- United States

- /

- Diversified Financial

- /

- NYSE:APO

Apollo Global Management (APO): Evaluating Value After Recent Stock Volatility and Long-Term Gains

Reviewed by Simply Wall St

Apollo Global Management (APO) has experienced some notable movement recently, with the stock changing by nearly 2% in the past week. Investors are keeping an eye on its year-to-date performance as broader market conditions continue to shift.

See our latest analysis for Apollo Global Management.

While Apollo Global Management’s share price has dipped almost 25% year-to-date, and volatility has picked up in recent weeks, its multi-year track record is hard to ignore. With three- and five-year total shareholder returns of 137% and 283% respectively, longer-term investors have seen substantial gains even as recent momentum has faded.

If financial momentum or a shift in market sentiment has you rethinking your approach, it could be worth broadening your search and checking out fast growing stocks with high insider ownership.

With Apollo trading around 25% below recent highs and analysts still forecasting upside, the lingering question is whether the current dip reflects undervaluation or if expectations for future growth are already factored in.

Most Popular Narrative: 22.8% Undervalued

Apollo Global Management’s most closely tracked valuation narrative assigns a fair value significantly above recent trading levels, suggesting meaningful upside potential in the current price. The valuation estimate is based on a synthesis of forward-looking financial assumptions and strategic catalysts described below.

"The company's strategic focus on the global industrial renaissance, particularly in areas like energy and infrastructure, is anticipated to significantly boost origination volumes, enhancing both revenue and earnings. Apollo's expansion into retirement solutions and evolving products for guaranteed income, alongside legislative prospects, could stimulate strong growth in retirement inflows, positively impacting net margins."

Are you curious how shifting strategic bets and new lines of business come together to boost this valuation? The fair value is supported by a combination of ambitious expansion plans, projected improvements in profit margins, and a future earnings profile that may not be widely anticipated. Discover what key figure changes and industry moves are driving this bold fair value target.

Result: Fair Value of $161.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks and intensifying competition in the insurance sector could challenge Apollo’s optimistic growth assumptions and may reduce enthusiasm around its fair value narrative.

Find out about the key risks to this Apollo Global Management narrative.

Another View: Signals from Market Comparisons

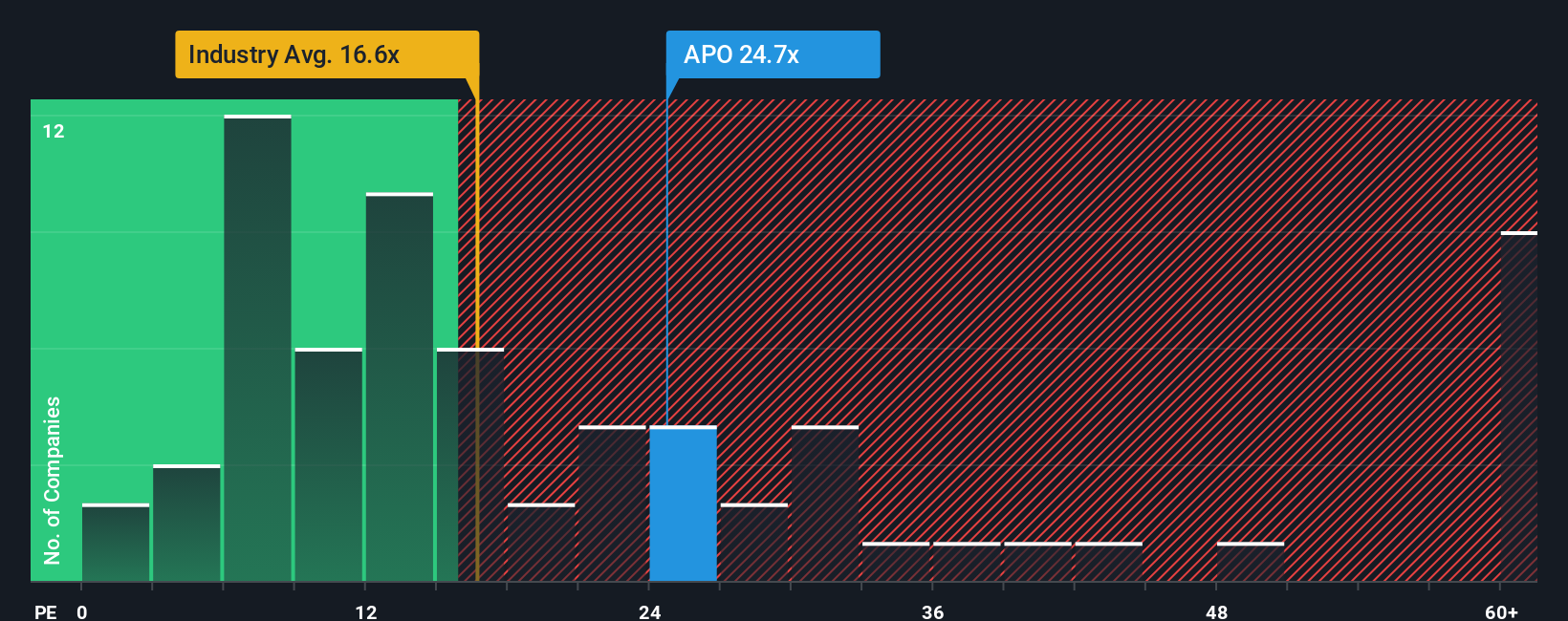

Looking through the lens of earnings multiples, Apollo trades at 22.6 times its earnings, which is higher than both its industry peers (20.7x) and the broader US Diversified Financials sector (16.6x). While it looks expensive on this measure, it still sits below its calculated fair ratio of 25.2x, indicating some valuation room. Does this premium reflect strength, or does it add risk if market sentiment turns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Apollo Global Management Narrative

If you see the story differently or want to research your own angle, you can create a fresh narrative with your own perspective in just minutes. Do it your way.

A great starting point for your Apollo Global Management research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your horizons and uncover new potential. Some of the market’s most rewarding opportunities are waiting beyond Apollo. Don’t let the next winner pass you by.

- Tap into the momentum of rising companies with strong financials by checking out these 3558 penny stocks with strong financials that are gaining traction among savvy investors.

- Unlock a stream of passive income by reviewing these 17 dividend stocks with yields > 3% with yields exceeding 3% and see which stocks offer the most reliable payouts.

- Get ahead of the AI trend by researching these 27 AI penny stocks, where technology and innovation are driving transformational growth across the sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APO

Apollo Global Management

A private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion