- United States

- /

- Capital Markets

- /

- NYSE:ARES

Ares Management (NYSE:ARES) Will Pay A Larger Dividend Than Last Year At US$0.61

Ares Management Corporation (NYSE:ARES) will increase its dividend on the 31st of March to US$0.61. This takes the annual payment to 2.5% of the current stock price, which is about average for the industry.

Check out our latest analysis for Ares Management

Ares Management Doesn't Earn Enough To Cover Its Payments

We aren't too impressed by dividend yields unless they can be sustained over time. The last dividend made up quite a large portion of free cash flows, and this was made worse by the lack of free cash flows. Generally, we think that this would be a risky long term practice.

The next 12 months is set to see EPS grow by 38.8%. If the dividend continues on its recent course, the payout ratio in 12 months could be 123%, which is a bit high and could start applying pressure to the balance sheet.

Ares Management's Dividend Has Lacked Consistency

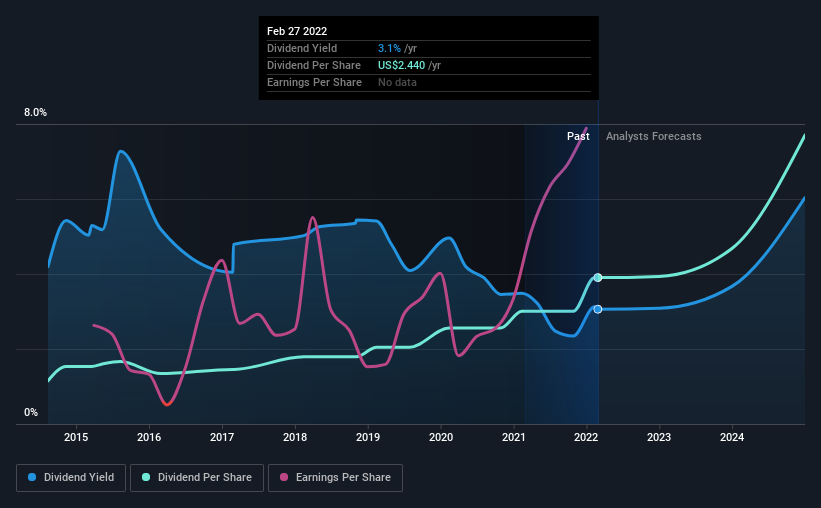

It's comforting to see that Ares Management has been paying a dividend for a number of years now, however it has been cut at least once in that time. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. Since 2014, the dividend has gone from US$0.72 to US$2.44. This works out to be a compound annual growth rate (CAGR) of approximately 16% a year over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

Dividend Growth May Be Hard To Achieve

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Although it's important to note that Ares Management's earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time. There are exceptions, but limited earnings growth and a high payout ratio can signal that a company has reached maturity. When the rate of return on reinvestment opportunities falls below a certain minimum level, companies often elect to pay a larger dividend instead. This is why many mature companies often have larger dividend yields.

The company has also been raising capital by issuing stock equal to 11% of shares outstanding in the last 12 months. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Ares Management's Dividend Doesn't Look Sustainable

Overall, we always like to see the dividend being raised, but we don't think Ares Management will make a great income stock. The payments are bit high to be considered sustainable, and the track record isn't the best. We would probably look elsewhere for an income investment.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 4 warning signs for Ares Management (of which 1 can't be ignored!) you should know about. Is Ares Management not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ARES

Ares Management

Operates as an alternative asset manager in the United States, Europe, and Asia.

High growth potential slight.

Similar Companies

Market Insights

Community Narratives