- United States

- /

- Mortgage REITs

- /

- NYSE:ABR

Is Arbor Realty Trust’s 36% Drop an Opportunity or a Caution for 2025?

Reviewed by Bailey Pemberton

If you have Arbor Realty Trust on your radar, you are not alone. Whether you are thinking about holding, buying more, or simply watching from the sidelines, there is plenty to consider when it comes to this stock. The company’s recent price moves have given investors a lot to unpack. The last week saw the stock dip by 0.8%, while the past month brought only a slight 0.3% uptick. Despite a tough year-to-date showing, down 14.5%, the longer lens tells a different story. Arbor Realty Trust has delivered an impressive 77.6% return over the past five years, a figure that definitely catches the eye for anyone weighing the stock’s long-term potential.

Part of what is driving the conversation are the shifts in the real estate market and industry regulation, both of which have played into recent sentiment around the stock. News around tighter credit conditions and changing commercial property trends have investors questioning how these forces could affect Arbor’s loan portfolio and future growth. This could increase near-term risk but also set the stage for future recovery. If you have been watching the headlines, you have seen how even small hints of change in lending practices or property demand can move the needle for companies like Arbor.

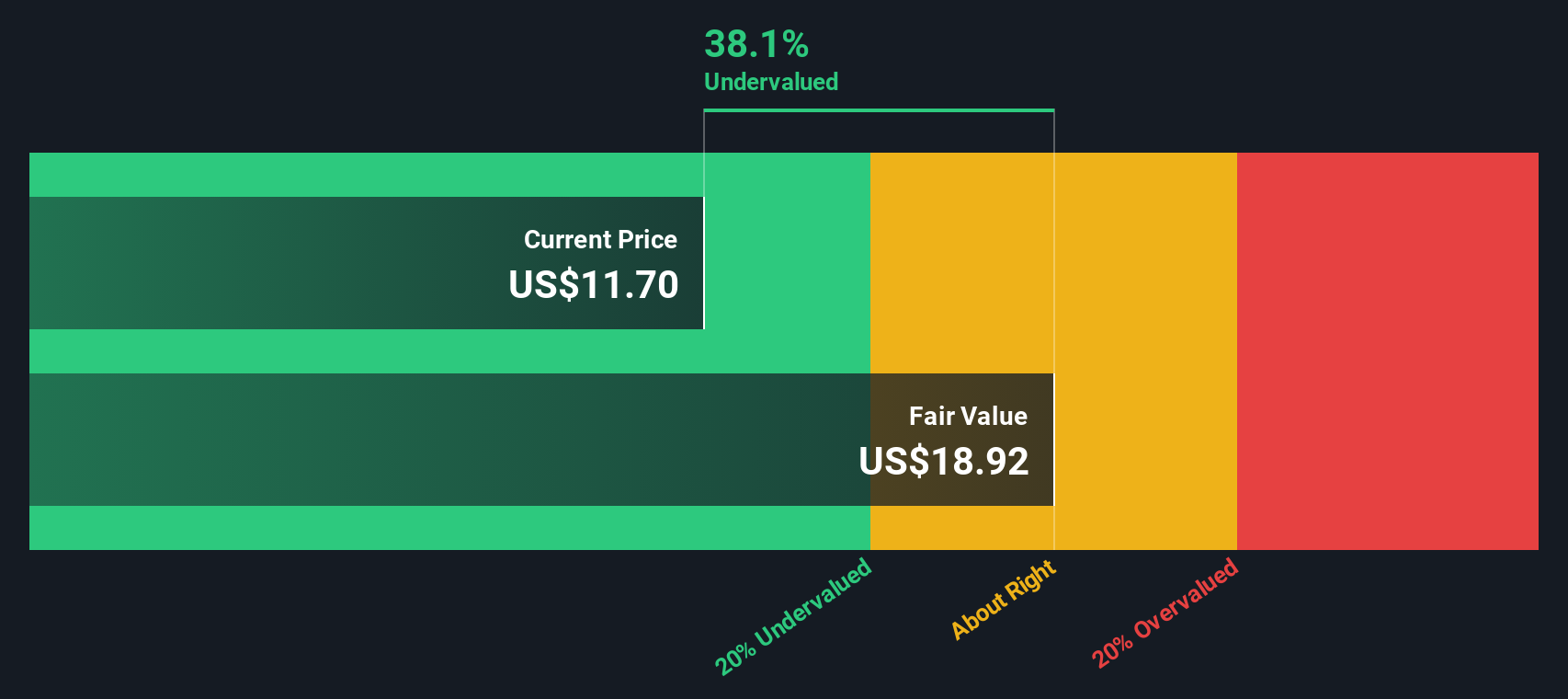

So, is the stock undervalued, or is the recent slide just a reflection of real risks? By our latest valuation analysis, Arbor Realty Trust scores a 3 out of 6—undervalued on half the key checks, but not across the board. Next, we will break down these valuation methods to help you make sense of where Arbor might be heading, and at the end, explore an even smarter approach to thinking about its true worth.

Why Arbor Realty Trust is lagging behind its peers

Approach 1: Arbor Realty Trust Excess Returns Analysis

The Excess Returns valuation model takes a closer look at how effectively a company generates profits above its cost of equity. For Arbor Realty Trust, this method evaluates whether the returns it delivers on invested capital consistently exceed what shareholders require for the risk they are taking on.

According to the latest data, Arbor’s average return on equity has been a solid 11.44%, with a stable EPS of $1.32 per share. This is calculated from the median return on equity over the past five years. Its per-share book value stands at $12.17, while the cost of equity is estimated at $0.96 per share. This results in an excess return of $0.36 per share, suggesting Arbor is generating value above its basic capital costs. Looking ahead, analysts expect the book value to stabilize around $11.55 per share, based on weighted projections from three professionals who follow the company closely.

Based on these combined returns and future growth assumptions, the Excess Returns model estimates Arbor’s intrinsic value at $18.49 per share. With the share price currently carrying a 36.3% intrinsic discount, Arbor Realty Trust appears undervalued from this perspective.

Result: UNDERVALUED

Our Excess Returns analysis suggests Arbor Realty Trust is undervalued by 36.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

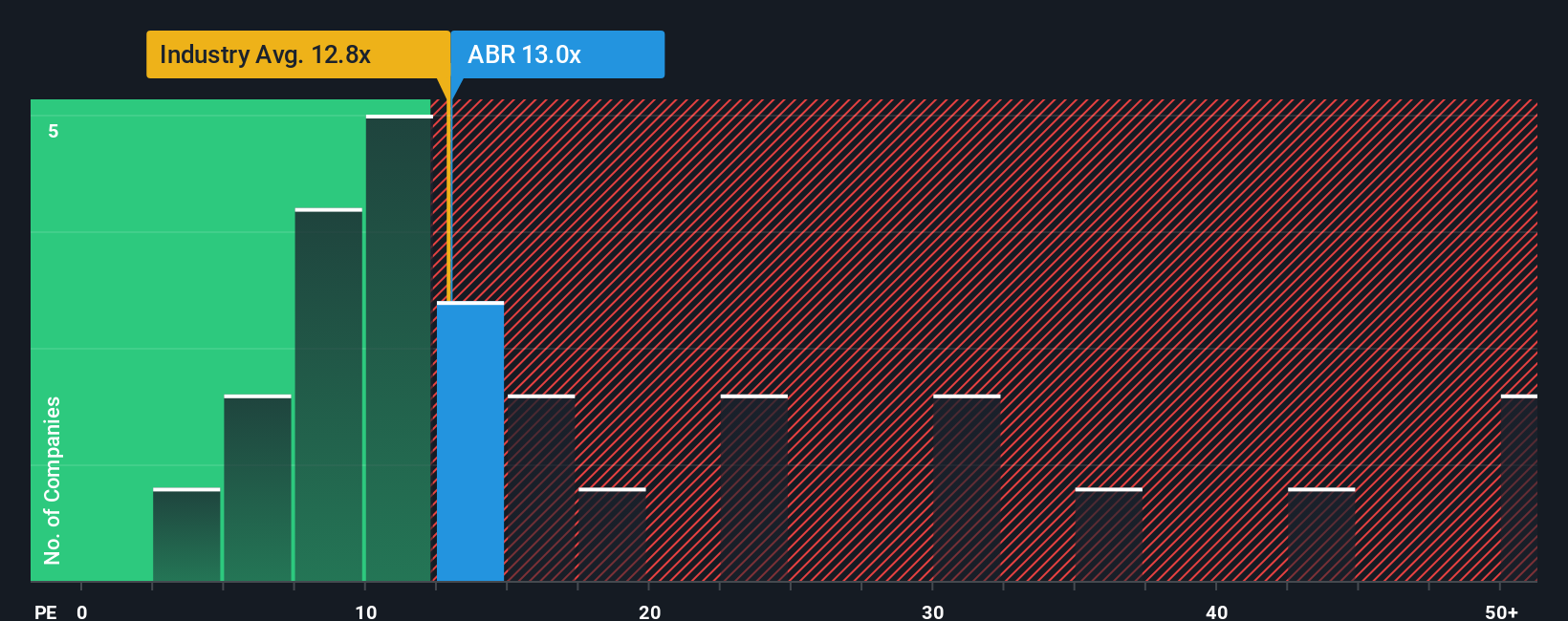

Approach 2: Arbor Realty Trust Price vs Earnings

For profitable companies like Arbor Realty Trust, the price-to-earnings (PE) ratio is a widely used and intuitive way to measure valuation. This metric helps investors understand how much they are paying for each dollar of the company’s earnings, providing a straightforward assessment of value, especially when those earnings are stable and reliable.

The “normal” or “fair” PE ratio for a company depends heavily on expectations for its growth and the risks it faces. Faster-growing companies or those with lower perceived risk tend to command higher PE ratios, while slower growth or greater uncertainty typically warrants a lower multiple.

Currently, Arbor Realty Trust trades at a PE ratio of 13.1x. By comparison, the industry average for mortgage REITs sits at 13.05x, and the company’s direct peers average 11.63x. This indicates that Arbor’s valuation via PE is fairly in line with its industry and a bit above peers.

Simply Wall St’s "Fair Ratio" provides deeper context by factoring in Arbor’s growth prospects, profit margin, market capitalization, industry characteristics, and risk profile, producing a fair PE of 13.7x. This approach is superior to simply comparing with peers or the industry, as it is tailored specifically to Arbor’s own outlook and fundamentals instead of broad averages.

Given that the actual PE of 13.1x is just a fraction below the Fair Ratio of 13.7x, Arbor Realty Trust appears fairly valued based on this method, neither meaningfully overvalued nor undervalued.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Arbor Realty Trust Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative lets you build your own story about Arbor Realty Trust, connecting your view of the business and the economic environment to key numbers like future revenue, earnings, and margins. This ultimately produces a fair value that reflects your unique outlook. Instead of relying solely on backward-looking ratios or analyst forecasts, Narratives allow you to articulate your perspective. For example, you may be optimistic about the company’s loan innovation or cautious about tightening credit. Narratives show exactly how those beliefs translate into a forecast and valuation.

This approach is simple and accessible, and it is used by millions of investors on Simply Wall St’s Community page. Narratives help you decide whether to buy, sell, or hold by instantly comparing your calculated Fair Value to the company’s current Price. Because they update dynamically whenever important news or results surface, your investment thesis is always up to date. For example, some Narratives for Arbor Realty Trust assume strong recovery in investment activity and set a bullish fair value of $15.0. Others anticipate persistent industry pressure and see a more conservative target as low as $10.5. Your chosen Narrative empowers you to move beyond standard metrics and make investment decisions that genuinely reflect your view of Arbor’s future.

Do you think there's more to the story for Arbor Realty Trust? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABR

Arbor Realty Trust

Invests in a diversified portfolio of structured finance assets in the multifamily, single-family rental, and commercial real estate markets in the United States.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives