- United States

- /

- Capital Markets

- /

- NYSE:ADX

Distribution Election Feature Might Change The Case For Investing In Adams Diversified Equity Fund (ADX)

Reviewed by Simply Wall St

- On July 18, 2025, Adams Diversified Equity Fund, Inc. declared a $0.46 per share distribution payable August 28, 2025, with shareholders automatically receiving shares unless they elect cash by August 15.

- This flexible payout structure allows investors to tailor their returns, which may influence preferences between reinvestment and immediate income.

- We'll explore how this distribution election feature could shape Adams Diversified Equity Fund's appeal among income-focused and growth-oriented investors.

What Is Adams Diversified Equity Fund's Investment Narrative?

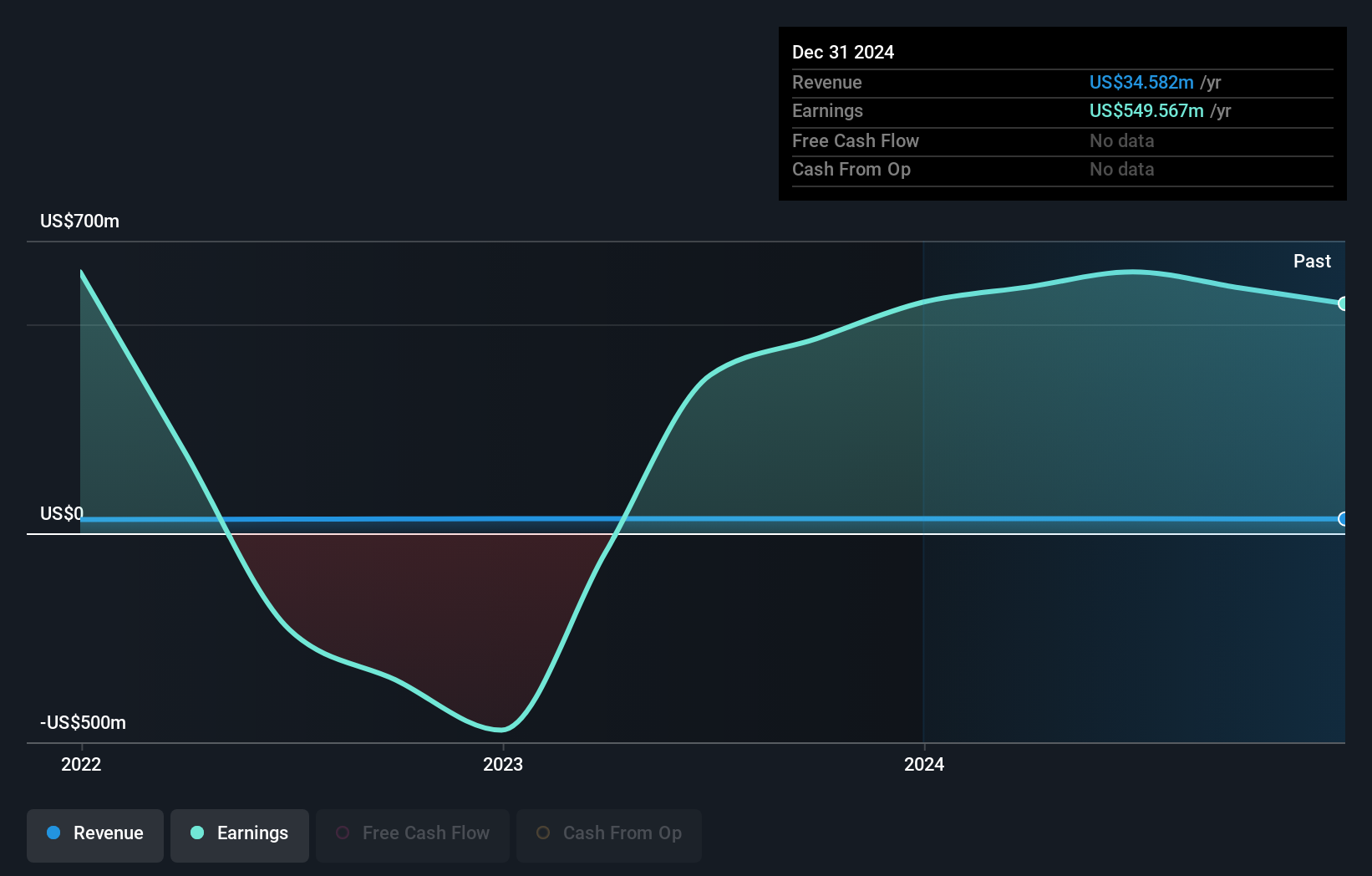

To be a shareholder in Adams Diversified Equity Fund, investors typically need to see value in its established dividend-paying approach, experienced management, and perceived discount to estimated fair value, as shown by the fund’s low P/E ratio. The recent announcement of a $0.46 per share distribution, with a flexible reinvestment or cash option, aligns with the fund’s practice of regular payouts. This extra flexibility could slightly strengthen ADX’s appeal among new and existing investors, but it is unlikely to shift the biggest short-term catalysts or risks right now. Major drivers continue to be the fund’s earnings stability, reliable return on equity, and its large one-off gains, while risks include an unstable dividend record and underperformance versus the broader market and industry. The recent announcement has not had a material impact on these factors, with the share price moving only modestly higher. Still, an unstable dividend track record may catch some investors off guard.

Adams Diversified Equity Fund's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Build Your Own Adams Diversified Equity Fund Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adams Diversified Equity Fund research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Adams Diversified Equity Fund research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adams Diversified Equity Fund's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADX

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives