- United States

- /

- Capital Markets

- /

- NYSE:ARES

Ares Management (NYSE:ARES): Is the Stock Undervalued After Recent Pullback?

Reviewed by Kshitija Bhandaru

See our latest analysis for Ares Management.

Despite a tough stretch for many financial stocks, Ares Management’s share price has pulled back sharply over the past month, falling more than 20 percent as shifting market sentiment outweighs recent strong earnings growth. Even with this drop, the firm boasts a notable 268 percent total shareholder return over five years. However, longer-term momentum is cooling for now.

If you’re weighing the current market landscape, it may be the right moment to explore fast growing stocks with high insider ownership.

The real question now is whether the recent slide has created an undervalued entry point for Ares Management or if the market is already factoring in all of its future growth potential.

Most Popular Narrative: 25.7% Undervalued

Ares Management’s most widely followed narrative sees more than 25 percent upside from the last close at $141.87, based on a robust set of underlying catalysts. With this target significantly above the stock’s recent pullback level, a closer look at the drivers behind such a fair value is warranted.

“Diversification across asset classes and international markets is strengthening Ares' growth prospects, fee stability, and global reach. Increasing perpetual capital and a robust investment pipeline support recurring revenues, higher profitability, and greater earnings visibility.”

Want to know why bullish analysts think Ares is just warming up? Hidden in this narrative are aggressive forecasts on recurring fee revenue and profit margins that challenge industry norms. Curious exactly which numbers raise the fair value so sharply, and what scenarios could deliver or derail such growth? Dive in to see which assumptions set Ares apart from the field.

Result: Fair Value of $191 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, mounting competition in private markets and greater regulatory scrutiny could pressure Ares Management’s fee revenues and limit upside from this point onward.

Find out about the key risks to this Ares Management narrative.

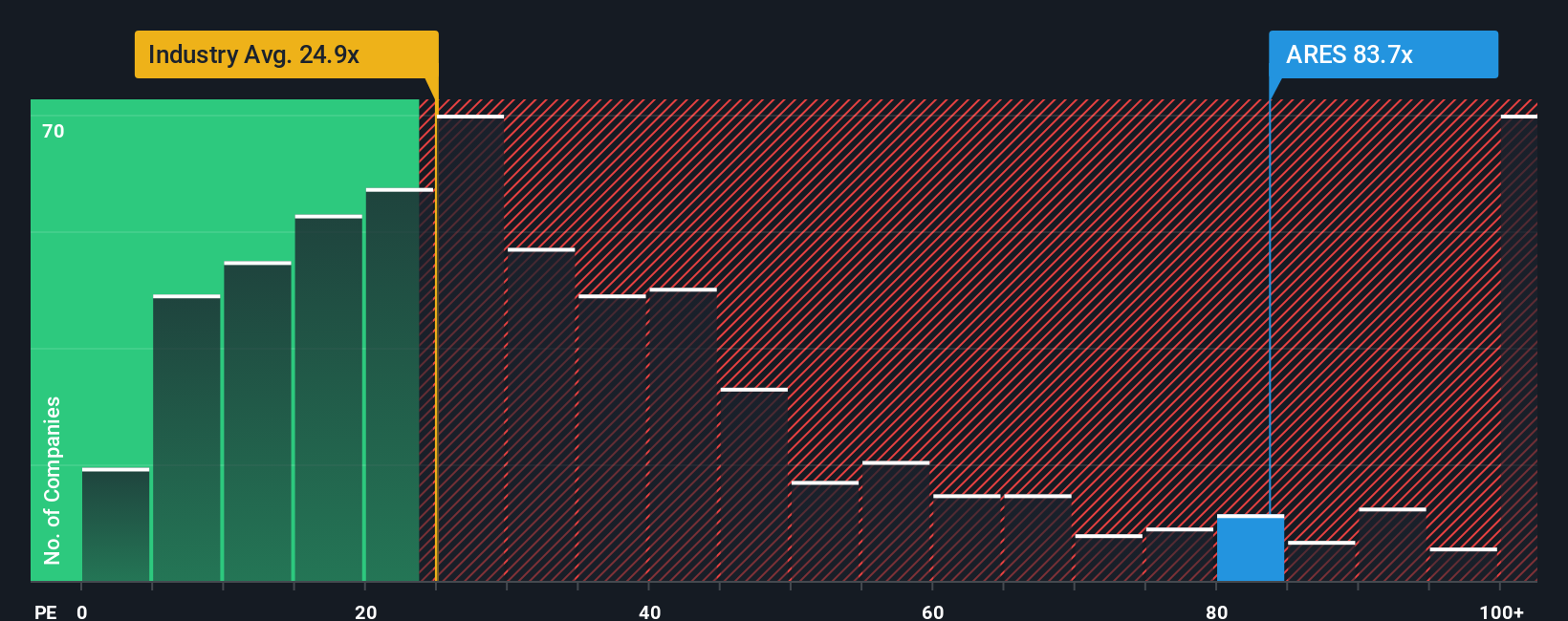

Another View: Looking at Price-to-Earnings

While the most popular narrative claims Ares Management is undervalued, a look through the lens of its price-to-earnings ratio paints a different picture. The company trades at 84.2x earnings, which is much higher than both the US Capital Markets industry average of 25.4x and the peer average of 13.7x. Even the fair ratio estimate sits at just 26.6x. This wide gap could signal valuation risk if the market pivots toward these benchmarks. Is the market overlooking red flags, or will future growth prove the premium justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ares Management Narrative

If you’d rather draw your own conclusions or think there’s more beneath the surface, it only takes a few minutes to build your perspective and do it your way, Do it your way.

A great starting point for your Ares Management research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Great Investment Ideas?

The smartest investors always seek fresh opportunities before the crowd arrives. Gain an edge by tapping into market trends and powerful growth themes using these hand-picked stock sets from Simply Wall Street:

- Uncover exciting prospects among companies harnessing artificial intelligence with these 24 AI penny stocks. These companies are driving the next wave of innovation and automation.

- Capitalize on income streams and stability by checking out these 18 dividend stocks with yields > 3%, which offers yields over 3 percent for steady potential returns.

- Capture tomorrow’s superstars early with these 877 undervalued stocks based on cash flows, trading at attractive prices based on robust cash flow projections and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARES

Ares Management

Operates as an alternative asset manager in the United States, Europe, and Asia.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives