- United States

- /

- Capital Markets

- /

- NYSE:AMG

Will AMG’s Minority Stake in BBH Credit Partners Mark a Turning Point in Its U.S. Strategy?

Reviewed by Sasha Jovanovic

- In the past week, Brown Brothers Harriman and Affiliated Managers Group announced a collaboration to expand BBH’s suite of structured and alternative credit investment strategies into the U.S. wealth market, with AMG providing seed capital and taking a minority stake in BBH Credit Partners, a new subsidiary overseeing this business.

- This partnership brings together BBH’s US$55 billion taxable fixed income platform and AMG’s product development and distribution expertise, aiming to broaden access to alternative credit products for U.S. wealth clients and their advisors.

- We’ll explore how AMG’s entry into the U.S. wealth market for structured and alternative credit products through this collaboration could influence its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Affiliated Managers Group Investment Narrative Recap

To own Affiliated Managers Group shares, investors need to believe that accelerating demand for alternative investment strategies can sustain AMG’s growth, even as traditional active equity outflows and pressure from lower-cost products continue. The recent partnership with Brown Brothers Harriman to expand into the U.S. wealth market with structured and alternative credit offerings is a meaningful move that could bolster AMG’s biggest near-term catalyst: broadening its footprint in alternatives. However, the risk remains that volatility in private markets fundraising could still disrupt earnings visibility.

Among recent announcements, AMG’s ongoing share repurchase program stands out, signaling management’s focus on enhancing per-share value alongside new investments like the BBH partnership. As the company continues to invest in growth affiliates and return capital, investor attention will likely stay on the integration and performance of newly acquired businesses, a key execution risk as AMG seeks to scale in alternatives.

By contrast, while diversifying into alternatives opens new channels for AMG, investors should be aware that higher earnings concentration among a few affiliates could...

Read the full narrative on Affiliated Managers Group (it's free!)

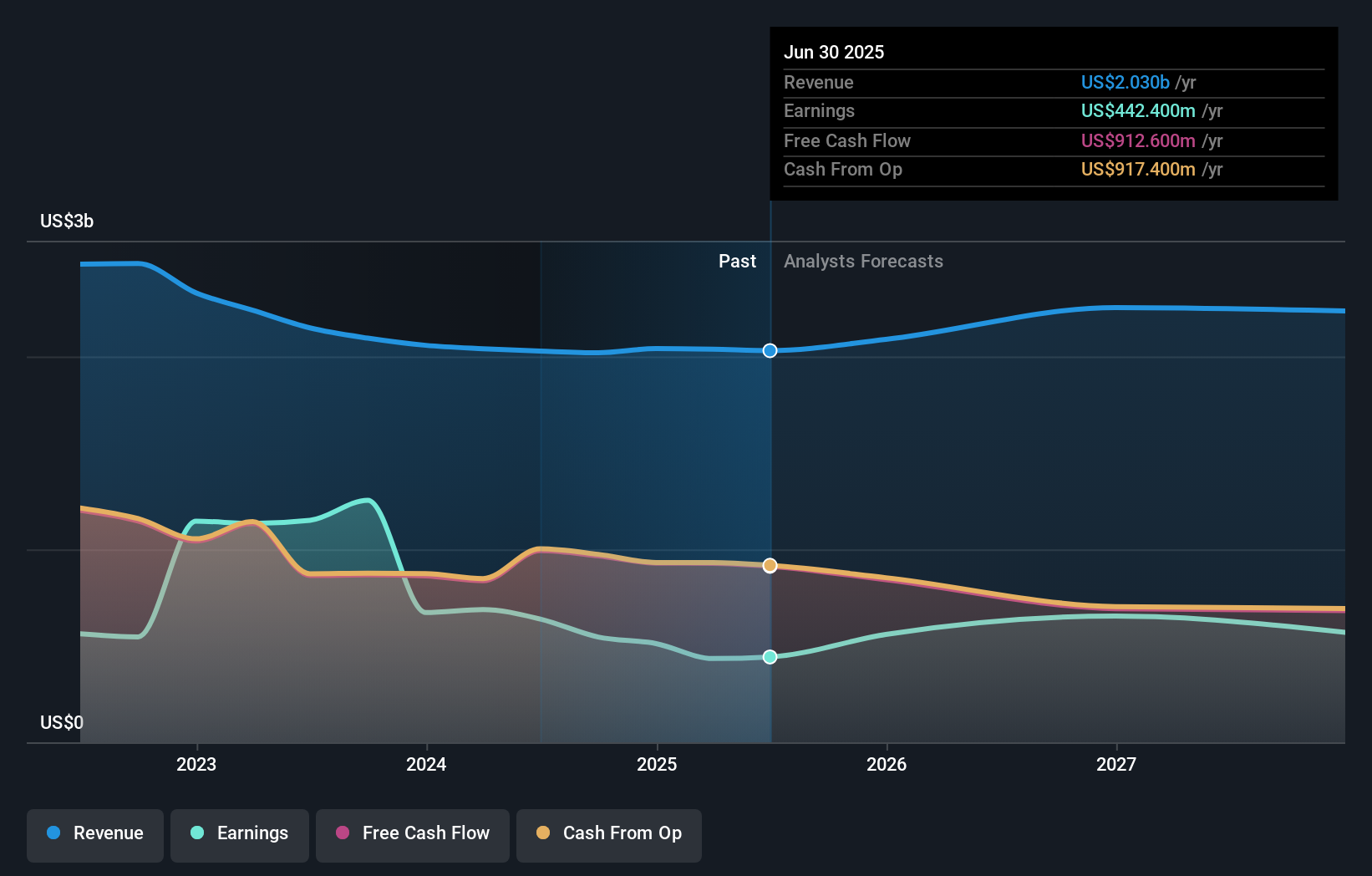

Affiliated Managers Group is projected to reach $2.2 billion in revenue and $594.9 million in earnings by 2028. This outlook is based on an annual revenue growth rate of 2.7% and a $152.5 million increase in earnings from the current $442.4 million.

Uncover how Affiliated Managers Group's forecasts yield a $263.86 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range tightly from US$261.08 to US$263.86, with 2 individual perspectives captured. With alternatives driving recent growth, market cycles and client preferences could shift rapidly, impacting AMG’s earnings mix. Explore how investors’ varied outlooks shape opportunity and risk.

Explore 2 other fair value estimates on Affiliated Managers Group - why the stock might be worth as much as 9% more than the current price!

Build Your Own Affiliated Managers Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Affiliated Managers Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Affiliated Managers Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Affiliated Managers Group's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMG

Affiliated Managers Group

Through its affiliates, operates as an investment management company providing investment management services to mutual funds, institutional clients,retails and high net worth individuals in the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives