- United States

- /

- Diversified Financial

- /

- NYSE:APO

What Apollo Global Management (APO)'s Real Estate Leadership Shake-Up Means For Shareholders

Reviewed by Sasha Jovanovic

- Earlier this month, Apollo Global Management appointed Bert Crouch as Partner and Head of Real Estate Equity, following its integration of Bridge Investment Group, and announced Robert Morse’s transition to Vice Chairman along with leadership continuity under Jonathan Slager at Bridge.

- This move introduces extensive real estate investment experience from Crouch and signals Apollo's intent to strengthen its position within the real estate equity business through seasoned leadership and platform growth.

- We'll examine how these executive appointments and expanded real estate capabilities could influence Apollo's investment outlook and growth narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Apollo Global Management Investment Narrative Recap

To become a shareholder in Apollo Global Management, you need to believe in the firm’s ability to execute on strategic expansion and leadership alignment, capitalizing on long-term demand for alternative assets across real estate, infrastructure, and retirement solutions. While the recent appointment of Bert Crouch as Head of Real Estate Equity reinforces Apollo’s growth ambitions in property, it does not materially impact the most important short-term catalyst, continued scaling of origination capabilities, or its main risk tied to internal execution and resource allocation.

Among the latest company moves, the integration of Bridge Investment Group, with Crouch now leading the combined real estate equity business, stands out as most relevant. This further enhances Apollo's platform and management depth in real estate at a time when effective leadership and strategic alignment remain crucial to delivering on projected growth and margin goals amid intensifying competition and execution challenges.

On the other hand, investors should keep a close eye on the risk that Apollo’s focus on internal alignment and execution could...

Read the full narrative on Apollo Global Management (it's free!)

Apollo Global Management's outlook anticipates $1.1 billion in revenue and $6.6 billion in earnings by 2028. This implies a 64.6% annual decline in revenue and a $3.5 billion increase in earnings from today's $3.1 billion.

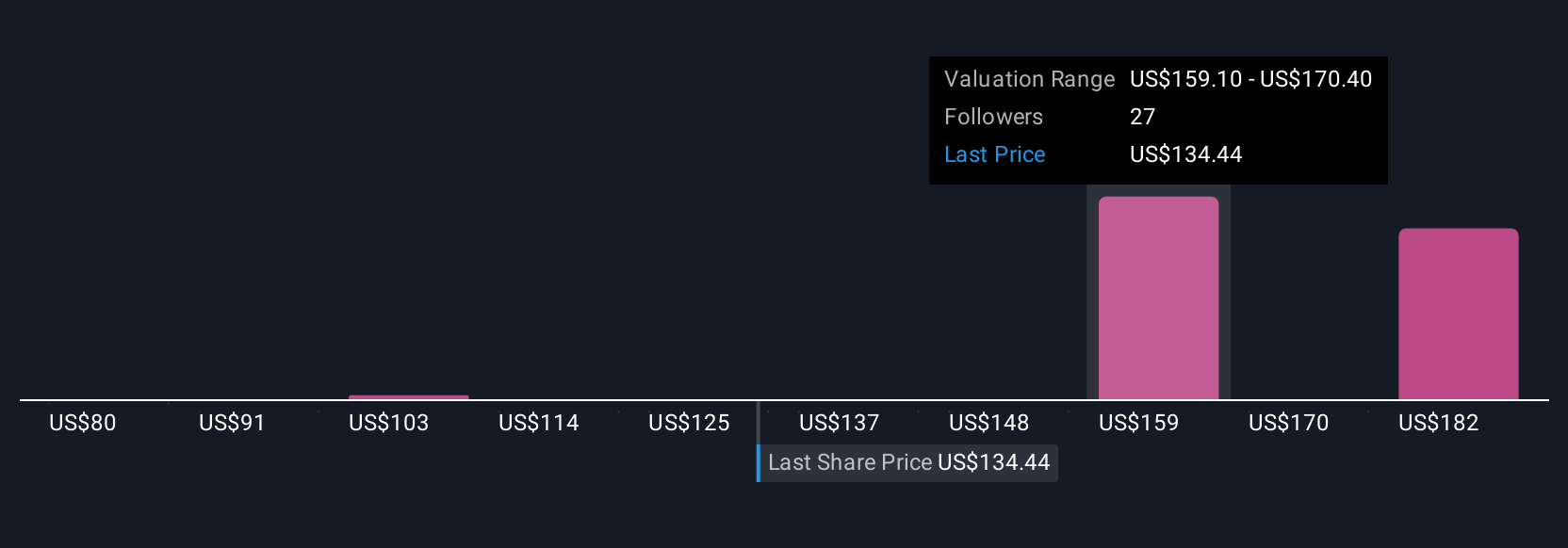

Uncover how Apollo Global Management's forecasts yield a $161.86 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have offered five fair value estimates for Apollo, ranging from US$110 to US$193 per share. While projections vary widely, internal execution remains the central factor in whether the company delivers on its growth ambitions; explore these perspectives to see how your view stacks up.

Explore 5 other fair value estimates on Apollo Global Management - why the stock might be worth as much as 53% more than the current price!

Build Your Own Apollo Global Management Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Apollo Global Management research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Apollo Global Management research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Apollo Global Management's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APO

Apollo Global Management

A private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives