- United States

- /

- Capital Markets

- /

- NYSE:ARES

Will Ares Management's (ARES) LenderMAC Partnership Redefine Its Alternative Credit Strategy?

Reviewed by Sasha Jovanovic

- Earlier in October 2025, LenderMAC announced a strategic alliance with Ares Management, through which Ares will acquire a significant portion of LenderMAC's Non-QM loan production and provide capital to fuel LenderMAC’s nationwide expansion and origination efforts.

- This partnership highlights Ares Management’s ongoing move to strengthen its position in the alternative credit market while supporting the rapid development and technological advancement of an emerging player in mortgage lending.

- We’ll examine how Ares’ entry into LenderMAC’s Non-QM lending market could influence its investment narrative and sector positioning.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Ares Management Investment Narrative Recap

To own Ares Management, I believe an investor must be confident in continued demand for alternative assets and the firm’s ability to grow assets under management (AUM) while defending management fee margins. The new alliance with LenderMAC directly supports Ares’ push into alternative credit, but it does not meaningfully change the most important near-term catalyst: Ares’ progress converting dry powder into fee-paying AUM, nor does it diminish the ongoing risk of fee compression from rising competition in alternative investments.

Of the recent announcements, the launch of the Ares European Strategic Income ELTIF Fund in June is particularly relevant, it demonstrates the firm’s intent to expand its offerings in semi-liquid credit products, echoing themes in the LenderMAC partnership. Moves like these are designed to broaden distribution, yet they also highlight Ares’ increasing reliance on retail and wealth channels to support fee growth.

In contrast, investors should also be alert to the potential impact of ongoing fee pressure as...

Read the full narrative on Ares Management (it's free!)

Ares Management's narrative projects $7.1 billion revenue and $2.2 billion earnings by 2028. This requires 13.7% yearly revenue growth and a $1.83 billion earnings increase from $369.5 million.

Uncover how Ares Management's forecasts yield a $180.20 fair value, a 27% upside to its current price.

Exploring Other Perspectives

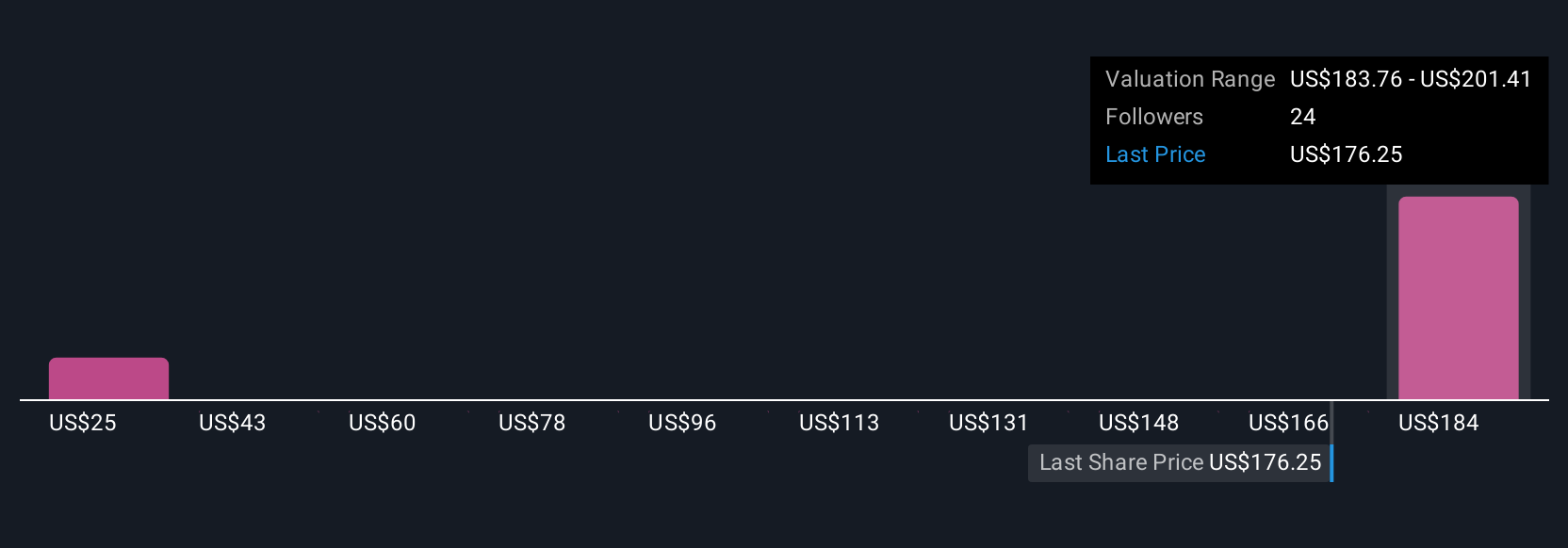

Private investors in the Simply Wall St Community placed Ares Management’s fair value between US$180.20 and US$201.41, with just two independent estimates. While many have high expectations for AUM growth, fee compression from intensifying competition remains an ongoing concern affecting the outlook for profitability.

Explore 2 other fair value estimates on Ares Management - why the stock might be worth just $180.20!

Build Your Own Ares Management Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ares Management research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Ares Management research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ares Management's overall financial health at a glance.

No Opportunity In Ares Management?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARES

Ares Management

Operates as an alternative asset manager in the United States, Europe, and Asia.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives