- United States

- /

- Capital Markets

- /

- NYSE:AMG

Is It Time to Reconsider AMG After Shares Surge 30% in 2025?

Reviewed by Bailey Pemberton

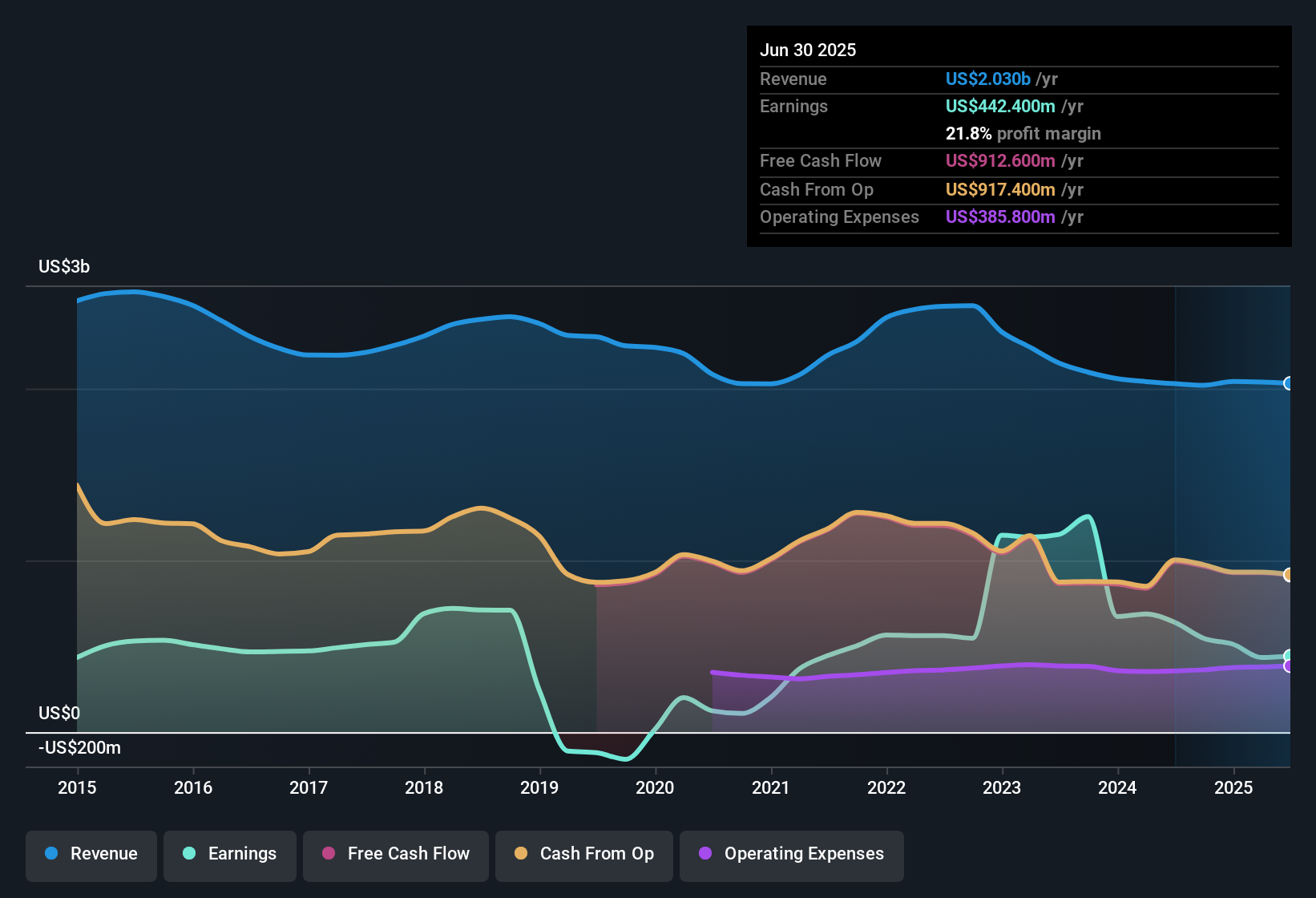

Deciding what to do with Affiliated Managers Group right now? You’re not alone—investors have had plenty to think about with this stock lately. Its share price has done more than just tread water, climbing 1.8% over the last week, 5.5% in the past month, and a striking 30.0% since the start of the year. If you had bought in five years ago, you’d be looking at gains of 216.1%. Clearly, Affiliated Managers Group has been on the move, and those moves have not gone unnoticed as the market keeps responding to shifting expectations about the economy and the investment management sector as a whole.

But let’s get to what really matters: is Affiliated Managers Group actually undervalued, or is the recent run-up just the market catching up? According to our valuation scorecard, where a company gets one point for each of six key checks it passes for being undervalued, the company measures up on four out of six. That’s a solid showing, suggesting there may still be room for cautious optimism if you believe in fundamentals as your guide.

In the sections that follow, we’ll break down the main ways investors approach valuation, taking a closer look at how Affiliated Managers Group stacks up by those measures. And, if you stick around to the end, there’s an even smarter way to think about valuation that might change the way you look at the numbers altogether.

Approach 1: Affiliated Managers Group Excess Returns Analysis

The Excess Returns model is built on a straightforward idea: it estimates a company’s value by looking at how much return it generates above the required cost of equity, using key measures of profitability and growth. For Affiliated Managers Group, this approach spotlights the company’s ability to consistently generate profits well in excess of what investors would demand from the equity invested.

By the numbers, Affiliated Managers Group has a Book Value of $114.44 per share and an average Return on Equity of 19.01%. This leads to a Stable EPS of $19.07 per share, calculated using the median Return on Equity from the past five years. The company’s cost of equity comes out to $9.22 per share, resulting in an Excess Return of $9.85 per share above what equity holders require. A Stable Book Value of $100.33 per share, based on a five-year median, adds further confidence in the company’s foundation.

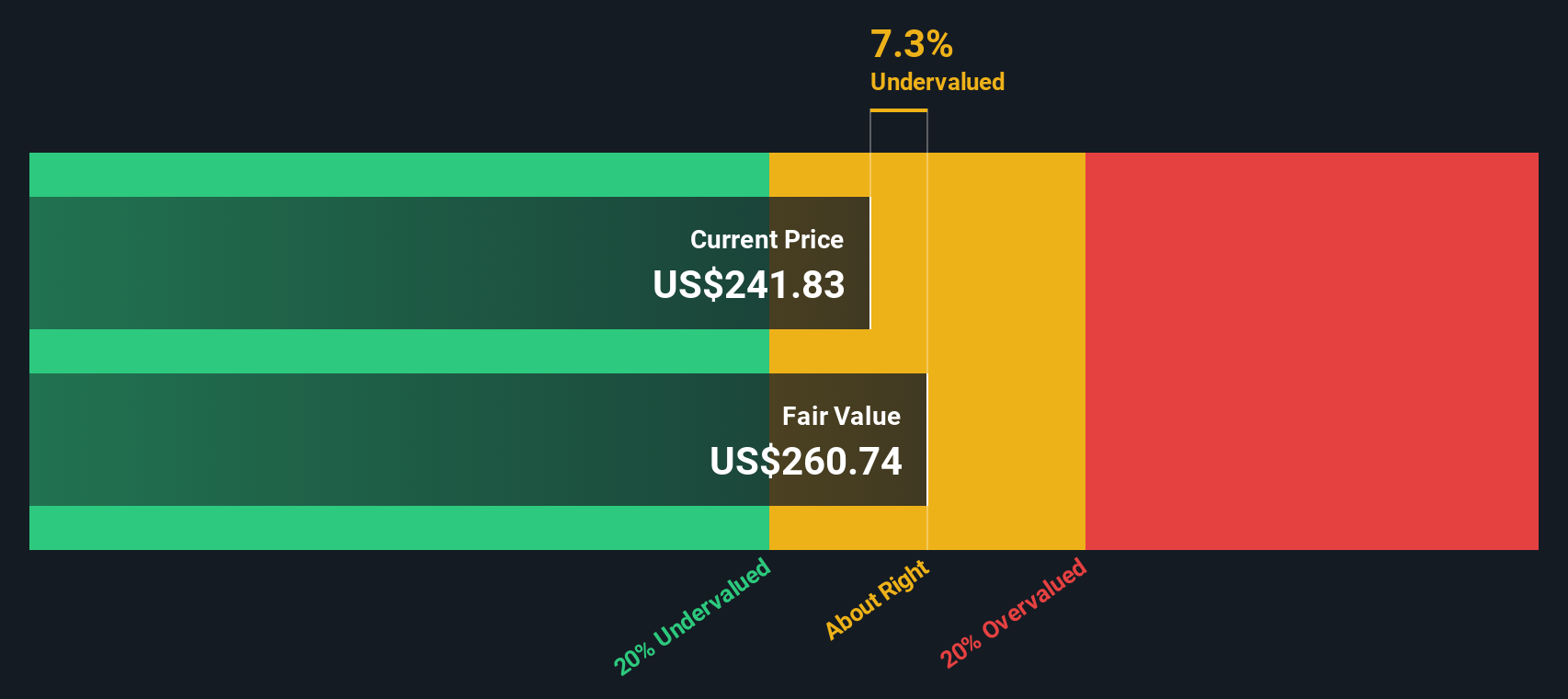

Based on the Excess Returns model, the estimated intrinsic value is $261.73 per share. This implies the stock is currently trading at an approximate 7.1% discount to its fair value. Affiliated Managers Group shares are priced about right given the available data and margin of safety.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Affiliated Managers Group's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Affiliated Managers Group Price vs Earnings

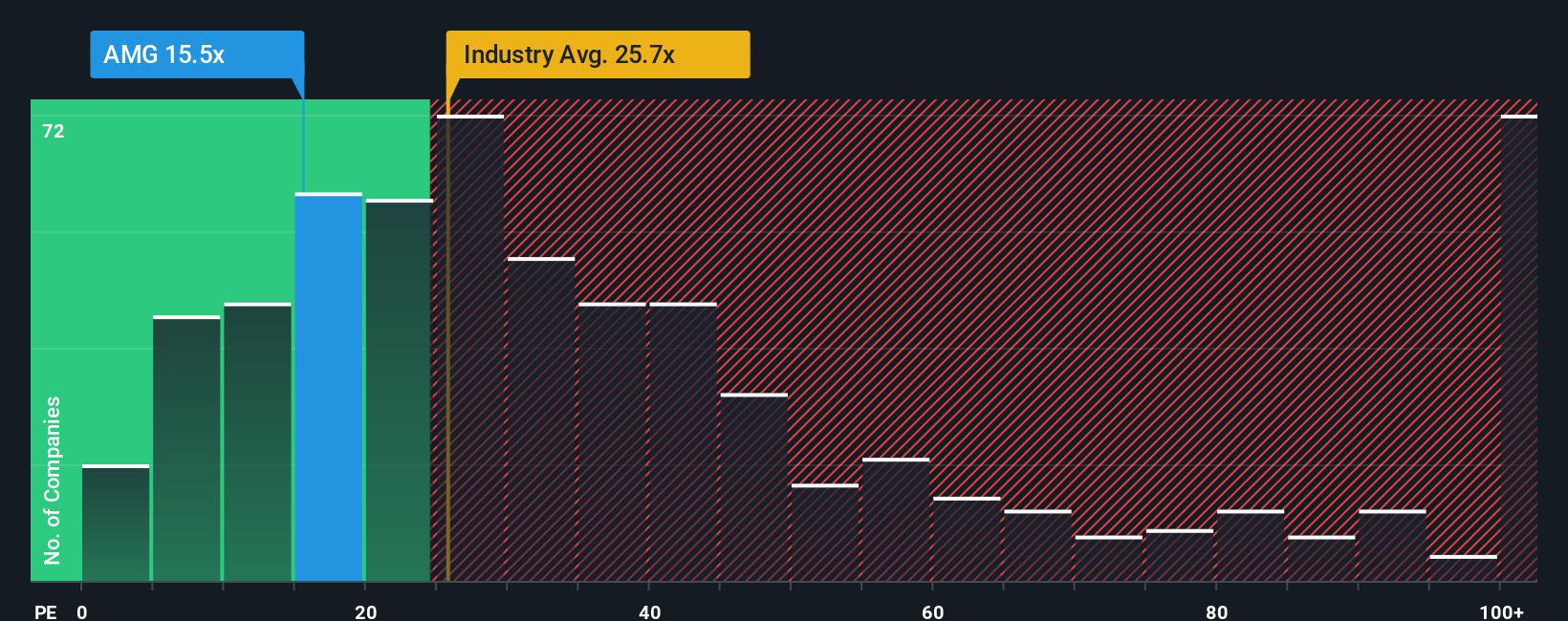

The Price-to-Earnings (PE) ratio is a widely used valuation metric, especially for profitable companies like Affiliated Managers Group. It helps investors determine how much they are paying for each dollar of earnings the company generates. For established, consistently profitable businesses, the PE ratio gives a clear sense of whether the market is expecting healthy growth ahead or is pricing in potential risks around future profitability or stability.

It is important to recognize that a “fair” PE ratio is not universal. It shifts based on expectations for earnings growth, risk profile, and how the business compares within its industry. Companies with higher growth or lower risk often justify a higher PE, while slower or riskier businesses generally trade at a discount.

Affiliated Managers Group currently trades at a PE ratio of 15.6x. This is noticeably below the industry average of 27.1x and lower than the peer average of 21.1x, suggesting the market is pricing in more caution than optimism compared to its sector. However, a more precise benchmark is Simply Wall St’s Fair Ratio of 15.6x, which factors in the company’s own earnings growth, profit margin, market risks, and industry position. Unlike raw peer or industry comparisons, the Fair Ratio is tailored to the business’s unique fundamentals and offers a more accurate reflection of what a reasonable multiple should be.

Given that Affiliated Managers Group’s actual PE of 15.6x almost exactly matches its Fair Ratio, it indicates the stock is reasonably valued at current levels based on earnings.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Affiliated Managers Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a powerful tool for investors to make truly evidence-based decisions by connecting a company's story to its financial future and share price.

A Narrative is your own perspective on Affiliated Managers Group, turning your expectations about revenue, profit margins, and risk into a forecast and an estimated fair value. Unlike simple ratios, Narratives "tell the story" by linking what you believe (for example, new partnerships or evolving demand for alternatives) directly to numbers and, ultimately, to a fair value you can act on.

Best of all, Narratives are easy to create and explore for free on Simply Wall St’s Community page, where millions of investors compare their assumptions, debate scenarios, and track how changing news or fresh earnings forecasts impact their fair value in real-time.

This approach lets you decide when to buy or sell Affiliated Managers Group by comparing your Narrative’s updated Fair Value against today’s share price. In this way, you are always acting on your own conviction, not just consensus.

For example, right now some investors expect persistent demand for private markets and margin expansion, leading to bullish valuations as high as $331 per share. Others see risks like affiliate concentration and fee pressures, leading to more cautious targets near $195. So, what’s your Affiliated Managers Group Narrative?

Do you think there's more to the story for Affiliated Managers Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMG

Affiliated Managers Group

Through its affiliates, operates as an investment management company providing investment management services to mutual funds, institutional clients,retails and high net worth individuals in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion