- United States

- /

- Capital Markets

- /

- NYSE:ARES

The Bull Case For Ares Management (ARES) Could Change Following Leadership Moves and Major Investment Initiatives

Reviewed by Simply Wall St

- Ares Management Corporation recently announced several major developments, including the appointment of Anup Agarwal as Partner and CIO of Ares Insurance Solutions, a fully leased Texas industrial portfolio acquisition, expanded global data center investments, and a $1.9 billion preferred equity investment in Leaf Home to support its acquisition of Erie Home.

- These moves underscore Ares' ongoing commitment to diversifying its real assets and private credit capabilities while reinforcing its leadership team to accelerate insurance channel growth and alternative investment offerings.

- We'll look at how Ares' multi-billion dollar investments and new insurance leadership may reshape its long-term earnings narrative and growth strategy.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Ares Management Investment Narrative Recap

To be an Ares Management shareholder, you need to believe in the company's ability to expand recurring revenues by capturing demand for alternative investments while managing the risks of market competition and fee pressures. The recent appointment of Anup Agarwal as CIO of Ares Insurance Solutions is not expected to materially affect the short-term catalyst of accelerating fee-paying AUM growth, but could help address execution and integration risks tied to new business lines. The most relevant news is Agarwal's leadership role, which connects directly to the challenge of successfully scaling insurance asset management to support long-term earnings growth. In contrast, investors should stay mindful of ongoing margin pressures and how execution risks in new sectors could affect future results if integration does not go as planned...

Read the full narrative on Ares Management (it's free!)

Ares Management's outlook forecasts $7.1 billion in revenue and $2.2 billion in earnings by 2028. This scenario requires a 13.7% annual revenue growth rate and a $1.83 billion increase in earnings from the current $369.5 million.

Uncover how Ares Management's forecasts yield a $193.69 fair value, a 6% upside to its current price.

Exploring Other Perspectives

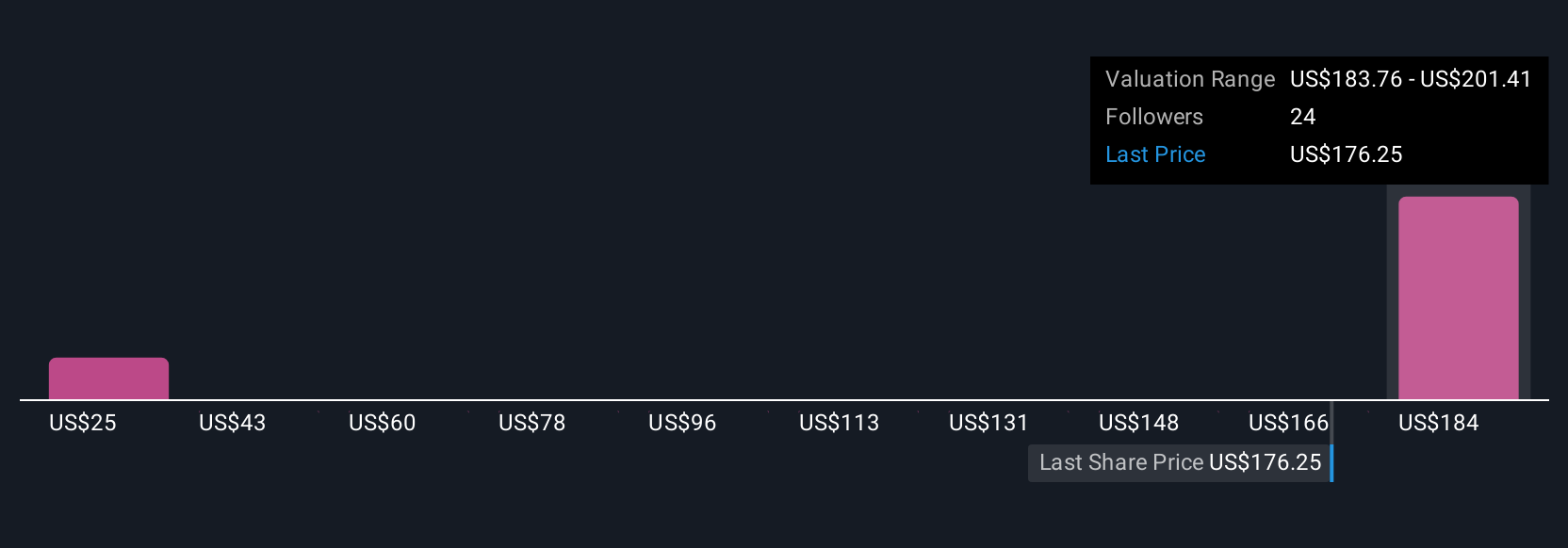

Three members of the Simply Wall St Community estimate Ares Management's fair value anywhere from US$24.71 to US$201.41 per share. As peers keep pressure on fees in private credit, broader competition could influence margin outlook, making it critical to compare these varied valuations and seek out multiple viewpoints.

Explore 3 other fair value estimates on Ares Management - why the stock might be worth as much as 10% more than the current price!

Build Your Own Ares Management Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ares Management research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Ares Management research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ares Management's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARES

Ares Management

Operates as an alternative asset manager in the United States, Europe, and Asia.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives