- United States

- /

- Diversified Financial

- /

- NYSE:APO

Analyzing Apollo Stock After S&P 500 Inclusion and Recent Price Drop in 2025

Reviewed by Bailey Pemberton

Deciding what to do with Apollo Global Management stock? You are definitely not alone. Whether you have been watching the recent market roller coaster or are just curious about an alternative asset manager with serious long-term growth, Apollo is a name on a lot of radars. After an impressive run over the past 3 and 5 years, up 159.4% and 235.5% respectively, recent weeks tell a different story. The stock has slipped by 2.2% in the last 7 days and a sizable 13.7% over the past month, deepening a longer-term drop of 27.1% year-to-date. Over the past year, shares are still down 15.7%. This is a clear sign that investor perceptions around risk and future payoff are shifting, possibly in response to broader market developments and changing expectations for asset managers.

Yet despite these recent drawdowns, Apollo stands out as potentially undervalued. Our analysis shows the company meets 4 out of 6 key undervaluation checks, giving it a strong value score of 4. So, what do those scores actually mean for investors, and do traditional valuation approaches tell the full story? Let’s break down the numbers behind Apollo’s valuation, and stay tuned for an even smarter way to weigh the stock’s true worth coming at the end.

Why Apollo Global Management is lagging behind its peers

Approach 1: Apollo Global Management Excess Returns Analysis

The Excess Returns model evaluates a company's ability to generate profits above the minimum return required by investors, also known as the cost of equity. Essentially, it gauges whether Apollo Global Management is consistently earning more from its investments than what is needed to compensate shareholders for their risk.

For Apollo, several key metrics stand out. The current book value per share is $31.33, with a stable projected book value of $55.27 per share, based on weighted estimates from two analysts. Stable earnings per share are estimated at $10.99, sourced from four analyst projections of future return on equity. The company's average return on equity is 19.89 percent, with a calculated cost of equity of $4.64 per share. This results in an excess return per share of $6.36, meaning Apollo generates a meaningful surplus over its required return to investors.

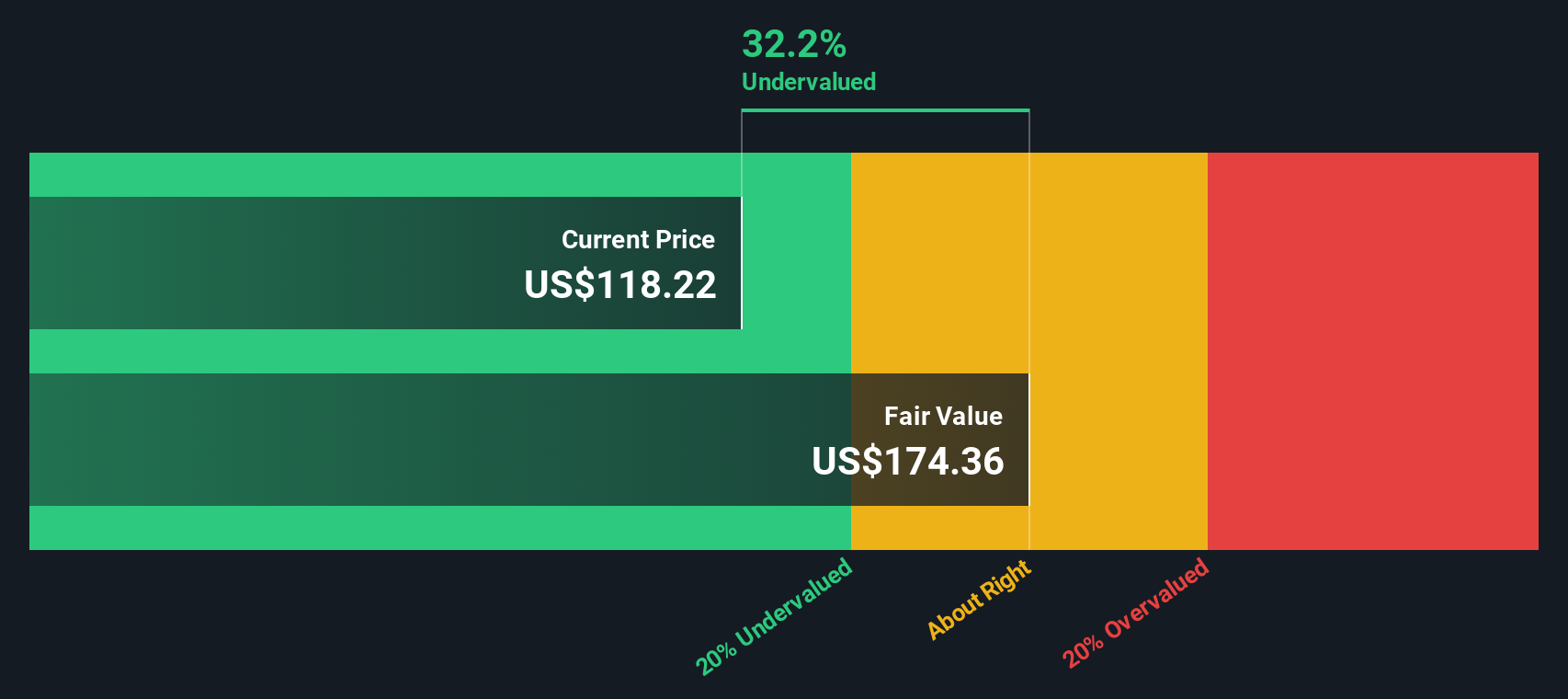

Looking at valuation, the estimated intrinsic value for Apollo derived from this model is $174.89 per share. With the current share price trailing behind by roughly 30.9 percent, this assessment suggests the stock is meaningfully undervalued at present levels.

Result: UNDERVALUED

Our Excess Returns analysis suggests Apollo Global Management is undervalued by 30.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Apollo Global Management Price vs Earnings

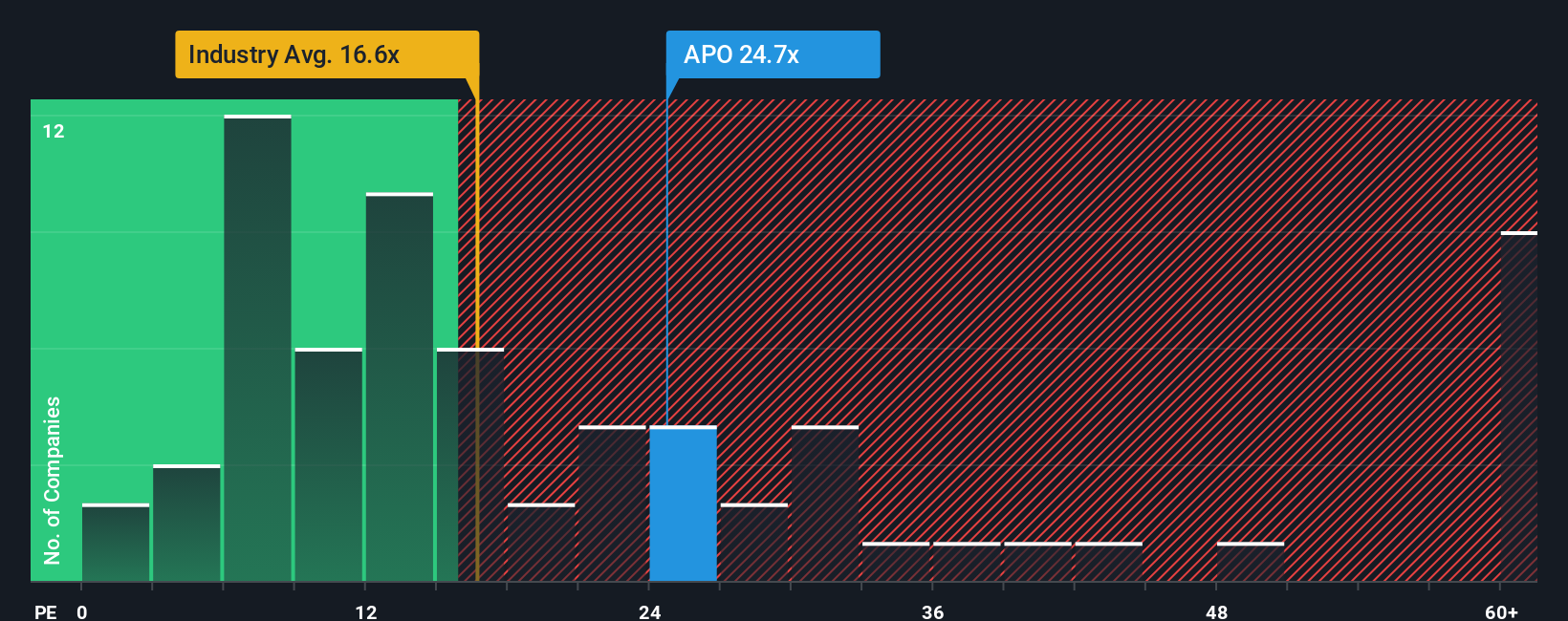

The price-to-earnings (PE) ratio is a favored metric for valuing profitable companies like Apollo Global Management, as it illustrates how much investors are willing to pay today for a dollar of earnings. A company’s growth prospects and its perceived risk directly affect what is considered a “normal” or fair PE ratio. Higher growth or lower risk tends to justify a higher ratio, while sluggish growth or high risk leads to a lower one.

Apollo’s current PE ratio stands at 21.9x, which is notable when set against the industry average of 15.7x and the peer average of 19.9x. On the surface, this suggests Apollo is trading at a premium relative to broader industry norms and close peers. However, benchmark comparisons do not always tell the whole story, since not every company has equal growth, profitability, or risk.

This is where Simply Wall St’s “Fair Ratio” comes in. This proprietary metric considers not only the company’s earnings growth potential but also factors like profit margin, sector, size, and unique risks. This customized approach provides a more accurate yardstick than a simple industry or peer comparison. For Apollo, its Fair Ratio is calculated at 25.2x. With its current PE of 21.9x sitting below this level, the implication is that Apollo’s stock is undervalued on an earnings basis given its profile and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Apollo Global Management Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a simple yet powerful way to connect the story you believe about Apollo Global Management to the numbers that matter, such as your own future estimates for revenue, earnings, and margins. This helps you define your fair value and investment stance.

Unlike generic ratios or static models, a Narrative links your perspective on the company’s future to a financial forecast and a calculated fair value, helping you see the story in the numbers. On Simply Wall St’s Community page, millions of investors are already using Narratives to easily create and share their viewpoint on stocks, including Apollo, without any advanced finance training needed.

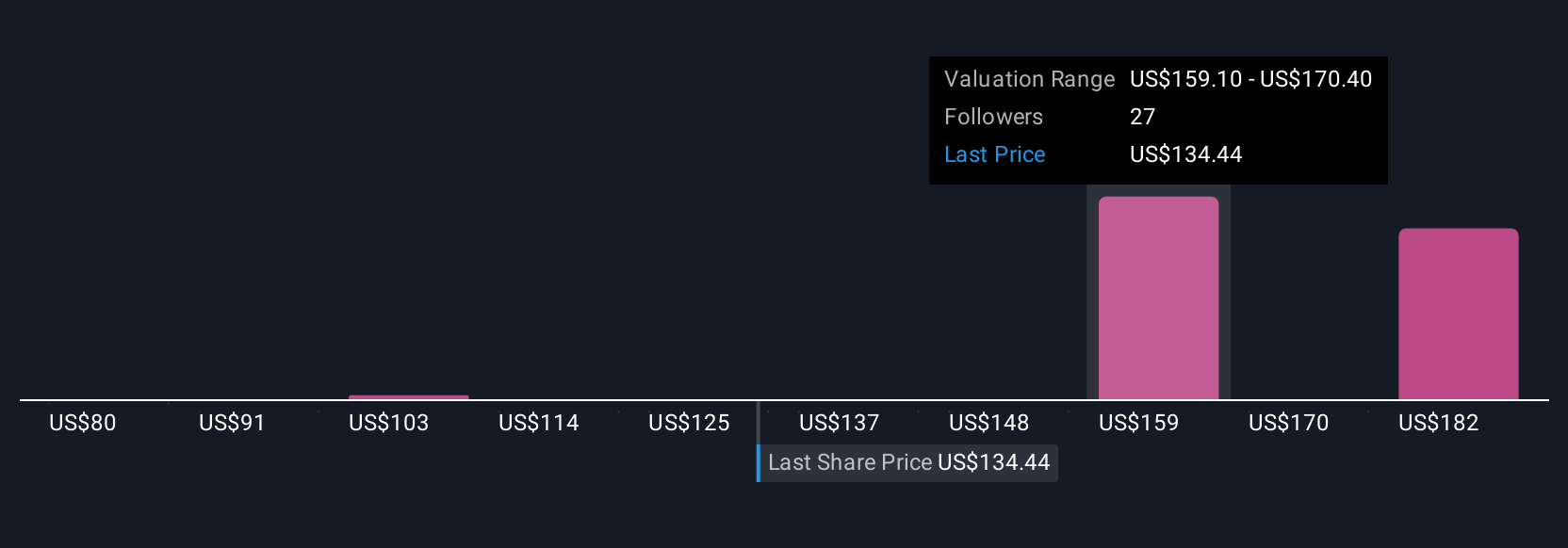

Narratives empower you to decide when to buy or sell by comparing your Fair Value to the current Price. They update automatically when new news or earnings become available, giving you a real-time, informed edge. For Apollo, you will find a range of views from investors who see a bullish path driven by S&P 500 inclusion and industrial growth (highest price target: $178) to those expecting more conservative returns due to competition and regulatory risks (lowest price target: $117.70).

Do you think there's more to the story for Apollo Global Management? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APO

Apollo Global Management

A private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion