- United States

- /

- Capital Markets

- /

- NYSE:ASA

A Fresh Look at ASA Gold and Precious Metals (NYSE:ASA) Valuation After Insider Buying and Board Changes

Reviewed by Kshitija Bhandaru

Saba Capital Management’s recent open market purchases of ASA Gold and Precious Metals (NYSE:ASA), combined with board changes including Karen Caldwell’s appointment as Audit and Ethics Chair, are drawing extra attention from investors this month.

See our latest analysis for ASA Gold and Precious Metals.

This wave of insider buying and board refresh at ASA Gold and Precious Metals comes as momentum builds in its share price. The past month delivered a 19.65% share price return, while the total shareholder return for the past year stands at an impressive 119.8%. Investors watching the nearly 285.7% three-year total shareholder return can’t help but see signs of renewed confidence and potential for further upside, even after a recent dip.

If seeing insiders double down gets you thinking beyond the gold sector, now’s an interesting moment to expand your search and discover fast growing stocks with high insider ownership

With insiders showing conviction and ASA Gold and Precious Metals boasting triple-digit returns over the past year, the real question now is whether there is still value for new investors or if the market is already pricing in the company’s growth trajectory.

Price-to-Earnings of 2.5x: Is it justified?

ASA Gold and Precious Metals is currently trading at a price-to-earnings (P/E) ratio of 2.5x, dramatically below both its industry and the wider market. This suggests that investors may be undervaluing the company’s recent surge in profitability. With a last close price of $49.07 and such a low multiple, the stock appears undervalued relative to its peers and historic norms.

The P/E ratio compares a company’s current share price to its earnings per share, making it a widely used measure of valuation in capital markets. For an asset management company like ASA Gold and Precious Metals, a significantly lower P/E often reflects either market skepticism or overlooked earnings power, particularly in the context of recent record profit growth.

ASA stands out with a P/E of just 2.5x while the US Capital Markets industry averages 25.4x. Its peer group also sits much higher at 30.7x. This large gap could indicate the market’s cautious stance on the sustainability of recent strong earnings, or it may simply be missing a genuine value opportunity. If the market eventually moves toward a fairer valuation, a significant re-rating could occur.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 2.5x (UNDERVALUED)

However, a sudden reversal in gold prices or shifts in market sentiment could quickly dampen ASA Gold and Precious Metals’s impressive investor momentum.

Find out about the key risks to this ASA Gold and Precious Metals narrative.

Another View: DCF Tells a Different Story

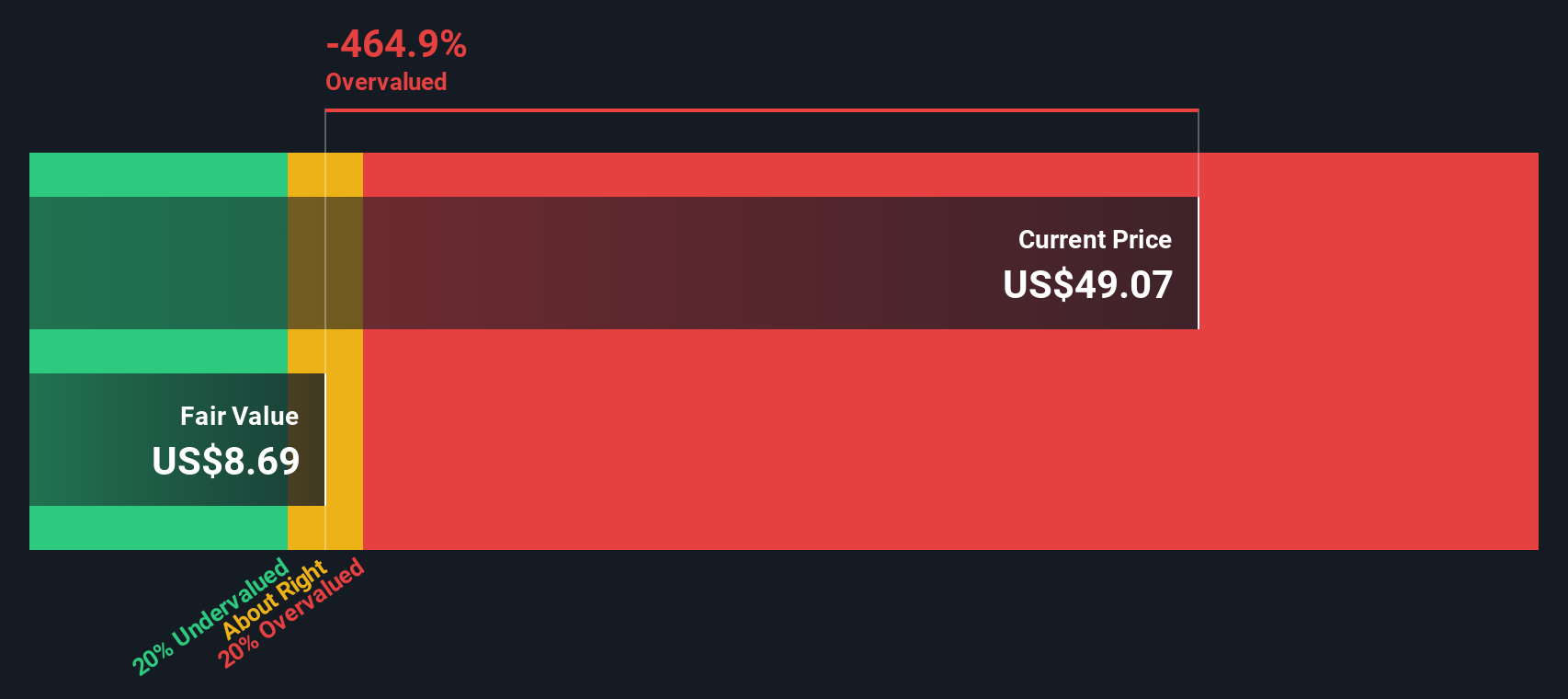

While the price-to-earnings ratio points to ASA Gold and Precious Metals being undervalued compared to its sector, our DCF model suggests a very different picture. Based on our calculations, the SWS DCF model estimates the fair value at $8.68, which is significantly below the current price of $49.07. This implies the stock could be overvalued if those long-term cash flow forecasts play out.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ASA Gold and Precious Metals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ASA Gold and Precious Metals Narrative

If you see things differently or want to take a hands-on approach, you can dig into the data and craft your own story in just a few minutes: Do it your way

A great starting point for your ASA Gold and Precious Metals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Ways to Strengthen Your Portfolio?

Smart investors never stop looking for the next promising trend or hidden gem. Let Simply Wall Street’s tailored screener help you unlock your next great investment idea today.

- Tap into high potential with these 878 undervalued stocks based on cash flows and spot companies trading below their intrinsic value before the crowd catches on.

- Stay ahead of the curve by accessing these 33 healthcare AI stocks, connecting you with companies at the forefront of medical innovation using artificial intelligence.

- Accelerate your search for income with these 18 dividend stocks with yields > 3%, which highlights opportunities offering reliable dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASA

Solid track record with excellent balance sheet.

Market Insights

Community Narratives