identify stocks with serious potential that others may be missing.

- Boost your income by checking out these 15 dividend stocks with yields > 3% with high yields and a track record for stable payouts.

- Tap into the artificial intelligence boom by scanning these 27 AI penny stocks that are setting the pace in AI innovation and adoption.

- Uncover real bargains before they hit the spotlight. See these 884 undervalued stocks based on cash flows to spot stocks priced below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BEN

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives