- United States

- /

- Capital Markets

- /

- NYSE:ASA

Should Major Insider Buying and New Board Leadership Prompt Action From ASA Gold and Precious Metals (ASA) Investors?

Reviewed by Sasha Jovanovic

- In October 2025, Saba Capital Management, a major shareholder, purchased over 130,000 additional shares of ASA Gold and Precious Metals Ltd for a total value of more than US$5.7 million, while the company announced board changes including the appointment of Karen Caldwell as director and Audit & Ethics Committee Chair.

- The combination of significant insider buying and refreshed governance leadership highlights renewed investor confidence and an increased focus on oversight at ASA Gold and Precious Metals Ltd.

- We'll examine how these insider purchases by a major shareholder reinforce ASA Gold and Precious Metals' investment narrative around long-term potential.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is ASA Gold and Precious Metals' Investment Narrative?

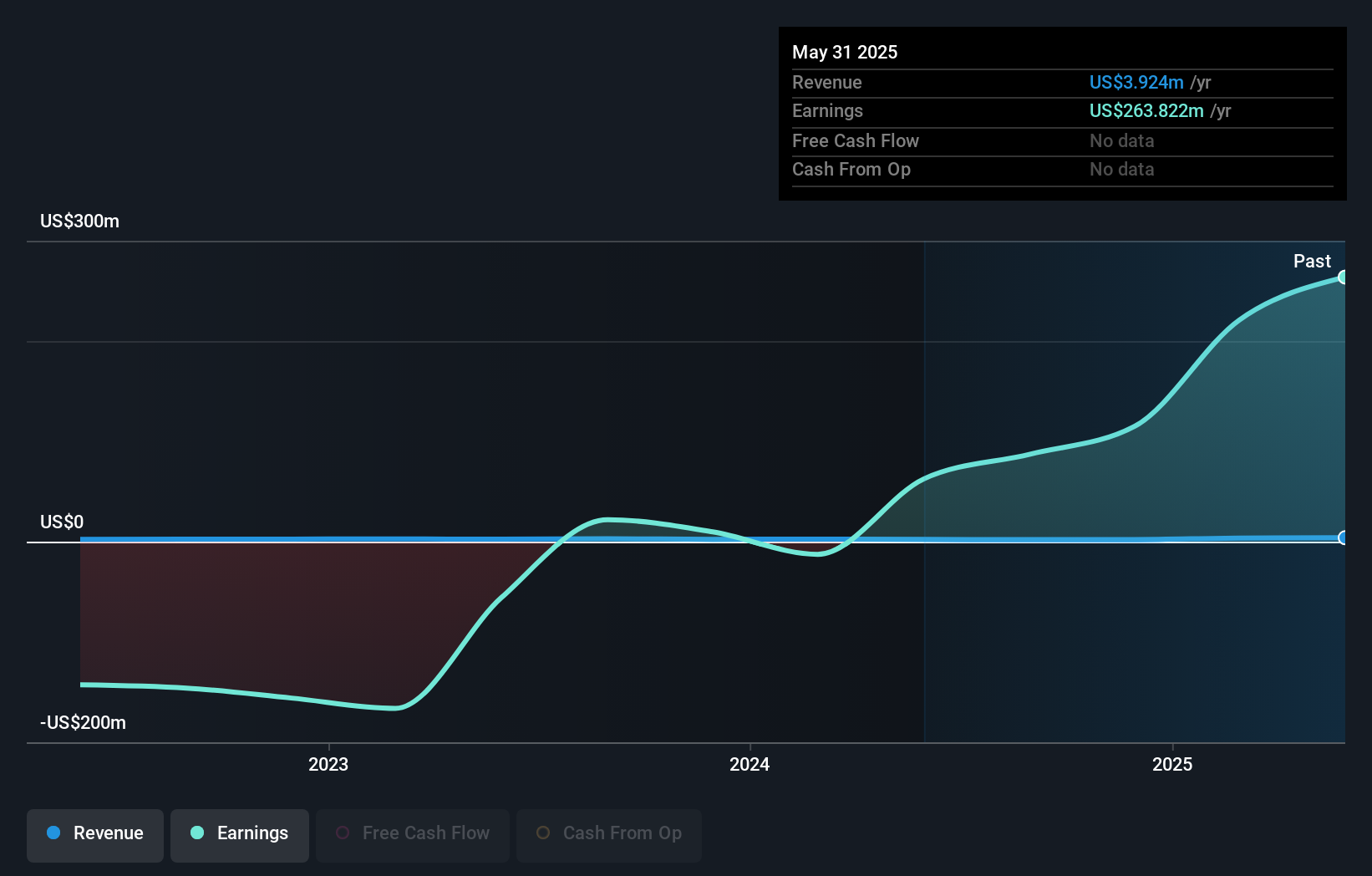

To be an ASA Gold and Precious Metals shareholder, you need to believe in the underlying value of precious metals investments and expect that governance shifts can translate into stronger oversight and future returns. The recent Saba Capital share purchases and the refreshed board demonstrate activist confidence, but also highlight the real-time impact of ongoing governance changes. While Saba's move and renewed leadership could bring near-term stability and enhanced stewardship, the biggest short-term catalysts, such as outcomes of the upcoming AGM and ongoing legal matters, remain tied to how well ASA navigates activist demands and board integration. Risks haven’t disappeared: rapid board turnover and a lack of management experience underline the uncertainty around operational consistency, despite high recent returns. At this stage, the latest news supports positive sentiment, but the business's core risks, including outsized one-off financial gains and governance transitions, remain in focus.

On the other hand, the company's new board still faces big questions about stability. ASA Gold and Precious Metals' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on ASA Gold and Precious Metals - why the stock might be worth less than half the current price!

Build Your Own ASA Gold and Precious Metals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ASA Gold and Precious Metals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ASA Gold and Precious Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ASA Gold and Precious Metals' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASA

Solid track record with excellent balance sheet.

Market Insights

Community Narratives