- United States

- /

- Mortgage REITs

- /

- NYSE:ARI

Is Improved Loan Portfolio Quality Altering the Investment Case for Apollo Commercial Real Estate Finance (ARI)?

Reviewed by Sasha Jovanovic

- In recent days, JP Morgan upgraded Apollo Commercial Real Estate Finance from Neutral to Overweight, citing improved loan portfolio quality and renewed earnings potential following progress in resolving troubled loans.

- This analyst upgrade was echoed by other firms maintaining positive recommendations, reflecting a consensus of strengthening confidence in Apollo's core business outlook.

- To understand how portfolio quality improvements are shaping Apollo's investment narrative, we'll examine how these developments have influenced recent investor sentiment.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Apollo Commercial Real Estate Finance's Investment Narrative?

To see Apollo Commercial Real Estate Finance as an appealing investment right now, you have to believe the company’s recent progress in cleaning up its loan portfolio can mark a true turning point, particularly with JP Morgan and other analysts raising their ratings on the back of that improved loan quality. The big short-term catalyst for shareholders is whether this turnaround will show up in upcoming earnings, reversing a period of declining revenue and last quarter’s shrink in net income. At the same time, the analyst upgrades suggest that some market watchers are more optimistic about Apollo’s future earnings power and ability to redeploy capital. Still, risks remain prominent: revenue trends remain negative, dividends are not covered by earnings, and the fair value estimate only modestly exceeds the current share price, so any improvement must prove sustainable. The latest news injects hope but does not eliminate fundamental challenges. Yet, dividend coverage by earnings remains an information point investors should not ignore.

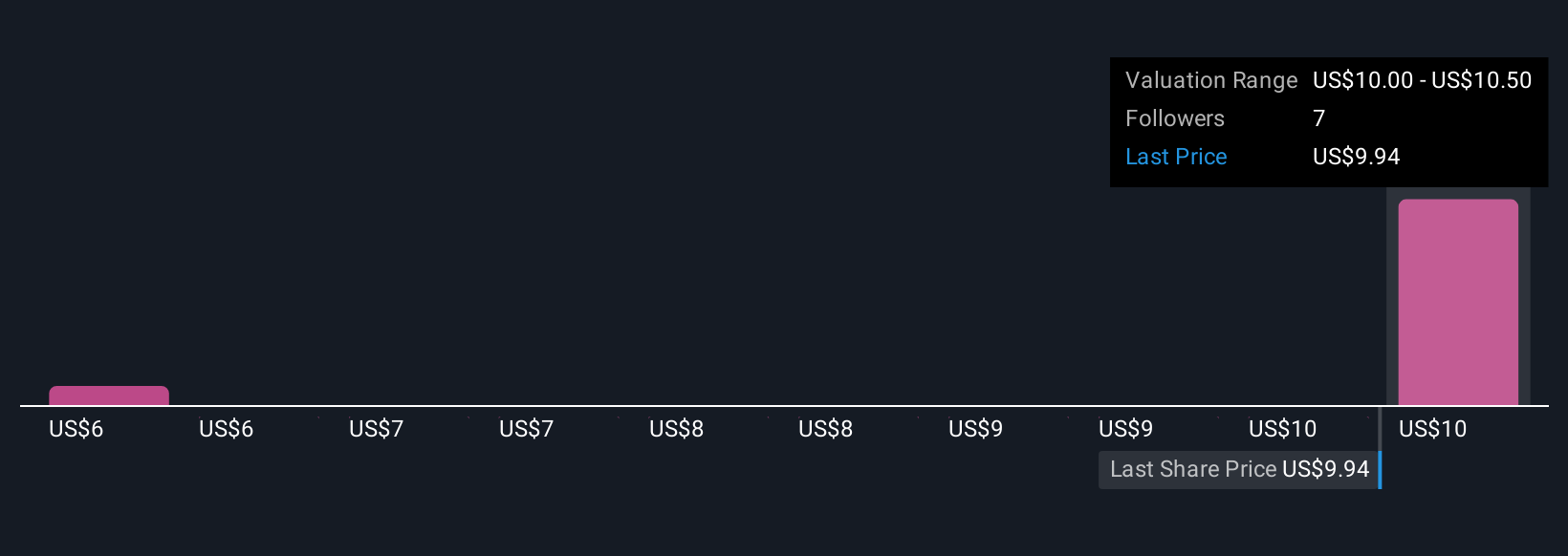

The valuation report we've compiled suggests that Apollo Commercial Real Estate Finance's current price could be inflated.Exploring Other Perspectives

Explore 3 other fair value estimates on Apollo Commercial Real Estate Finance - why the stock might be worth as much as $10.50!

Build Your Own Apollo Commercial Real Estate Finance Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Apollo Commercial Real Estate Finance research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Apollo Commercial Real Estate Finance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Apollo Commercial Real Estate Finance's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARI

Apollo Commercial Real Estate Finance

Apollo Commercial Real Estate Finance, Inc.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives