- United States

- /

- Capital Markets

- /

- NYSE:AMP

How New Regulations Could Impact Ameriprise as Shares Sit Nearly 10% Lower in 2025

Reviewed by Bailey Pemberton

If you’re wondering what to do with Ameriprise Financial right now, you’re not alone. The stock is attracting plenty of attention from investors curious about its next move. After all, shares just closed at $478.15. While the past week delivered a reassuring 2.2% uptick, the year so far hasn’t been as kind, with the stock down about 9.8%. Over the past twelve months, Ameriprise is modestly lower, but pull the camera back a little and the story gets much brighter. There has been a three-year gain of 66.4%, and a staggering 221.3% return over five years. Clearly, there’s been real long-term growth here, even if recent months have brought steeper challenges.

Part of what is driving the conversation around Ameriprise is news swirling about upcoming changes to regulations impacting wealth management firms. This background has sparked debate about how much the company may benefit from regulatory shifts, potentially helping investor sentiment recover from recent dips. At the same time, some analysts are pointing out that Ameriprise appears undervalued across nearly every lens you use. In fact, it scores a 5 out of 6 on our valuation checks, making a strong case for a closer look.

So, how do we determine if Ameriprise’s current stock price actually reflects its underlying value? In the next section, we will dive into a few popular valuation approaches. Stick around, because at the end we will highlight a smarter method for judging whether a stock is truly cheap or expensive.

Why Ameriprise Financial is lagging behind its peers

Approach 1: Ameriprise Financial Excess Returns Analysis

The Excess Returns model helps estimate a company's fair value by looking beyond typical earnings metrics and instead focusing on how much profit the company generates relative to the cost of the capital it invests. Essentially, it considers whether the company delivers returns above what shareholders could get from similar risk elsewhere. For Ameriprise Financial, the details are telling.

The current Book Value stands at $64.42 per share, while analysts expect a stable Book Value of $83.48 per share going forward. Based on projections from six analysts, the stable Earnings Per Share (EPS) is anticipated at $41.42 per share. With an average Return on Equity of 49.61% and a Cost of Equity at $6.86 per share, Ameriprise generates an impressive $34.56 per share in excess returns. These figures highlight the company’s strong ability to create value for shareholders, much higher than its cost of capital.

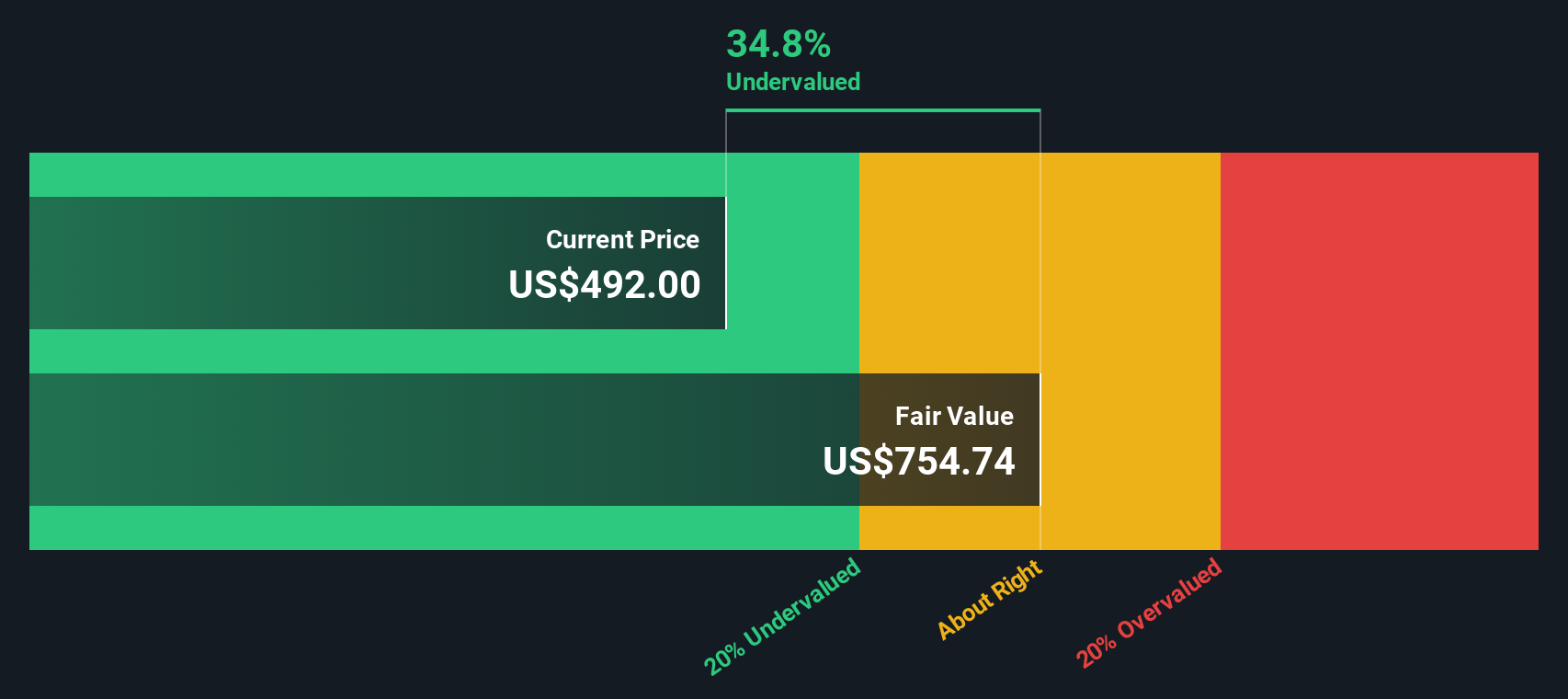

According to this approach, the Excess Returns model calculates Ameriprise Financial’s intrinsic value at around $755.85 per share, well above its recent closing price of $478.15. This suggests the stock is approximately 36.7% undervalued relative to its long-term potential.

Result: UNDERVALUED

Our Excess Returns analysis suggests Ameriprise Financial is undervalued by 36.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Ameriprise Financial Price vs Earnings

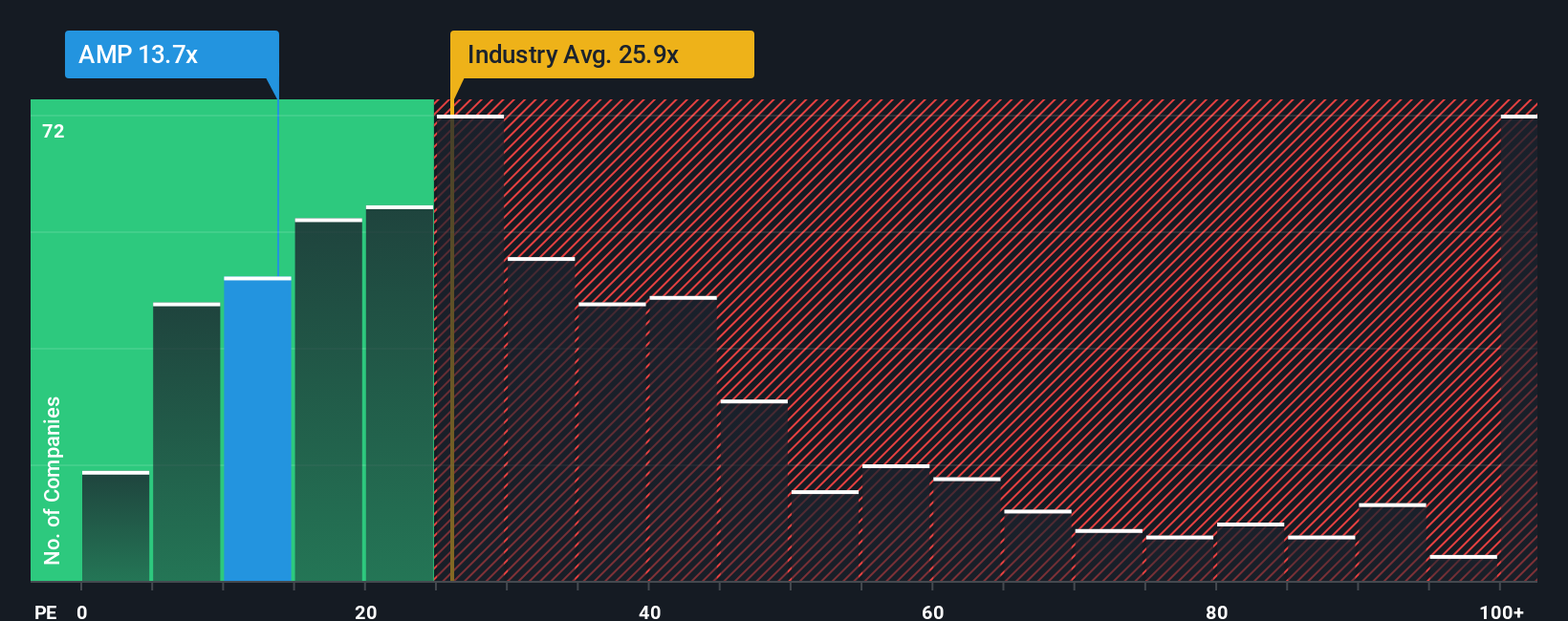

The price-to-earnings (PE) ratio is often the preferred valuation method when analyzing consistently profitable companies like Ameriprise Financial. This metric gives investors a quick sense of how much they are paying for each dollar of earnings, making it especially relevant for established firms with reliable profits. In general, higher expected growth and lower risk levels support a higher PE ratio. The reverse is true for riskier or stagnant companies.

Ameriprise currently trades at a PE ratio of 14x. For context, the average PE ratio across its Capital Markets industry sits at 26x, while its peers average an even higher 32.2x. This significant gap could signal that the stock is undervalued relative to its sector, but relying solely on these benchmarks does not capture the full picture.

That is where Simply Wall St’s "Fair Ratio" comes in. For Ameriprise, the Fair PE Ratio is estimated at 17.3x. This proprietary calculation is more reliable than a simple industry or peer comparison because it blends multiple factors like the company’s earnings growth prospects, industry trends, profit margins, risks, and market capitalization. By weighing all these factors, the Fair Ratio provides a more nuanced assessment of what Ameriprise should reasonably be valued at right now.

Since Ameriprise’s current PE of 14x is below its Fair Ratio of 17.3x, the stock appears undervalued on this metric as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ameriprise Financial Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply the story behind a company’s numbers, letting you define your own perspective about its future: you decide what you think is fair value by outlining how revenues, earnings, and margins might develop, and then seeing how the numbers stack up.

In practice, a Narrative connects your view of what will drive Ameriprise Financial’s growth, through a forecast of its financials, all the way to an estimated fair value. It is not just about what has happened or what the average analyst thinks, but what you believe is most likely given your knowledge of the industry or recent news.

Narratives are an easy, accessible tool available to all investors on Simply Wall St’s Community page, already used by millions to help make more confident investment choices. With Narratives, you can track your investment thesis, compare your Fair Value to the current Price, and decide whether now is the right time to buy, sell, or hold. Importantly, Narratives are updated automatically as new information such as earnings or news events arrive, so your view stays fresh even as conditions change.

For example, one investor might use optimistic projections about Ameriprise’s technology investments and assign a Fair Value of $650.0, while a more cautious investor, wary of margin pressures, lands at a conservative $434.0. Your Narrative is truly your own.

Do you think there's more to the story for Ameriprise Financial? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMP

Ameriprise Financial

Operates as a diversified financial services company in the United States and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives